Total communications spending will decline 1% in 2009, to $882.6 billion—its first spending decline since the 2001 recession—according to the latest Communications Industry Forecast (CIF) from private-equity firm Veronis Suhler Stevenson (VSS).

Covering the years 2003-2013, the report forecasts, however, that communications spending will grow 3.6% per year over the next five years, to over $1 trillion, making communications the third fastest-growing sector of the US economy over the 2008-2013 period.

Highlights

- Institutional end-user and alternative media are growing as traditional media advertising declines.

- Institutional end-user spending is expected to remain the largest, fastest-growing sector; the 5.6% future annual spending gain will be driven by business information services and for-profit higher education.

- Communications will be the third-fastest-growing economic sector in the forecast period, moving up from the fourth position.

- The Communications Industry Forecast foresees a decline of 1% in 2009, but spending will grow faster than GDP in '09 and over next 5 years.

- Marketing services spending will grow 3.4% annually, primarily in alternative marketing segments, during the forecast period.

Segments driven by end-user spending and targeted marketing services are gaining even as traditional advertising is shrinking, VSS said.

The CIF report covers the four major sectors—advertising, marketing, consumer, and institutional—and the following major segments (and some 100 sub-segments), among others: Broadcast Television, Subscription Television (formerly Cable & Satellite TV), Broadcast and Satellite Radio, Out-of-Home Media, Entertainment Media, Internet and Mobile Media, Newspaper Publishing, Consumer Book Publishing, Yellow Pages Directories, Consumer Magazine Publishing, Business-to-Business (B2B) Media, Education and Training Media and Services, Professional and Business Information and Services.

Below, details from the 2009 forecast, as provided by VSS.

Advertising Becomes the Smallest Sector, Others Grow

In 2008 and 2009, a major shift occurred in communications-industry spending patterns, as advertising became the smallest of the four major sectors in 2008—a first for advertising since VSS began tracking the industry in 1986.

Meanwhile, institutional and consumer communications became the dominant sectors in US communications spending. VSS forecasts that the institutional sectors and various alternative-media segments will drive overall communications spending for the next five years. Specifically:

- Institutional end-user spending will remain the largest and fastest-growing communications sector, rising 5.6% annually as a result of strong gains in business information services, particularly in the marketing and financial services sub-segments, and the for-profit higher education sub-segment of educational and training media and services.

- The institutional end-user sector will be responsible for bringing the vast majority of the new dollars coming to the communications industry—on top of the nearly $90 billion in spending the sector was able to add from 2003 to 2008.

- Alternative marketing segments—including branded entertainment and word-of-mouth marketing—will grow at 12.6% annually from 2008-2013 and will contribute to overall marketing services spending growth of 3.4% annually in the forecast period.

As expected, the current challenges facing the industry are largely the result of the current cyclical economic downturn, which is exacerbating the impact of structural and secular changes already underway.

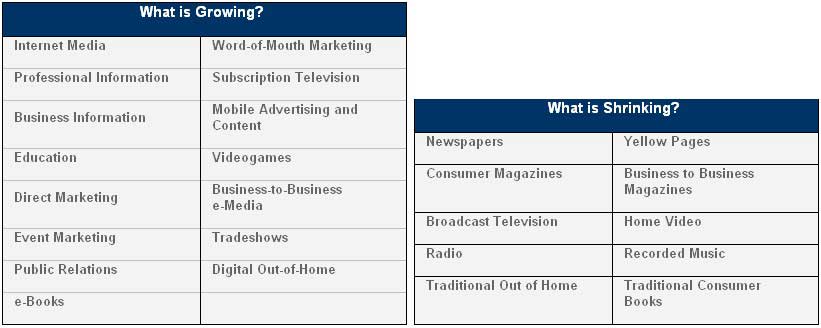

Over the five-year forecast period, 12 of the 20 major industry segments are expected to show positive growth, with the most challenged segments clustered in traditional advertising:

However, the long-term demand for information, education, and entertainment will continue, and the bright spot for advertising will be in digital and other alternative and targeted advertising businesses.

The current downturn is causing several of the communications industry's sub-segments to register their weakest growth in more than five decades. Nonetheless, four segments are projected to generate more than $100 billion in spending by 2013—subscription television, professional & business information services, direct marketing, and entertainment media.

"The prolonged economic downturn has accelerated changes already underway in the communications industry. Notwithstanding significant declines in traditional media, the industry taken as a whole will continue to show relatively solid performance compared to the overall economy," said Jim Rutherfurd, EVP and managing director at VSS.

Fourth-Largest Sector of Economy

Despite the expected spending decline in 2009, the media and communications industry is expected to rise from the fourth position to the third fastest-growing economic sector in the US (following mining and construction) over the next five years. Moreover:

- The media and communications industry will also rise to become the fourth-largest sector of the economy overall by 2013, up from the fifth-largest sector in 2008.

- Over the next five years, the communications industry will increase 20% more (at 3.6%) than Nominal GDP, which is expected to be increasing only 3.0% annually by 2013.

In early 2009 and as the economy rebounds, communications spending is projected to accelerate and outperform the overall economy during the forecast period:

- Growth will be driven by robust gains in many of the same markets generating 2009 growth, such as pure-play consumer internet and mobile services, subscription TV, and branded entertainment.

- In addition, gains will resume in several sub-segments adversely affected by the recession, such as K-12 media, consumer books, outsource corporate training, customer publishing, and B2B tradeshows.

"While we have seen consumer media usage remain generally flat over the past year, the way in which consumers are spending their time continues to evolve. No longer are newspaper and magazine subscription purchases and network primetime viewing the norm. Instead, they are declining and consumers are spending more time with media which they support and pay for as opposed to ad-supported media," said John Suhler, cofounder, president, and general partner of VSS. "This development is a culmination of two decades of this secular shift towards consumer-controlled media, and shows no signs of slowing."

Direct Marketing and Alternative Marketing Services to Drive Growth

The institutional end-user sector is the largest and fastest-growing communications sector:

- Powered by relatively strong gains in professional and business information services and TV programming, institutional communications spending rose 6.5% to $241.06 billion in 2008. More moderate growth occurred in the education and training and B2B media segments.

- Media usage in the institutional sector also gained as the need to access information throughout the day and in multiple locations became more important, allowing digital materials in the professional and business information services and B2B media markets to climb 13.3%.

Branded entertainment was a bright spot in 2008 and shows no signs of slowing down:

- Spending on branded entertainment soared 12%, to $24.97 billion, in 2008 as brands pursued marketing strategies that engage and connect with target audiences who are increasingly skipping ads and migrating away from traditional media.

- More brands pursued opportunities to integrate their products into television content and approached the nascent webisode and advergaming markets in an attempt to connect with young consumers.

- As more brands incorporate venue-based media into their mix, overall spending on branded entertainment is expected to grow at a compound annual growth rate (CAGR) of 9.3% during the forecast period, reaching $38.88 billion in 2013.

Direct marketing benefited from the same trends as branded entertainment as marketers increasingly opted to reach their target consumer with one-to-one messaging as opposed to one-to-many:

- While direct mail and telesales spending declined due their reliance on such stressed industries as automobiles and financial services, direct marketing registered a 3.2% increase in 2008 to $106.52 billion

- Direct is moreover forecast to achieve a 5.6 % CAGR during 2008-2013.

- Email marketing performed even better, and continues to expand at double-digit rates because it offers a low-cost alternative to direct mail and other marketing strategies, VSS said.

Both alternative advertising and alternative marketing services will continue their growth, driven by gains in online advertising and digital out-of-home, VSS forecasts:

- Alternative advertising is forecast to have a 12.3% CAGR from 2008-2013, compared with a 3.3% decline for traditional advertising.

- Alternative marketing services will only slightly outpaced alternative advertising, growing at a CAGR of 12.6% during the forecast period.

- Spending on alternative media as a whole is projected to reach $139.45 billion in 2013, accounting for a 29.7% share of total advertising and marketing spending, up from just 18.2% in 2008.

Traditional Advertising Sectors Remain Challenged

The current economic cycle has accelerated long-developing trends away from mass-market image advertising and toward individualized, technology-enabled access to information and entertainment.

Changing consumer behaviors have led to declining print-advertising spend, particularly newspaper spending, which fell 13.1% to $54.16 billion in 2008, and consumer-magazine publishing, with a drop of 5.8% to $22.91 billion. These sectors also suffered from budget cuts by local and national advertisers in key categories such as auto and financial services. The difficult economy has also driven circulation spending down as consumers canceled subscriptions.

Broadcast and satellite radio were not able to avoid the industry decline in advertising spend. Local-station advertising, extremely dependent on stressed economic sectors, including auto and home, underwent spend declines of 7.1% to $20.28 billion in 2008. Consumers are migrating away from traditional radio to online social networks featuring up-and-coming artists. In addition, the depressed auto industry is hindering satellite radio growth, as fewer new cars are being sold with satellite-radio services.

As the economy took its toll on companies throughout the year, B2B promotions as well as outsourced publishing were affected. Spending on B2B promotions, including promotional products and travel marketing incentives, fell 7% as budgets were cut and fewer salespeople were in the field calling on clients. Declining profits, layoffs, and trimmed expenses all lined up to hinder growth in the B2B promotion market, and spending in the top promotional product category fell by double-digit rates. During the 2008-2013 period, the B2B promotion market is forecast to undergo a 2.9% annual decline.

About the VSS Communications Industry Forecast: The VSS CIF tracks, analyzes, and forecasts spending, usage, and trends in all four major media sectors—advertising, marketing, consumer, and institutional—20 segments and more than 100 sub-segments of the US media industry. PQ Media (www.pqmedia.com) licenses data from its Alternative Media Research Series for use in the CIF, which VSS has published annually since 1986.