Total measured advertising expenditures in the first six months of 2009 fell 14.3% compared with a year earlier, to $60.87 billion, according to data released by TNS Media Intelligence.

Ad spending during the second quarter of 2009 was off 13.9% compared with last year, the fifth consecutive quarter of year-over-year decline.

"The rate of decline in ad spending was level throughout the second quarter," said Jon Swallen, SVP of research at TNS Media Intelligence. "While it's tempting to interpret this as a positive indicator that things aren't getting worse, the fact remains that the market has been steadily tracking at around 14% declines for several consecutive months and this represents billions of lost revenue."

"Early data from third quarter hint at possible improvements for some media due to easy comparisons against distressed levels of year ago expenditures," Swallen said.

Below, ad expenditure-related data and analysis released by TNS Media Intelligence.

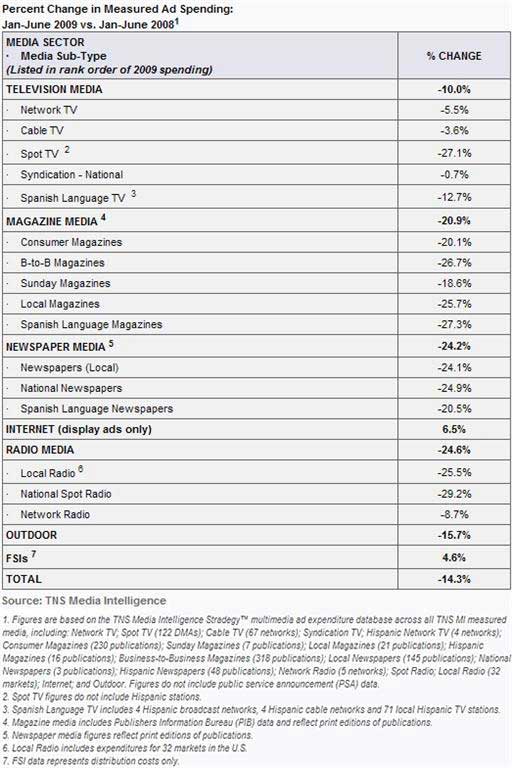

Ad Spending by Media

- Internet display and free-standing inserts (FSIs) were the only media to achieve expenditure growth in the first half of 2009 (6.5% and 4.6% growth, respectively). Each benefited from larger budget allocations by CPG marketers, while online publishers also capitalized on a spending surge from wireless telecom operators.

- Print media continued to suffer large rollbacks in ad pages from key categories, resulting in aggregate spending declines of 24.2% for newspaper media and 20.9% for magazine media.

- Total spending in radio media was down 24.6% due to ongoing weakness in automotive, retail and local services.

- Among television media, ad spending on network TV declined 5.5% and cable TV slipped 3.6% in the first half of 2009. For both, Q2 results were slightly worse than Q1. Spot TV expenditures dropped 27.1%, buffeted by the slump in auto and retail activity.

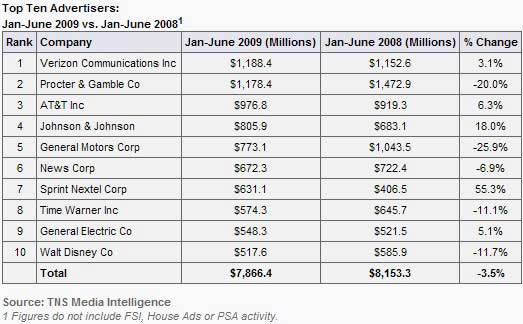

Ad Spending by Advertiser

The top 10 advertisers in the first six months of 2009 spent a combined total of $7,866.4 million, or a 3.5% decrease from last year. Across the top 100 companies—a more diversified group of marketers representing almost one-half of total ad expenditures—spending fell 6.2%.

- Verizon Communications edged out Procter & Gamble to claim the top spot in the rankings. The telecom behemoth spent $1,188.4 million, up 3.1% from last year.

- Its two leading competitors also landed in the top ten: AT&T was the third-largest advertiser, with total ad expenditures of $976.8 million, up 6.3% from a year ago;. Sprint Nextel, after slashing its ad budgets in 2008, reversed course and spent $631.1 million, a gain of 55.3%.

- P&G slipped to second position in the rankings after reducing its half-year spending 20%, to $1,178.4 million. It pared its TV budgets 30% while leaving magazine spending untouched. The only other packaged goods marketer in the top 10 was Johnson & Johnson which spent $805.9 million, up 18.0%.

- General Motors had the largest budget reduction among the Top 10; its spending was down 25.9%, to $773.1 million. It was the only automaker to make the list.

- Media companies rounded out the Top 10: General Electric posed a spending increase of 5.1%, while News Corp., Time Warner, and Walt Disney finished the period with decreases. At each of those advertisers, results were primarily shaped by their movie studio divisions.

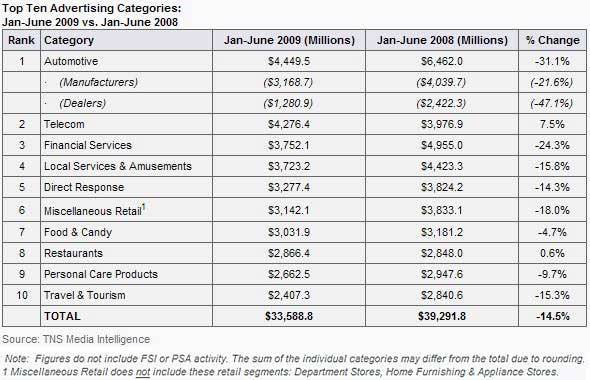

Ad Spending by Category

The ten largest advertising categories in the first half of 2009 spent a total of $33,588.8 million, a drop of 14.5% from a year ago.

- Automotive barely kept the top spot after expenditures plunged 31.1%, to $4,449.5 million, in response to depressed sales of new vehicles. Dealer spending was off more sharply than that of manufacturers. Through June, auto advertising was pacing at a level one-half its 2005 peak.

- Heightened competition among wireless phone companies and TV service providers boosted telecommunications category spending to $4,276.4 million, an increase of 7.5%.

- The only other top category to achieve a gain in the period was restaurants, up 0.6% to $2,886.4 million.

- Financial services advertising sank 24.3%, to $3,752.1 million. As consumer lending seized up, credit card companies and loan providers severely curtailed their marketing programs.

- Consumer packaged goods, traditionally looked to as a pillar of strength in advertising recessions, performed better than the overall ad market but still wound up in negative territory:

- The food & candy category slipped 4.7% to $3,031.9 million and personal-care products declined 9.7% to $2,662.5 million.

- Further down the rankings, other CPG segments also fell. Non-prescription remedies was 5.7% lower, at $1,799.4 million. Household products was down 2.7% to $1,027.9 million.

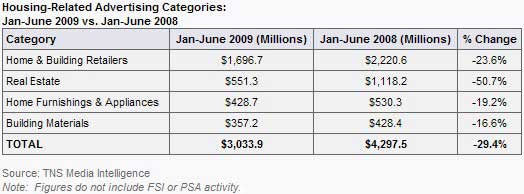

Elsewhere, the impact of the housing market slowdown was reflected in sharply lower ad spending from housing-related categories:

Branded Entertainment

In the second quarter of 2009, an average hour of monitored primetime network programming contained 9 minutes, 51 seconds (9:51) of in-show brand appearances, a 19% increase from a year ago. In addition, there was 14:05 per hour of network commercial messages. The combined total of 23:56 of marketing clutter represents 40% of a prime-time hour.

Other findings:

- Unscripted reality programming had an average of 16:42 per hour of brand appearances, compared with just 5:52 per hour for scripted programs such as sitcoms and dramas.

- Late-night network talk shows averaged 11:31 per hour of brand appearances. The combined clutter level of brand appearances and network ad messages in these shows reached 26:48 per hour, or 45% of total programming time.

- Among all monitored network programming during the period, Hell's Kitchen had the highest average volume of Brand Appearance time at 58 minutes, 14 seconds (58:14) per hour.

- Rounding out the top five were Celebrity Apprentice (49:58); Biggest Loser: Couples (45:02); American Idol (42:44); and Chopping Block (33:13).

Note: TNS's brand appearance tracking identifies brand appearances and measures their duration and attributes. Given the short length of many brand appearances, duration is a more relevant metric than a count of occurrences for quantifying and comparing the gross amount of brand activity that viewers are potentially exposed to in the program versus in the commercial breaks.

About the data: TNS Media tracks all media (print, radio, TV, Internet, social media, cinema and outdoor, worldwide) to collect marketing intelligence, including advertising expenditure monitoring, advertising creation monitoring, audience measurement, market influence analytics, online consumer behavior tracking, news monitoring, sports sponsorship evaluation, among others. TNS is part of the Kantar Group, a research, insight, and consultancy global network.