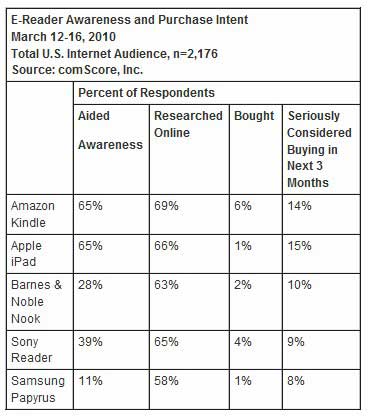

Less than a week before iPad's April 3 ship date, nearly two-thirds (65%) of consumers are aware of Apple's tablet device and 15% are already thinking about buying it in the next three months, according to comScore.

Awareness for the iPad is matched only by awareness of the Amazon Kindle (65%), whereas awareness of the Sony Reader and the Barnes and Noble Nook trail significantly: 39% and 28%, respectively.

In addition to those consumers considering an iPad purchase, another 14% are seriously considering the purchase of a Kindle and 10% are considering the B&N Nook.

Below, other findings from comScore's study on the Apple iPad and e-reader consumer attitudes, behaviors, and purchase intentions.

iPad Use Intentions

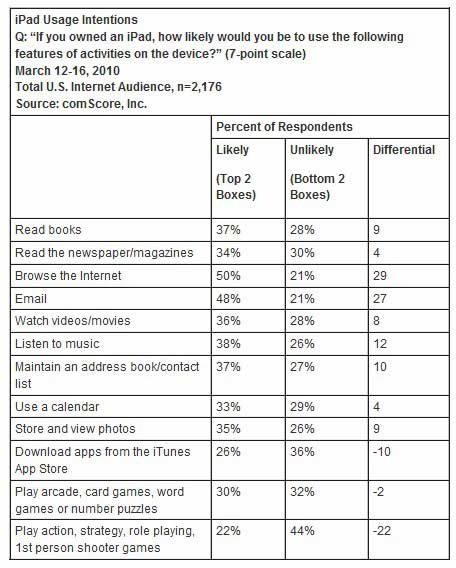

One-half (50%) of consumers say they would use the iPad to browse the Internet, and 48% say they would check email. Some 38% would use the iPad to listen to music, and 37% would use it to read books.

Over one-third (36%) of consumers say they're unlikely to use the iPad to download mobile applications, while 26% say they would do so.

'iOwners' Are Attractive Segment for Paid Digital Content

Over one-half (52%) of "iOwners" (those who own an iPhone or iPod Touch) say they are willing or very willing to pay for newspaper and magazine subscriptions formatted for e-readers, compared with just 22% of non-iOwners.

Similarly, those who are already familiar with making digital content purchases via iTunes have a much higher receptivity to making purchases for the iPad: 50% of iOwners who also own an e-reader report having spent at least $60 on e-books in the past three months, compared with only 24% non-iOwners.

Furthermore, younger users indicate a significantly higher willingness to pay for news and magazines formatted for e-readers: 68% of consumers age 25-34 and 59% of those age 35-44 say they would be willing to pay for such content, substantially higher percentages than those age 45+.

Device Attributes

The most important device attributes (top 2 boxes on a 7-point scale) that consumers would like to have included in the iPad are the following:

- Ability to use multiple applications/programs simultaneously: Cited by 43% of consumers and 56% of iOwners

- A screen the same size as a laptop or desktop computer: 37% of consumers and 66% of iOwners

- Built-in camera: 34% of consumers and 51% of iOwners

"The tablet and e-reader market is developing at a breakneck pace right now, and Apple's entry into the market is sure to accelerate mainstream consumer adoption," said Serge Matta, comScore EVP.

"These devices have the potential to be incredibly disruptive to the way consumers currently access digital content. While only time will tell exactly how consumer behavior will change, our research suggests that not only will a variety of markets be impacted by the introduction of these devices but also that there are substantial opportunities for those in the digital content ecosystem."

Looking for real, hard data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, a 240-page original research report from MarketingProfs, gives you the inside scoop on how 5,140 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

Other findings issued by comScore:

- Male and female consumers surveyed have nearly identical favorability around the choice of the name iPad: Approximately 49% have a positive impression of the name, 27% are indifferent, and 24% have a negative impression.

- Though ownership of an iPhone or iPod Touch is a strong predictor of those who have already ordered an iPad, it is not a strong predictor of purchase intent: 3% of iOwners have already purchased the iPad compared with 1% of non-iOwners, but 15% of each consumer segment plan to purchase the device in the next three months.

- iOwners have significantly higher awareness of the iPad than non-iOwners: 84% of iOwners have heard of the iPad, compared with 61% non-iOwners. Some 22% of iOwners report having seen an iPad commercial on TV, compared with just 12% of non-iOwners.

- The devices most likely to be replaced by the iPad are the iPod Touch (37%) and netbooks (22%), according to consumers surveyed.

- Consumers' current carrier service is a determinant of purchase intent: 25% of AT&T Wireless customers who are aware of the iPad say they intend to purchase the device in the next three months, compared with just 10% of Verizon customers.

- 34% of males say they are likely to use the iPad for playing action/strategy/role-playing games, compared with 28% of females. Some 53% of consumers age 18-24 say they are likely to use the iPad for this form of gaming, 15 percentage points higher than those age 25-34, the next highest age segment.

About the data: Findings are from comScore's survey of 2,176 Internet users regarding their awareness, attitudes, and opinions of the Apple iPad and other e-readers/tablet devices. Results were analyzed across age and gender profiles, as well as the "iOwners" consumer segment, defined as those owning either an iPhone or iPod Touch.