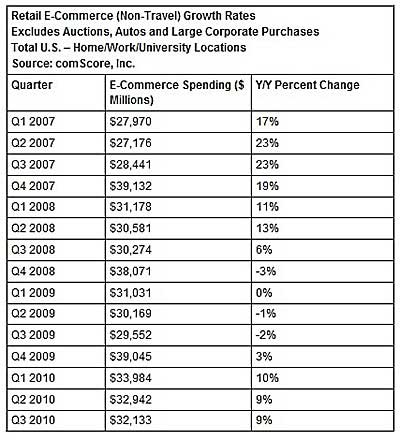

US online retail spending reached an estimated $32.1 billion in the third quarter of 2010, up 9% from $29.6 billion a year earlier, and the fourth consecutive quarter of positive year-over-year growth following a year of flat or negative growth rates, according to data from comScore.

Key e-commerce-related findings:

- The top-performing online product categories were books and magazines (excluding digital downloads); computers, peripherals, and PDAs; computer software (excluding PC games); and consumer electronics.

- The top 25 online retailers accounted for 70% of online spending, up 5.5 percentage points from a year earlier.

- Online "pureplay" retailers accounted for 58% of online spending, while multi-channel retailers accounted for the remaining 42%, unchanged from the previous year.

- 41% of online retail transactions included free shipping, down marginally from the previous year.

"Retail e-commerce growth in the third quarter remained solid at 9%, a fairly positive indicator for the upcoming holiday season," said comScore Chairman Gian Fulgoni. "However, we continue to preach caution due to the continuation of high unemployment, which is creating very divergent spending patterns between the 'haves' and the 'have nots.'"

"Until the economy begins adding jobs at a meaningful rate, the lack of spending power among consumers will continue to be a drag on purchasing, with many consumers indicating their intention to cut back on gift buying this holiday season."

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Retailers' 2010 Holiday Forecast Mixed

Holiday retail sales in 2010 will likely be stronger than they were in 2009—but modestly so, according to ForecastIQ data from Prosper Technologies.

Based on year-over-year growth of same store sales among 27 US retailers*, roughly one-half of retailers tracked (14) are forecasting likely or almost certain growth in November and December 2010, whereas nine retailers likely or almost certainly expect to register sales declines.

Another four retailers are forecasting sales to remain flat (over the lackluster 2009 holiday season).

Across retailer categories, same store sales forecasts for November and December are mixed:

- High-end retailer Saks Fifth Avenue now forecasts almost certain sales growth over the next 60 days, while Neiman Marcus and Nordstrom are likely to register growth, signaling the return of the "luxury" consumer, at least for the holidays.

- Specialty retailer Victoria's Secret forecasts almost certain sales growth, while Buckle and Children's Place are likely to register growth.

- Warehouse clubs Costco and BJ's Wholesale Club, and value-driven retailers Ross and TJX are almost certain or likely to register sales growth in the next 60 days, signaling the continued importance of value in consumers' purchase decisions.

On the other hand, those retailers forecasting flat or declining sales are also from specialty, department, and discount store categories.

Below, retailers' expectations for year-over-year same store sales for November and December 2010:

- Almost certain to see sales declines: Hot Topic and Wet Seal

- Almost certain to see increases: Costco, Saks Fifth Avenue, and Victoria's Secret

- Likely to see increases: Abercrombie & Fitch, Aéropostale, BJ's Wholesale Club, Buckle, Children's Place, JCPenny, Neiman Marcus, Nordstrom, Ross, and The TJX Companies

- Likely to see declines: Cato's, Dillard's, Fred's, Gap, Old Navy, and Stage

- Flat: American Eagle, Banana Republic, and Bon-Ton

*An "almost certain increase" indicator for October implies that in November and December, retailers are almost certain to experience same store sales growth over the same period a year earlier.

About the data: ForecastIQ findings are based on the analysis of 8+ years of data from the BIGresearch monthly Consumer Intentions & Actions (CIA) surveys of future spending plans of consumers and the same store sales of over 27 publicly held retailers. Results provide a forecast of consumer spending 75 days in advance. Same store sales forecasts are provided by percent growth over the next 45 and 75-day period.