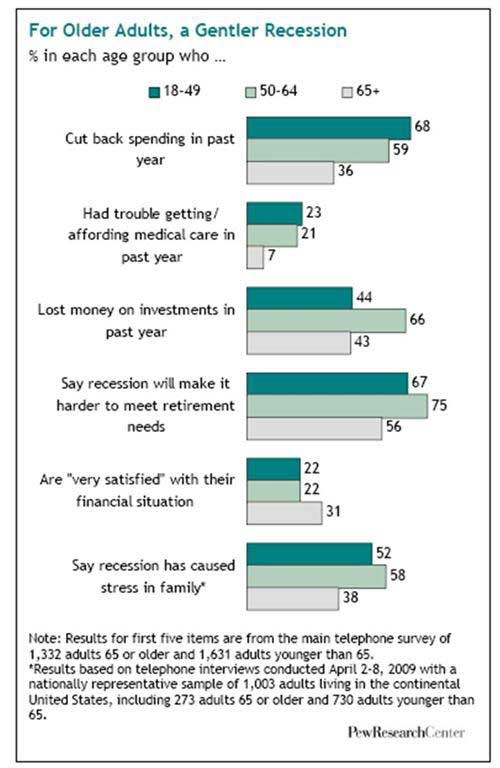

Americans 65+ have suffered less in this recession than other age cohorts, according to recent research from the Pew Research Center's Social & Demographic Trends project. Because most have already retired and downsized their lifestyle, write Pew's Rich Morin and Paul Taylor, they are relatively protected from the financial effects of the slumping economy.

Hardest hit has been the "Threshold Generation"—adults in late middle age (50-64) approaching retirement. At or near the peak of their earning power, they have watched their retirement savings dwindle. They also report the highest levels of uncertainty about the future.

Although people 18-49 have seen their job prospects dim, they remain fairly sanguine about their long-term financial outlook.

Key findings:

- Compared with younger cohorts, adults 65+ are less likely to have trimmed spending, to report trouble paying for housing or healthcare, or to have seen their retirement savings lose value.

- The 65+ cohort is more likely than younger Americans to report satisfaction with personal finances. Three-quarters of those 65+ expect to leave an inheritance, although more than half of adults 65+ report that the recession has carved into what they expect to leave.

Middle-Aged and Hardest-Hit

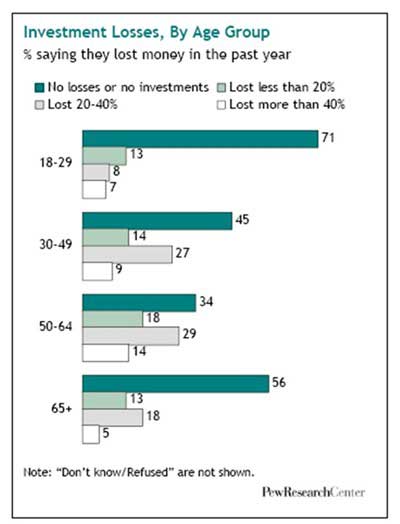

Adults of the Threshold Generation (50-64) are suffering the most in this recession among the age groups examined. Three-quarters of adults 50-64 say the recession will make affording retirement more difficult—unsurprising given that their retirement savings have borne the brunt of the economic meltdown.

Two-thirds of Threshold Generation adults report that in the previous year their mutual funds, individual stocks, or 401(k)-type retirement accounts lost value. Of those reporting losses, two in 10 say their investments dropped more than 40% in value, and nearly four in 10 report losing 20%-40%.

Far fewer adults 65+ and 18-49 reported similar losses.

Cutting Back

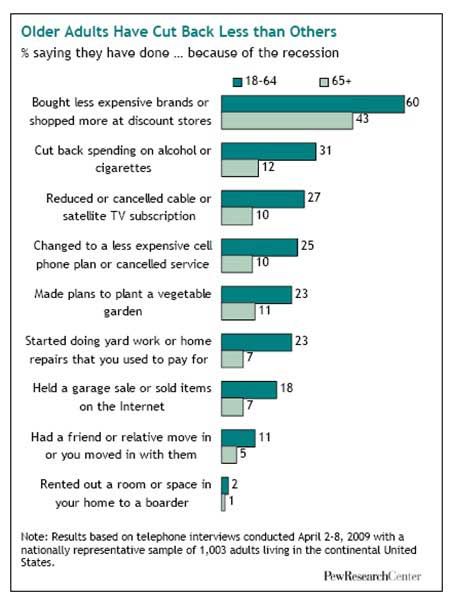

Older adults are much less likely than middle-aged or younger adults to have cut back spending or to have otherwise changed their behavior in response to the recession.

Key findings:

- Fully 60% of adults 18-64 report more shopping at discount stores or avoiding more expensive brands; only 43% of older adults (65+) report the same.

- Americans under 65 are much more likely than those 65 or older to have trimmed spending on alcohol or cigarettes (31% for adults < 65 vs. 12% for adults 65+) or on cable/satellite TV service (27% vs. 10%).

- Some 23% of adults 18-64 report planning to create a "recession garden" to reduce food expenses, compared with only 11% of adults 65+ who report planning to do so.

About the data: These figures are reported in Oldest Are Most Sheltered: Different Age Groups, Different Recessions, published May 14, 2009, by the Pew Research Center as part of its Social & Demographic Trends project. Data was collected from a telephone survey conducted Feb. 23 to March 23, 2009, on a nationally representative sample of 2,969 adults.