Advertisers are warming up to online video as a means to reach targeted audiences: 56% of ad agency executives and media buyers say online video advertising is more effective or much more effective than other forms of advertising, and 83% say they are getting more value for their online video spend this year than they were last year, according to a survey from BrightRoll.

That perception is likely to drive growth in the category: 94% of ad execs and media buyers say they plan to increase spending on online video, compared with the 87% who said so a year earlier.

Below, other findings from the second annual Online Video Advertising Report, which surveyed nearly 100 advertising agency executives and media buyers on their spending patterns and sentiments toward online video advertising.

Price, Access to Quality Inventory

Lower rates, better targeting, more access to quality inventory, and the emergence of performance-based metrics, such as cost per engagement (CPE) and cost per video view (CPV) have all contributed to the perceptions of increased value, according to BrightRoll.

Price, however, continues to be a prohibitive factor, along with others: 32% of execs and media buyers say lower costs would encourage more spending on online video advertising, followed by 24% who cite a lack of more defined industry standards and 20% who cite a lack of clearer ROI.

Regarding current CPM (cost per thousand impressions) pricing structures, quality of inventory is most important to buyers (61%), followed by specialized targeting (14%) and click-through rate (11%).

Targeting Takes Hold

Targeting is viewed online video's most valuable asset (32%), followed by ad unit format (21%), reach (19%), price relative to TV (10%), and ability to reuse creative (10%).

As ad networks improve their ability to provide the inventory, reach, impressions, and data needed to consistently access niche audiences, behaviorally targeted video ads will provide another way for brands to connect with their customers, according to BrightRoll.

Already, 61% of execs and media buyers say they have seen an improvement in performance on ads that are behaviorally targeted, and over one-half expect that at least 25% of their ads will be behaviorally targeted in 2010.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

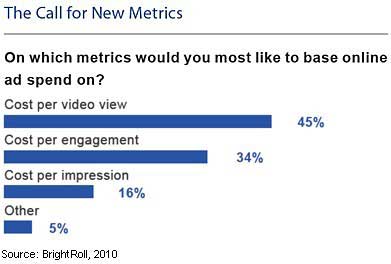

New Ad Metrics

Some 45% of execs and media buyers say they would prefer to base online ad spend on CPV (cost per video view), while 34% cite CPE (cost per engagement) and 16% cite CPI (cost per impression).

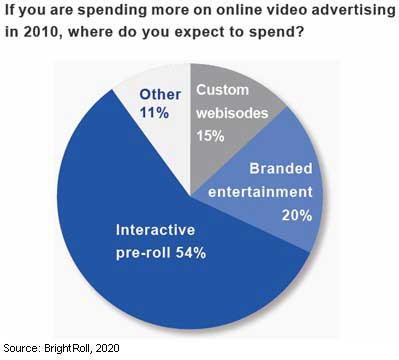

Video Ad Spending Breakdown

In 2009, advertisers, on average, bought 42% of their online video through ad networks, 43% of their video directly through publishers, and 15% through portals.

In 2010, spending on online video is forecast to increase nearly 48%. During the year, most advertisers plan to spend their creative budgets on interactive pre-roll (54%) and branded entertainment (20%):

About the data: BrightRoll conducted the survey among 97 executives and media buyers at advertising agencies across the US during March and the first week of April 2010.