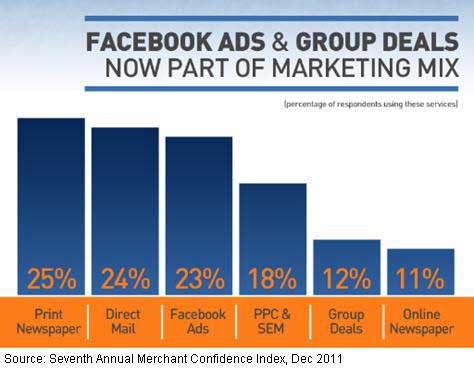

Group deals are gaining popularity among local businesses: 12% of surveyed local merchants say they have offered a group-deal promotion, up 33% (3 percentage points)(PPs) from the 9% who said so in June 2011, according to the seventh annual MerchantCircle Confidence Index.

Meanwhile, the adoption rate of Facebook Ads has slowed: 23% of local merchants now say they have used Facebook Ads, up just 5% (1 PP) from the 22% who said so six months earlier.

Traditional marketing channels also remain popular among local merchants: 25% say they use print newspaper ads and 24% use direct mail

Across other online channels, 18% of local merchants say they are buying pay-per-click search ads and 11% use online newspapers to promote their small businesses.

Below, additional findings from the seventh annual MerchantCircle Confidence Index, which tracks trends in sentiment among US local business and explores how they spend marketing dollars.

Both emerging platforms—group-deal services and Facebook Ads—are enjoying high favorability:

- Among local merchants who have used group deals, 75% say they would do so again.

- Among those who have used Facebook Ads, 62% they would do so again.

Customer Acquisition Top Benefit of Group Deals

Most merchants have had success acquiring new customers and generating a profit with group deals. Local merchants who would offer a daily deal again cite the following reasons for doing so:

- Effectiveness for customer acquisition: 61%

- Ability to negotiate effective deal structure: 38%

- Deal profitability: 37% (up from 24% in June)

- Competitors are doing it: 18%

However, among the 25% who would not offer another daily deal, most (42%) say their offer failed to attract new customers; 36% say it was too costly, 34% say they lost money on the deal, and 32% say the deal didn't make a competitive difference.

Google Offers Gains Momentum

Although Groupon and LivingSocial helped establish the daily-deals market in 2009, both services now face increased competition for local marketing dollars from Google, as well as from niche players.

Google Offers, the group-buying service that launched in the summer of 2011, has quickly gained momentum: 19% of local merchants who have offered a group deal have tried used Google Offers, compared with those who used Groupon (26%) and LivingSocial (21%). The large number of niche daily-deal providers has attracted roughly 43% of local merchants who have offered a group deal.

Looking ahead, an increasing number (32%) of local merchants plan to use Google Offers in 2012, whereas the share of those planning to use LivingSocial is expected to dip to 16%; the use of Groupon among local merchants is expected to remain flat in 2012.

Google Offers' growth will likely be, at least in part, at the expense of its two main competitors: 41% of Groupon and LivingSocial customers say they plan to use those services again, whereas 66% of those who have used Google Offers say they plan to use that service again.

Google Offers may also benefit from the closing of Facebook Deals. Before ceasing operations, Facebook Deals had been used by 22% of the surveyed local merchants who had offered a daily deal in the past. More than one-half (53%) of those customers say they plan to use Google Offers for their next deal.

Criteria for Selecting Group Deal Provider

When choosing a deals provider, cost remains the most important criteria for local merchants: 64% of local merchants cite cost as their top consideration, followed by local targeting (57%) and the ability to reach a large audience (52%).

However, businesses that plan to use Groupon in the future report the ability to reach a large audience is equally as important to them as cost: 62% cite reach and cost as key selection criteria.

Facebook Ads Adoption Slows

Although twice as many local merchants have used Facebook Ads than have tried a group deal—and 96% are aware of Facebook's targeted display ad offering—growth in the ad medium has slowed. As noted, 23% of local merchants say they have use Facebook Ads, up just 5% from six months earlier.

But favorability for Facebook Ads remains strong among those who have tried the program: 62% of local merchants say they would use Facebook Ads again, citing ease of use (62%) and the ability to start and stop campaigns (55%) as the top reasons for continuing.

Among the 28% who say they wouldn't use Facebook Ads again, nearly two-thirds (66%) say the ads failed to attract new customers.

However, merchants have become more concerned with high costs and low click-through rates as reasons not to advertise with Facebook again: 41% say the ads were too expensive (up from 35% who said so in June) and 37% report low click-through rates (vs. 29% in June).

Facebook Use Still Strong

Though Facebook Ads growth may have slowed, general Facebook marketing continues to be extremely popular among local merchants: 70% of local merchants use the social network for marketing (vs. 66% in June).

Pay-Per-Lead for Customer Acquisition

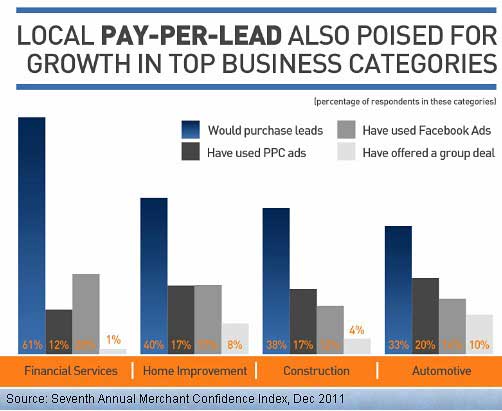

Merchants across several business sectors also say they would be willing to buy qualified prospect information on a pay-per-lead basis in 2012.

Some 61% of local merchants in the financial services and insurance industries say they would be willing to pay a per-lead fee for qualified customer prospect information, while more than one-third of merchants in the automotive (33%), construction (38%), home and garden and home improvement (40%) industries would pay for qualified leads as well.

Mobile Marketing

Just 22% local merchants report having done any type of mobile marketing and 72% say they don't have a good understanding of how to reach potential customers via mobile channels.

However, there are promising indicators for future mobile marketing activities: 60% of local merchants now own a smartphone and 24% own a tablet or plan to purchase one in the next six months (up from 19% in June).

Most 2012 Budgets to Remain Flat

Budgets are still tight: 63% of local merchants are spending less than $2,500 a year on marketing, and 78% have no plans to raise their budgets this year.

Moreover, the high cost of online marketing (30%) is cited as top marketing challenge among local merchants.

About the data: The MerchantCircle Confidence Index is a quarterly survey of local businesses owners who are members of MerchantCircle. The Index is derived from four key questions designed to synopsize the prevailing trends among local business owners with scoring based on a normalized five-point Likert scale. This seventh Merchant Confidence Index survey was fielded online among 2,555 US local business owners, Nov 8-28, 2011. Responding businesses classified themselves as legal and financial services, automotive, health and beauty, entertainment, travel and more. Some 78% percent of respondents employ fewer than five people.