It happens all the time: You learn that your active new-product programs are falling behind or the scope of the project has radically changed. Your teams are telling you they don't have enough resources to do all programs; moreover, they seem to be working at cross-purposes, and they have different opinions on the probability of getting the idea to work.

You need to figure out a way to get everyone on the same page so you can keep your new-product programs on track and get your ideas to market in a timely fashion.

In this article we will discuss ways to make sure you're properly resourcing your new-product portfolio, and then developing tracking tools to make sure they launch on time.

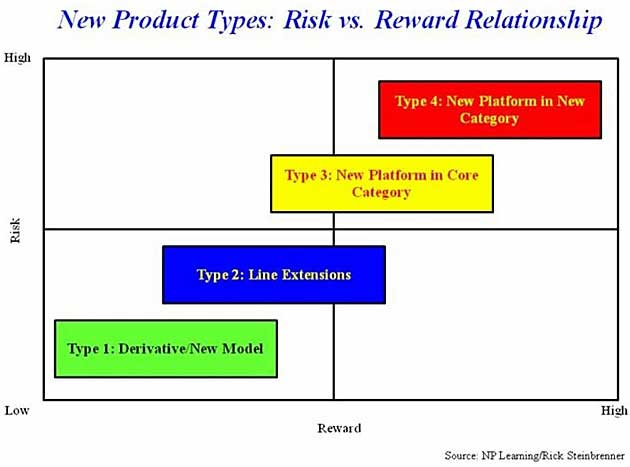

In "Are your new product ideas attractive enough?" I discussed the major types of new products as well as their differing risk/reward profiles:

- Type 1: Simple derivatives/new models of current product lines: easiest to do, lowest risk

- Type 2: Line extensions

- Type 3: New products/innovations in a company's core category

- Type 4: New product platforms in a category new to the company: hardest to do, highest risk

I then recommended using an objective assessment tool to help rank alternative new concept attractiveness from high to low. The goal of doing so is to prioritize your new-product portfolio—just as you would your individual financial investments.

Once that's completed, you need to determine whether your new product portfolio is "balanced" and can potentially deliver results vis-à-vis expectations. You must consider three critical elements to make sure your new product portfolio is "balanced":

- Are your new product ideas strategically aligned with business and innovation growth strategies?

- Is your new product portfolio balanced across product type, risk, time, and resources?

- Can they deliver against new product revenue growth expectations: Are they sufficient?

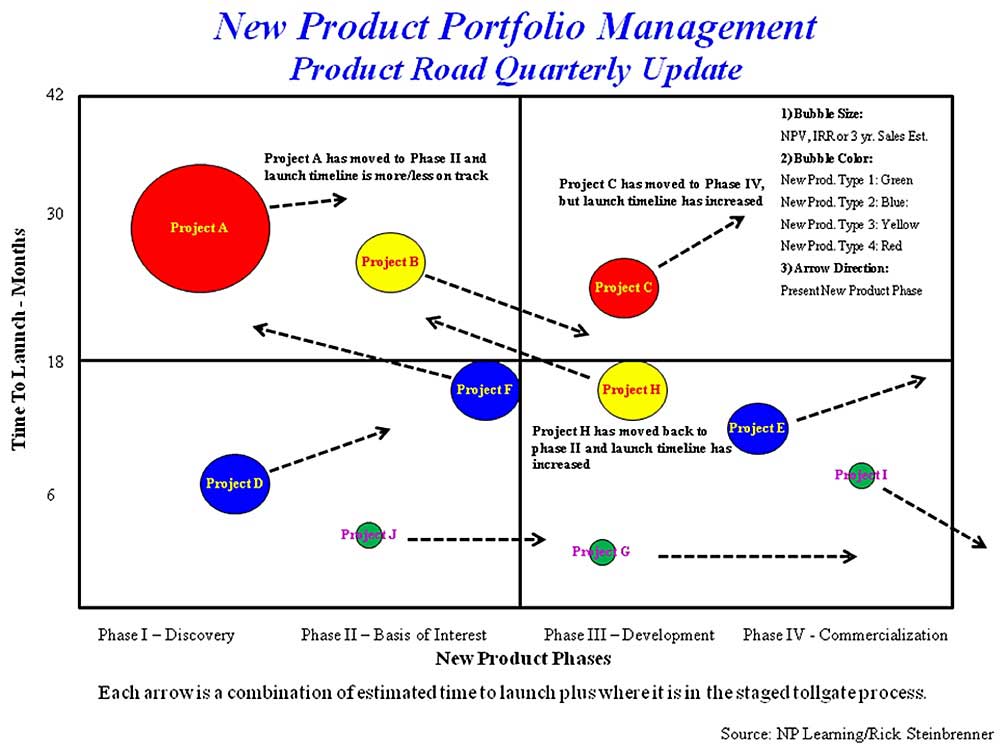

One tool than can help in this assessment is a new-product road map. The following is a graphical representation of a hypothetical product road map:

As you can see, this graphical plot shows the type of new product, the size of the opportunity, where it is in the new product process, and its estimated development timeline. The tool can then be used to help allocate limited development resources to achieve the desired risk/reward balance requirements.

Fortunately, the same tool can also help you track and manage your new product portfolio. All you need to do is plot progress along the launch time line as well as its current status in the new-product development process at different points in time (e.g., quarterly reviews) as shown in the following example:

As you can see, these tools are straightforward and easy to understand, and the really help get everyone on the same page. One caveat: In very large or global organizations, there can be literally hundreds of new product initiatives, which makes tracking more of a challenge.

Fortunately, various automated product portfolio management tools are on the market. (Once such program is called "Clarity," owned by Computer Associates.) This type of automated tracking programs uses a dashboard concept to assist in tracking a large number of new product programs. The following screen shot examples show how the dashboard can be used in larger organizations.

A final note: It's vital that both senior and line managers be consistent in their new-product resource management decision-making process. What that means is this: Line managers need to have "straight talk" with their senior leaders regarding realistic risk vs. reward opportunities; senior managers also need to realize their teams can't do everything. If priorities change too much, confusing signals are sent to the organization, easily crippling the effort to get anything out the door.

Also, the type of tracking tool that's used is not as important as having some tool to help manage and track alternative new product concepts.

Product portfolio tracking road maps are considered best-practice at many leading global companies, such as Proctor and Gamble, General Mills, Coca-Cola, Whirlpool, General Electric, Stanley Black & Decker, etc. They consistently manage and track their portfolios to make sure they're delivering the right mix of big and small ideas sufficient to meet the strategic growth objectives of their organizations.

It's little wonder, then, that many of those companies are No. 1 or No. 2 in their respective product categories. Can you say your company belongs on that list?