Consumers and advertisers largely disagree about the effectiveness of many types of ads (pdf), as well as in their assessments of Internet advertising (pdf) and Twitter (pdf), despite some areas of agreement, finds a recent survey by LinkedIn Research Network/Harris Poll.

With consumers' wallets shrinking and ad budgets tight, advertisers might want to readjust their strategies to bridge those gaps, the findings suggest.

Below, additional findings from the LinkedIn/Harris Poll survey.

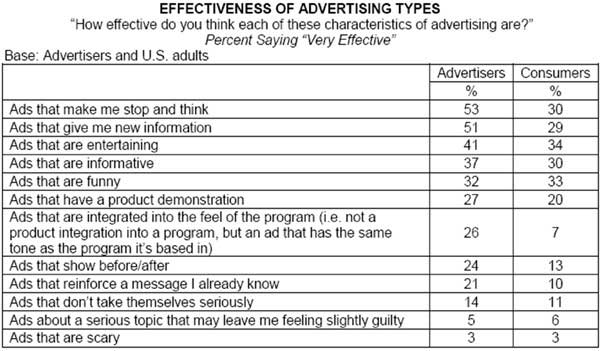

Ad Types: Divergent Views

Although some agreement exists between advertisers and consumers when judging different ad types, disagreement is the rule:

Highlights:

- More than half of advertisers say ads that make people stop and think and ads that give people new information are very effective. Only three in 10 consumers say the same.

- Approximately one-quarter of advertisers say ads that are integrated into the feel of the program are very effective, yet just 7% of consumers say so.

- Regarding ads that show before/after, 24% of advertisers say they are very effective while only 13% of consumers agree.

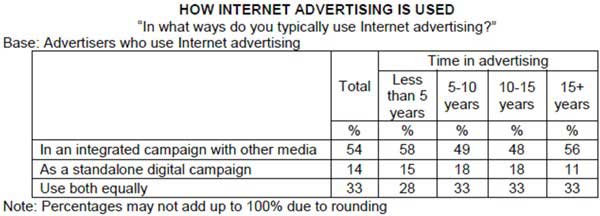

How Advertisers Use Online Advertising

Just 14% of advertisers say they use Internet advertising as a standalone digital campaign, whereas 54% say they use it in an integrated campaign.

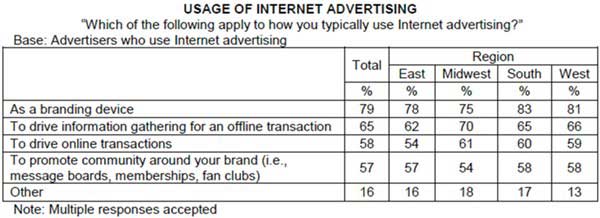

Moreover, advertisers tend to view Internet advertising mostly as a branding device (79%) and a means of information-gathering for an offline transactions (65%), though driving online transactions and promoting community around their brand are also important to them.

Internet ads frustrate consumers

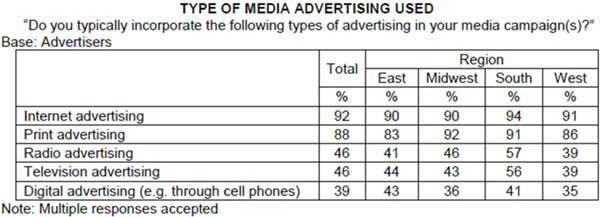

Advertisers' increasing use of Internet advertising contrasts with consumers' largely negative opinions of online ads.

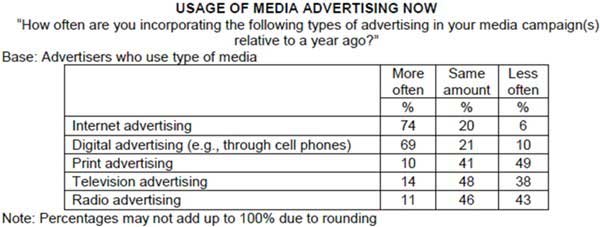

Most advertisers (92%) say they typically incorporate Internet advertising into their media campaigns, and 74% of those say their use of online ads has jumped from a year earlier.

Although the trend among advertisers is clearly toward the Internet, consumers' attitudes suggest caution might be warranted:

Highlights:

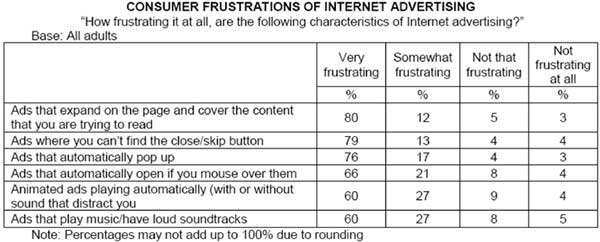

- Four in five consumers say they find ads that expand on the page and cover the content "very frustrating." Roughly the same number say the same of ads with hard-to-find close or skip buttons.

- Approximately three-quarters of consumers deem pop-ups very frustrating.

Advertisers, Consumers Twitter-Skeptics

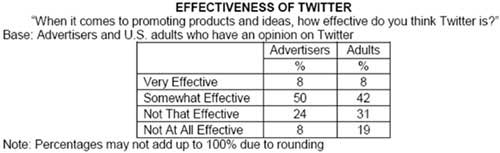

Advertisers and consumer share skepticism about the effectiveness of Twitter as a promotional vehicle:

Interestingly, these similar opinions are rooted in very different levels of familiarity with the medium and divergent opinions about its future:

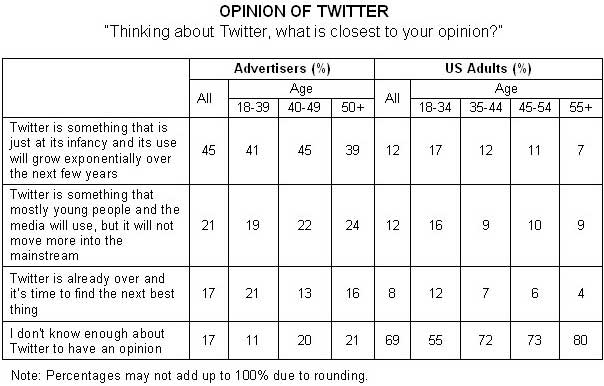

- 17% of advertisers say they don't know enough about Twitter to have an opinion on it, whereas 69% of consumers say the same.

- 45% of advertisers say Twitter is in its infancy and its use will grow exponentially; just 12% of consumers agree.

As might be expected, an age divide exists about Twitter, for advertisers and consumers alike:

- Younger advertisers are more likely to have an opinion on Twitter than their older counterparts. Only 11% of 18-39-yearolds do not know enough about Twitter to have an opinion, compared with 20% of advertisers 40-49 years old and 21% of advertisers 50+.

- 55% of adults 18-34 years old say they don't know enough to have an opinion, compared with 80% of those 55+.

Addressing the Economic Crisis

Are advertisers' strategies for addressing the economic crisis resonating with consumers? Cheerleading and empathy aren't:

- 25% of advertisers are using cheerleading: "We've made it through tough times before, we'll do it again, and we can help you do it." But 38% of consumers say cheerleading ads don't work.

- 39% of advertisers emphasize in their ads that companies understand what consumers are going through. But only 24% of consumers say empathy works very or somewhat well, and 33% say it does not work at all.

- A highlight on value, though, does work: 61% of advertisers say they are using a value proposition strategy, promoting sales, coupons and discounts, and 57% of consumers agree that this strategy is effective.

- The research highlighted one significant opportunity—luxuries for less: Only 18% of advertisers say they are emphasizing luxuries for less, but 34% of consumers say such ads work very well or well in selling products or services to them.

About the data: This LinkedIn Research Network/Harris Poll was conducted online within the United States June 24-26, 2009, among 2,025 adults (age 18 and older) and June 22-30, 2009, among 1,015 advertisers (age 18 and over).