The ad recovery is gaining momentum: Total US measured advertising expenditures reached $94.06 billion in the first nine months of 2010, up 6.4% from the same period a year earlier, according to data from Kantar Media. Ad spending in the third quarter was up 8.7% over 3Q09 levels—the largest quarterly gain since the end of 2004.

"The advertising recovery expanded during the third quarter to include stronger participation by the longtail of marketers beyond the Top 1,000," said Jon Swallen, SVP Research at Kantar Media. "Having fewer resources, this segment was previously cautious about raising budgets and it lagged behind the early year rebound in ad spending."

"Smaller advertisers are now as fully vested as their large counterparts and in that sense, the advertising recovery has reached a significant milestone.

Below, measured ad expenditure-related data and analysis for the first nine months of 2010 from Kantar Media.

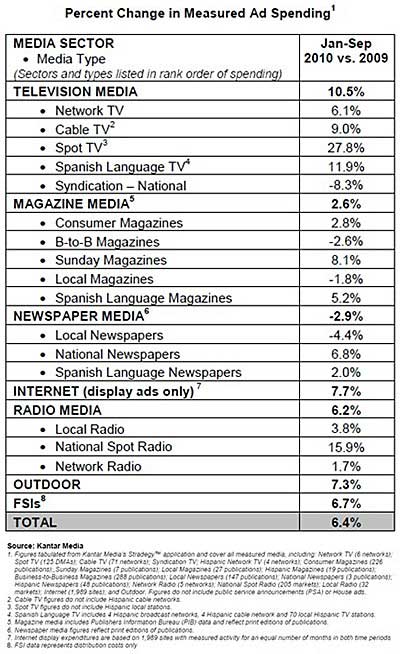

Measured Ad Spending by Medium

Television media continued to pace the advertising recovery in the first nine months of the year:

- Spot TV expenditures surged 27.8% year over year (YOY) on the strength of political advertising and sustained demand from automotive marketers and retailers.

- Spanish Language TV spending rose 11.9%, aided by the World Cup event during June and July.

- Gains for Cable TV (up 9.0%) and Network TV (up 6.1%) were driven by sharply higher spending from the auto, financial service and consumer package goods categories.

Internet display advertising had the second largest growth rate among the media sectors, up 7.7% YOY. Outdoor followed (up 7.3%).

The Radio sector, up 6.2% YOY was driven by spending in National Spot Radio (up 15.9%) and Local Radio (up 3.8%)—both paced by larger outlays from auto dealer and financial service advertisers. Network Radio registered a small increase (1.7%).

Consumer Magazines, after a weak first quarter, rebounded solidly in subsequent months, up 2.8% YOY. Sunday Magazines (up 8.1%) benefited from higher spending by pharmaceutical companies and home improvement retailers.

National Newspaper spending rose 6.8% YOY, primarily from gains at the Wall Street Journal. Local Newspaper expenditures fell 4.4% despite stable volume of ad space sold. Local Newspaper spending has now declined for 20 consecutive quarters.

Ad Spend by Category

Expenditures among the 10 largest advertising categories reached $53.55 billion in the first nine months of 2010, up 7.4% from the same period a year earlier.

- Automotive was the leading category in spending volume and growth among the Top 10—reaching $9,151.5 million, up 23.7% YOY, reflecting the improved climate for auto sales. Within the category, manufacturers and dealers had comparable rates of growth.

- Telecom was the second largest category, with $6,369.4 million in expenditures, up 4.7%. Slowing rates of spend in the wireless segment were offset by vigorous competition and larger budgets among TV service providers.

- Financial Services increased 9.4%, to $5,604.6 million, although growth rates slackened in the third quarter. Results were skewed by a sustained marketing barrage from a handful of leading credit card issuers. More telling is the ongoing weakness in retail bank advertising and a recent slowdown by marketers of investment products.

- Only two of the top 10 categories posted spending declines: Direct Response budgets shrank 6.2%, to $4,549.9 million. Pharmaceutical advertising was down 8.5%, to $3,160.9 million on broad reductions across top spending brands.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

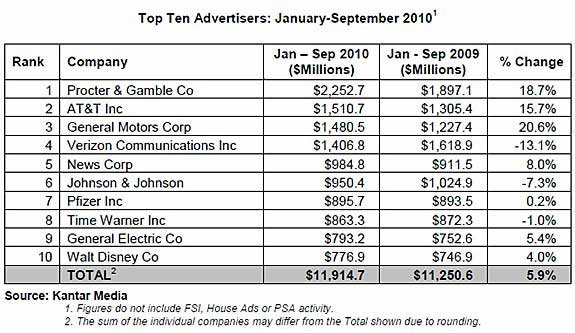

Ad Spend by Advertiser

Among the Top 1,000 advertisers, a diverse group accounting for three-fourths of the measured-ad economy, spending increased 7.3% in the first nine months of 2010. However, the long tail of small advertisers—defined as those outside the Top 1,000—registered a 3.3% increase in their aggregate media investments.

The top 10 advertisers in the first quarter spent a combined $11.91billion, up 18.7% from a year earlier.

- Procter & Gamble maintained its top ranking, spending $2,252.7 million, up 18.7% over the same period a year earlier. However, P&G's third quarter budgets were flat.

- AT&T boosted expenditures 15.7% to $1,510.7 million. Much of the additional money was directed towards its consumer television service, which accounted for nearly one-tenth of the company's ad dollars. Rival Verizon Communication cut spending 13.1%, to $1,406.8 million.

- Despite a widespread surge in the auto category, General Motors was the lone auto advertiser in the Top 10, investing $1,480.5 million, up 20.6% from a year earlier.

- Smaller increases were posted by News Corp (up 8.0%, to $984.8 million), General Electric (up 5.4%, to $793.2 million) and Walt Disney (up 4.0%, to $776.9 million). Results for each of those companies were primarily shaped by their movie studio divisions.

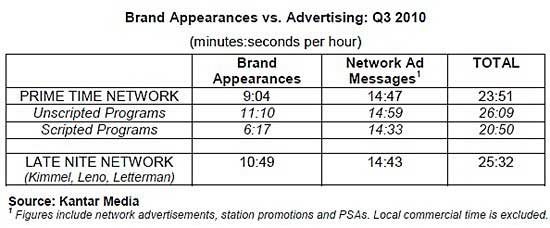

Branded Entertainment

In the first quarter of 2010, an average hour of monitored primetime network programming contained nine minutes, four seconds (9:04) of in-show brand appearances and 14:47 of network commercial messages. The combined total of 23:51 of marketing content constitutes 40% of a primetime hour.

Other brand-appearance-related findings:

- Unscripted reality programming had an average of 11:10 per hour of brand appearances, compared with just 6:17 per hour for scripted programs such as sitcoms and dramas.

- Late-night network talk shows had an average of 10:49 per hour. The combined load of brand appearances and network ad messages in those late-night shows was 25:32 per hour, or 43% of total content time.

- The top 5 brands ranked by total amount of brand appearance time were Chef Revival, Viking Appliances, Bud Light Beer, Yamaha Music, and Ford Motor Company.

Note: Kantar Media monitors branded entertainment within network prime time and late night programming. The tracking identifies brand appearances and measures their duration and attributes. Given the short length of many brand appearances, duration is a more relevant metric than a count of occurrences for quantifying and comparing the gross amount of brand activity that viewers are potentially exposed to in the program versus the commercial breaks.

About the data: Kantar Media tracks all media (print, radio, TV, internet, social media, and outdoors worldwide) for a full range of media insights and audience measurement.