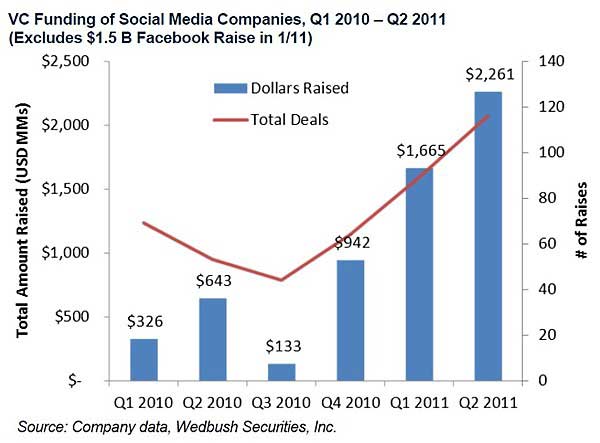

Venture capital (VC) funding of social media companies reached $2.23 billion in the second quarter of 2011, roughly 3.5 times the $643 million raised by social media companies one year earlier, according to a report by Wedbush Securities. Group-buying companies received the largest outlays during the quarter, led by LivingSocial, 55tuan, and Coupons.com.

The second-quarter results were slightly below the $3.17 billion raised by social media companies in the previous quarter. But 1Q11 results were inflated by the $1.5 billion Facebook raise in January, as well as a $950 million raise by Groupon.

Below, other findings from Wedbush Securities' report titled, "The Second Internet."

Among other results from the second quarter of 2011:

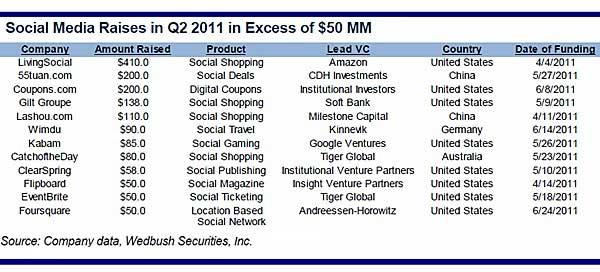

- The largest deals were social-commerce related, led by LivingSocial (raising $410 million), 55tuan ($200 million), Coupons.com ($200 million), and Gilt Groupe ($138 million).

- Social gaming companies raised a total of $217 million, up from $96 million in 1Q11.

- Buoyed by a $90 million investment in Wimdu, social travel companies raised $94.5 million, up from $2.0 million in 1Q11.

Below, a list of second-quarter social media investments that exceeded $50 million, which together amounted to $1.5 billion—or roughly 68% of total amount ($2.3 billion) raised in the quarter:

After excluding raises of $100 million or larger, average deal size for second quarter was $10.8 million, up from $8.1 million in the previous quarter.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

The future looks just as bright. Even given such financial hyper-activity, emerging social companies, or "Second Internet" ventures are changing the world to a far greater extent than Wall Street currently appreciates, Wedbush notes.

For the foreseeable future, the financial activity related to Second Internet companies will likely be very positive.

About the data: Findings are based on research conducted by Wedbush Securities.