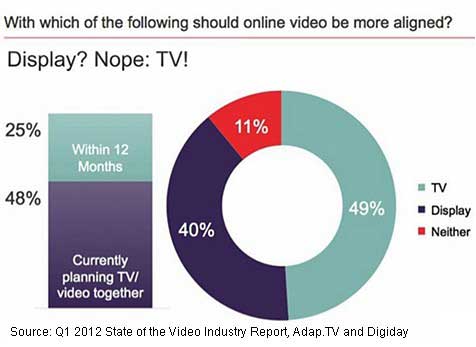

Most brands and ad professionals say video advertising should be more aligned with TV rather than online display, and 48% are already planning TV and video together, according to a survey from Adap.TV and Digiday.

Among brands, agencies, publishers, and ad networks surveyed, nearly one-half (49%) say video should be more aligned with TV, whereas 40% say video should be more aligned with online display; 11% are still unsure whether online video represents a new medium entirely.

Moreover, in addition to those 48% of brand and ad professionals who are planning TV and online video together in 2012, another 25% expect to do so over the next 12 months.

Below, additional findings from the Q2 2012 State of the Video Industry Report, by Adap.TV and Digiday.

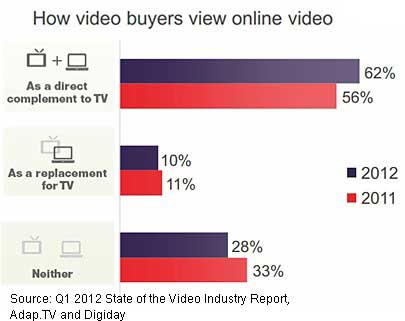

Video complements TV

More than six in ten (62%) brands and ad professionals say their use of online video is more likely to be a complement to TV; 10% say video campaigns have replaced TV; and 28% say the medium is "neither" a complement nor a replacement (i.e., it stands on its own).

Building the brand is most important

Nearly three-quarters (73%) of brands and ad professionals cite brand building as their main objective with online video marketing, up from the 68% who said so a year earlier.

Unified metrics are key

To support the fusion of TV and video, uniform measurement is important: 13% of brands and ad professionals say unified metrics are "most important" to fusing TV and video, 51% say such metrics are "important" to that end, and 28% say unified metrics are "somewhat important" for doing so.

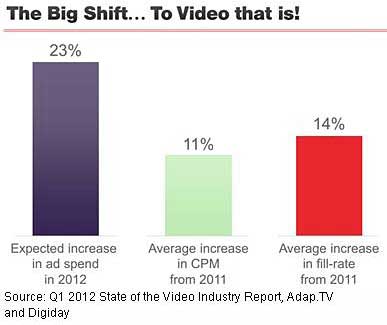

Optimism is healthy, CPM is up

Most (96%) video buyers surveyed expect video ad budgets to increase at least 23% in 2012.

Publishers are also bullish: 80% report CPMs have increased 11%, on average, over 2011 levels, and fill-rates are up 14% over the same period.

Connected TV is gaining support

A growing number of ad professionals are bullish on connected TV: 28% of advertisers already purchase connected TV inventory (up from 8% who did so a year earlier). Moreover, 32% of advertisers plan to buy such inventory in the coming year.

Similarly, publishers are optimistic: 26% say they plan to ramp up connected TV inventory availability over the next 12 months, up from 17% who said so a year earlier.

Advertisers are shifting to programmatic buying

Asked how they source their video ad inventory, most (73%) advertisers cite ad networks.

However, more advertisers are sourcing via other, automated environments:

- 29% buy inventory via exchanges, up from 15% one year earlier.

- 32% use demand-side platforms (DSPs), up from 11% in 2011.

- 27% buy via trading desks (included for the first time in this survey).

About the data: This survey was conducted in late March and early April 2012 among Digiday subscribers, conference attendees, and speakers who describe themselves as digital media and marketing professionals. Among the 638 respondents, 43% were from agencies, 25 from publishers, 19% from ad networks and DSPs, and 13% from brands.