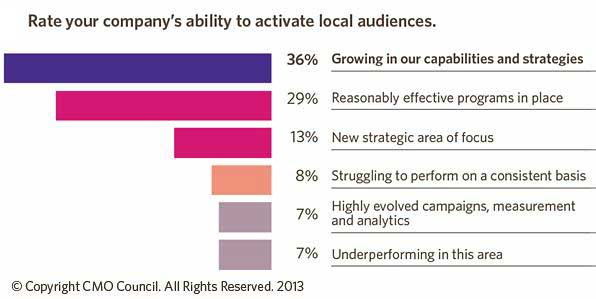

Though 59% of national brand marketers say local marketing is essential to their business growth and profitability, only 7% say they have highly evolved campaigns in place—complete with measurements and analytics—that can activate consumers at a local level, according to a report by the Chief Marketing Officer (CMO) Council in partnership with Balihoo.

One-third (36%) of national brand marketers say they are developing their campaigns and strategies to activate local audiences, and 29% have reasonably effective programs in place to do so:

Dissatisfied with the effectiveness of their local channels and field sales partners, many national brands are banking on new digital media channels to boost local marketing efforts, the study found. However, most still question the impact and value of mobile investments.

Below, additional findings from the report titled "Brand Automation for Local Activation," conducted by the CMO Council in partnership with Balihoo, a provider of local marketing automation (LMA) technology.

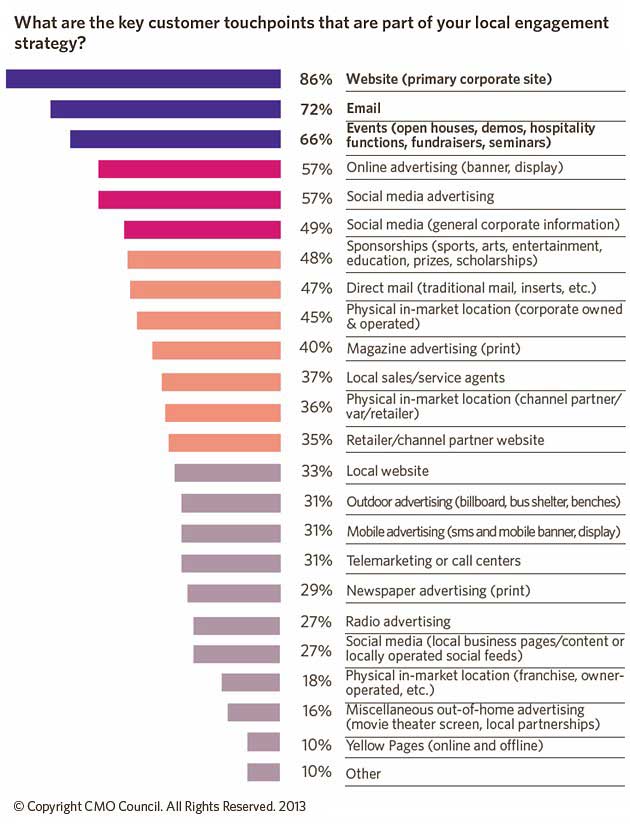

Key Customer Touch Points

For national brand marketers, managing a network of local marketing activities is challenging—particularly given the vast array of traditional and digital channels.

Not surprisingly, when communicating with local audiences, brand marketers tend to rely on the same channels at the local level as they do at the national level: 86% use corporate websites for local marketing, 72% use email, and 49% rely on corporate social media feed.

Fewer national brands rely on local websites (33%) or locally-focused social media feed (27%).

Who's in charge of local efforts? For the most part, senior leaders such as CMOs (31%) and corporate marketers (29%) are at the helm of local marketing strategies; fewer brands rely on regional marketing teams (24%).

Delays in Executing Local Campaigns

Though 30% of brand marketers execute local campaigns within 8 to 20 days of a national launch, 31% say they require 30+ days to distribute local marketing materials.

Nearly one-third (30%) say those delays are a result of a lack of resources to tackle both global/national and local campaigns.

However, the payoff for shorter timelines is evident: 88% of marketers who have executed local national campaigns simultaneously say their brand gained a competitive advantage by doing so.

Greater Reliance on Digital

National brand marketers became more reliant on digital marketing channels over the past 12 months:

- 27% of marketers say they shifted more resources to digital media.

- 18% worked to better centralize control of brand assets to ensure continuity.

- 15% have applied more rigor to measuring and integrating online and offline analytics.

- 9% have made social media a main channel of engagement with local customers.

- 4% have automated the local marketing process.

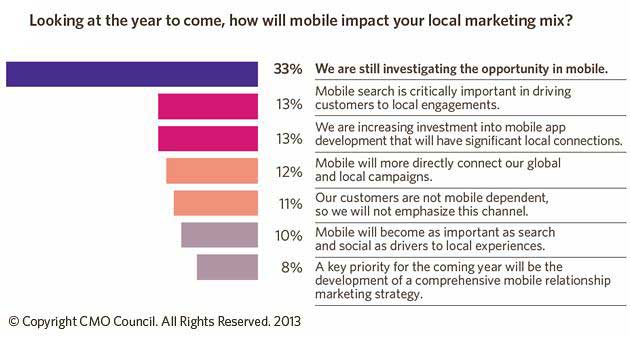

Outlook for Mobile Marketing

Notably, only 8% of national brand marketers say mobile will be critical to further local connections, and only 12% view mobile as a successful ad channel. Even so, 33% of brand marketers are still investigating the opportunity:

Bringing the Field Into Alignment

Only 8% of brand marketers surveyed say they're extremely satisfied with the way new product, pricing, and promotional campaigns are executed and leveraged by local field sales, reseller, franchise, or partner networks.

A more comprehensive strategy (24%) coupled with a comprehensive local marketing automation solution (30%) are core to marketing's plans to improve and transform localized marketing strategies.

Moreover, 52% of marketers agree that comprehensive brand campaign automation could strengthen ties between the head office and local customer-facing resources and touch points.

Measuring Local Campaigns

Some 40% of marketers have established a formalized measurement process for localized marketing, but nearly the same proportion (37%) say their measurement processes are managed on an ad-hoc basis.

Among those marketers who measure local campaigns, 26% have access to a comprehensive dashboard that can provide a view across all channels and campaigns. However, an equal proportion (26%) either do not have a formal process to access campaign measures or are only able to intermittently measure based on participation or level of measurement delivered from the field.

The byproduct of such random access to measures is the challenge of adjusting campaigns for optimal performance.

Only 33% of marketers say they are shifting national campaigns to have greater relevance and resonance with local markets, and 29% say they can only sometimes make adjustments because they don't always have the right intelligence to make substantive changes.

About the data: Findings are based on an online survey of 296 senior marketers, conducted Nov. 2012 to Feb. 2013 by the CMO Council and Balihoo.