Small business owners have enough to worry about without getting into the nitty-gritty of credit card transactions. As long as your process works and you're able to accept payments from your customers, then you have more important things to worry about.

But credit card processing fees can add up, and understanding where your money is going can help you negotiate better rates.

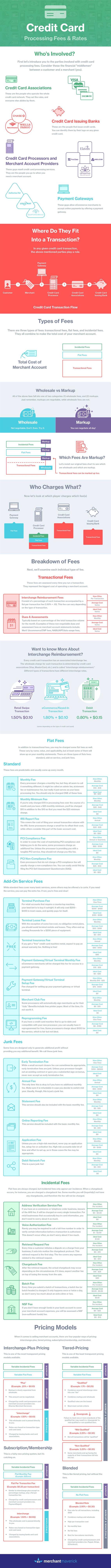

This infographic by Merchant Maverick explains what business owners need to know about credit card processing fees and rates.

It outlines...

- The four parties involved (credit card associations, issuing banks, processors, and payment gateways)

- The types of fees (incidental, flat, and transactional)

- The end-to-end process

- Pricing models