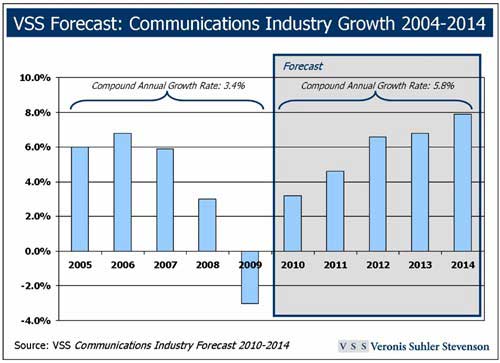

Driven by gradual economic recovery, advances in digital technology, and secular shifts in business and consumer spending, total communications industry spending is on pace to increase 3.5% in 2010 and post a compound annual growth rate (CAGR) of 5.8% from 2010 to 2014, reaching $1.4 trillion in spending by 2014, according to Veronis Suhler Stevenson (VSS).

Significant spending increases are expected in three industry sectors: Business & Professional Information & Services, Targeted Media (including substantial growth in the Pure-Play Consumer Internet & Mobile Services segment), and Entertainment & Leisure Media:

- Business & Professional Information & Services is forecast to post a CAGR of 8.2% during 2009-2014, reaching $249.00 billion in 2014. Increases will be a result of publishers/vendors and users continuing to expand their online and mobile products and services via application suites incorporating databases, software solutions, and outsourced processing services to drive productivity.

- Targeted Media, and Entertainment & Leisure Media is forecast to be the second-fastest growing industry sector, registering a 7.3% CAGR increase during 2009-2014, reaching $265.58 billion in 2014. Growth will be spurred by the Pure-Play Consumer Internet & Mobile Services segment, expected to grow at a CAGR of 14.6% in 2009-2014, reaching $87.79 billion in 2014. Branded Entertainment is forecast to increase a 9.2% CAGR to $38.16 billion, and Outsourced Custom Publishing, where advertisers are seeking targeted approaches to reaching key audiences, is expected to increase 11.2% CAGR to reach $6.57 billion in 2014. Other well performing segments include Public Relations & Word-of-Mouth Marketing, which is forecast to increase 9.7% CAGR during 2009-2014, reaching $8.01 billion in 2014, and Business & Professional Services, expected to register a 9.1% CAGR increase, reaching $147.12 billion in 2014.

- Education & Training Media & Services is forecast to increase 6.8% CAGR, reaching $311.28 billion in spending by 2014, due to gains in the for-profit post-secondary and college education markets and solid increases in outsourced corporate training and K-12 educational materials during the latter part of the forecast.

- Entertainment & Leisure Media is forecast to post CAGR gains of 6.3% over the next five years, reaching $353.87 billion in 2014. Subscription TV will continue to be the primary driver.

- Marketing Media is expected to be the slowest growing and smallest industry sector during the forecast period, increasing at a 1.8% CAGR from 2009 to 2014 to $77.23 billion. Solid gains in Public Relations and Word-of-Mouth Marketing will be unable to mitigate sluggish growth in traditional marketing segments, such as Business-to-Business Promotions and Consumer Promotions.

- Traditional Consumer Advertising Media, which includes Broadcast TV, Newspapers, Consumer Magazines, Broadcast & Satellite Radio, Yellow Pages Directories, and Out-of-Home Media, is forecast to post a CAGR gain of just 2.2% during 2009-2014, reaching $159.30 billion in spending by 2014. The availability of new media platforms and technologies will contribute to continued changes in consumers' media use, particularly secular declines in consumer consumption of traditional media platforms.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Below, additional projections issued by the private equity firm VSS.

Growth by Revenue Stream

From a revenue stream perspective, overall communications industry growth in the next five years will likely be fueled by gains in Consumer and Institutional End-User spending. The Advertising Revenue Stream, which has registered declines for two consecutive years, will experience stronger growth rates than Marketing Services during the forecast period:

- The Institutional End-User Revenue Stream will remain the largest and fastest growing of the four Revenue Streams, increasing 5.3% in 2010 to $490.54 billion, and posting a CAGR increase of 7.3% during 2010-2014, reaching $661.48 billion in spending by 2014.

- Consumer End-User Stream spending is expected to grow 3.6% in 2010 to $225.88 billion, and generate a 6.0% increase in CAGR during the 2010-2014, to $292.07 billion by 2014. As the economy strengthens, and digital/wireless channels proliferate, consumers will resume spending on hit-driven media, such as home video, video games, and recorded music, according to VSS. Spending on pure-play Internet and mobile content and access will enjoy robust growth due to ongoing consumer migration to digital platforms and increased adoption of third- and fourth-generation cell phones and smartphones.

- The Advertising Revenue Stream is expected to benefit from two additional even-year spending boosts—the Olympics and political campaigns—during 2010-2014. That is expected to drive a 5.4% increase in CAGR, pushing spending on Advertising to $234.90 billion by 2014.

- The Marketing Services Revenue Stream, which includes Direct Marketing, Branded Entertainment, and Outsourced Custom Publishing, will benefit over the next five years from alternative market vehicles, such as email marketing, consumer events, paid product placements, e-custom publishing, and word-of-mouth marketing. The sector posted its worst performance in 35 years during 2009, falling 9.6% to $189.86 billion. The primary cause of that decline was Traditional Marketing vehicles, such as direct mail, point-of-purchase and business-to-business promotions. The sector is expected to rebound during 2010-2014, posting a 3.7% CAGR during the period and reaching $227.82 billion in spending by 2014. However, it will become the smallest Revenue Stream, VSS found.