Bolstered by Internet advertising—particularly social media and online video—global ad spend growth is forecast to strengthen over the next three years, rising from an estimated 3.3% year-over-year (YOY) growth in 2012, to 4.1% growth in 2013 and 5.6% growth in 2015, according to projections by ZenithOptimedia.

Internet ad spending is forecast to grow 14.6% YOY in 2013, while traditional media is on track to grow 1.7%.

Moreover, Internet ad spending is projected to overtake newspapers—for the first time—in 2013, and then exceed the combined total of newspaper and magazine advertising in 2015.

"Advertisers are willing to increase their budgets wherever they can achieve a strong return on investment," said Steve King, global chief executive officer for ZenithOptimedia Group. "This means that developing markets, social media, and online video are all growing rapidly, supporting continued expansion in global ad expenditure despite stagnation in the eurozone."

On a regional basis, developing markets are expected to contribute 61% of ad spend growth between 2012 and 2015, increasing their share of total spend from 34% in 2012 to 37% in 2015.

Developing markets are forecast to grow 8% on average in 2013, while developed markets rise only 2%, weighed down by the eurozone crisis.

Below, additional projections issued by ZenithOptimedia.

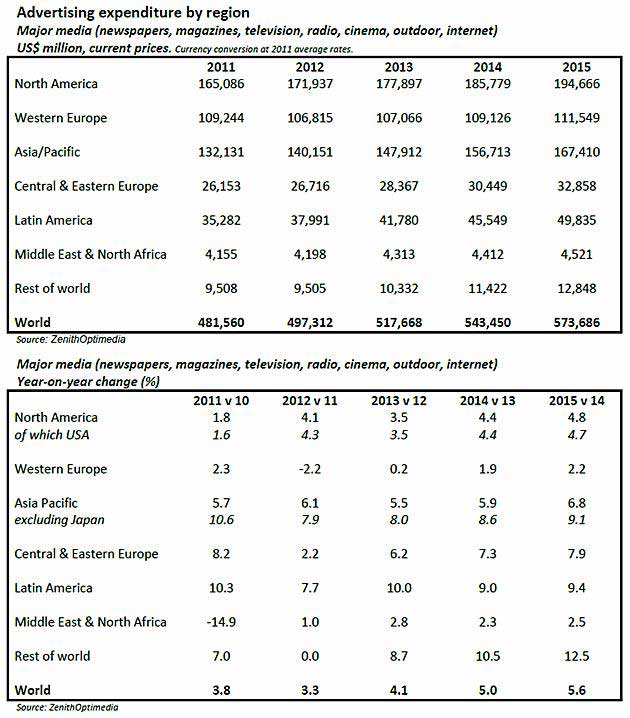

Overall global ad spend is projected to grow 4.1% in 2013, reaching $518 billion by the end of the year; however, regional growth levels vary dramatically:

- North-American ad spending is now forecast to grow 3.5% YOY in 2013 and 4.4% in 2014.

- The eurozone region, now the primary drag on the global ad market, is expected to shrink 4% in 2013, stabilize in 2014, and grow 2% in 2015.

- Northern and Central Europe is projected to be static in 2013, then grow 2% annually in 2014 and 2015.

- Strong growth is forecast for Latin America in 2013, up 10% YOY, then growing 9.0% in 2014 and 9.4% in 2015.

- Asia-Pacific excluding Japan is expected to grow 5.5% in 2013 YOY; Japan's ad spend is on track to rise 8.0% in 2013 and 8.6% in 2014.

Key risks to growth in 2013 are the US fiscal cliff (automatic increases in tax and reductions in public spending that come into effect in January unless Congress passes legislation) and the potential for further conflict in the Middle East (and therefore higher oil prices).

However, the general consensus among economic forecasters is that the global economy will gradually build up speed over the next three years.

Global Ad Spend by Medium

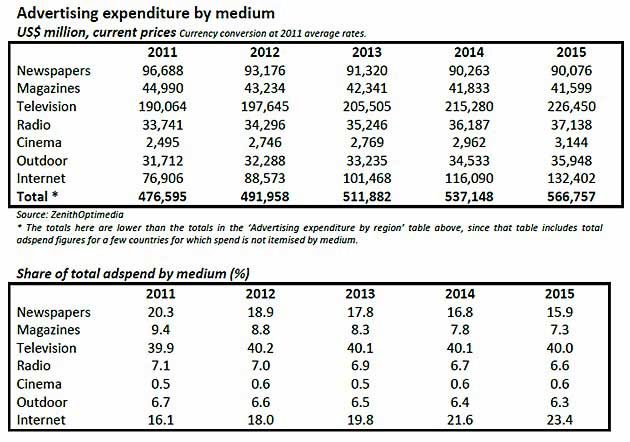

Internet advertising is expected to grow an estimated 15.2% in 2012, and then 14% to 15% annually from 2013 to 2015.

Key Internet-related analysis and forecasts:

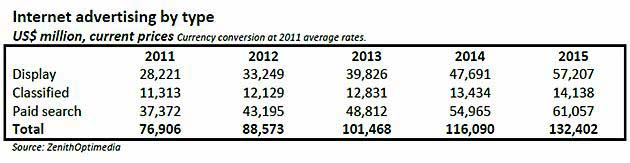

- Display is the fastest-growing sub-category, with 20% annual growth, due to the rapid rise of social media and online video advertising, each of which is growing roughly 30% per year.

- Display ads are now growing substantially faster than paid search (which is forecast to grow 12% a year to 2015) and classified (5% a year).

- Display advertising accounted for an estimated 38% of Internet advertising in 2012; by 2015 that proportion is expected to rise to 43%.

Internet Ads to Overtake Newspaper

Since it began in the mid-1990s, Internet advertising has principally risen at the expense of print.

Between 2002 and 2012, the Internet's share of global advertising rose 15 percentage points, while newspapers' share fell 12 points and magazines' share fell 5 points.

Internet advertising is now projected to increase its share of the ad market from an estimated 18.0% in 2012 to 23.4% in 2015, while newspapers and magazines shrink at an average of 1% a year.*

Internet advertising, forecast to overtake newspapers for the first time in 2013, will likely exceed the combined total of newspaper and magazine advertising by 2015.

Other key analysis and forecasts:

- From 2012 to 2015, Internet ad spending is expected to account for 59% of the growth in total expenditure.

- Television is the second largest contributor to spending growth, expected to account for 39% of the growth over the forecast period.

- TV's share of global ad spend has stabilized after growing moderately for most of the last three decades. Television accounted for 31% of spend in 1980, 32% in 1990, 36% in 2000, and 39% in 2010. Now TV is expected to fall back slightly, from 40.2% in 2012 to 40.0% in 2015.

- Driven by growth in online video, video formats overall (television plus online video) are increasing their share of global spend, from 41.5% in 2010 to 42.6% in 2015.

*Note: Figures include only advertising in printed editions of these publications, not on their websites, or in tablet editions or mobile apps, all of which are picked up in the Internet category.

About the data: Ad-expenditure projections are issued on a quarterly basis by ZenithOptimedia. The above projections were issued on December 3, 2012.