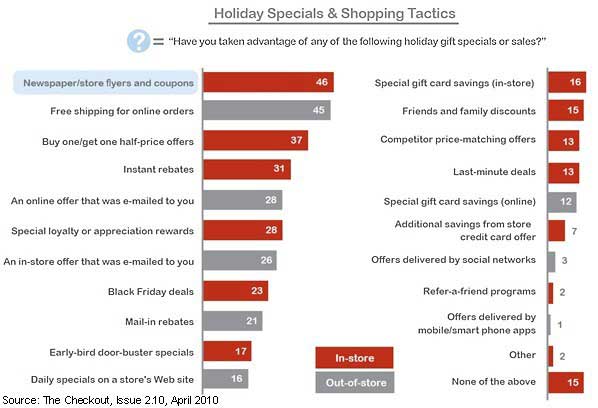

Among a variety of holiday specials and shopping tactics, store coupons and free-shipping offers were the two incentives most used by shoppers during the fourth-quarter 2009 holiday-shopping season, according to a survey from MARC Research.

Nearly one-half of shoppers surveyed said they took advantage of store coupons (46%) or free online shipping (45%) when they shopped for gifts in the fourth quarter.

Shoppers wanted instant gratification: In addition to free shipping, shoppers were most attracted to offers that provided immediate savings, such as "buy one, get one half-price" offers (37%) and instant rebates (31%).

Below, other finding from the Checkout, Inside the In-Store Experience study, which surveyed consumers on their experiences shopping during the fourth quarter of 2009.

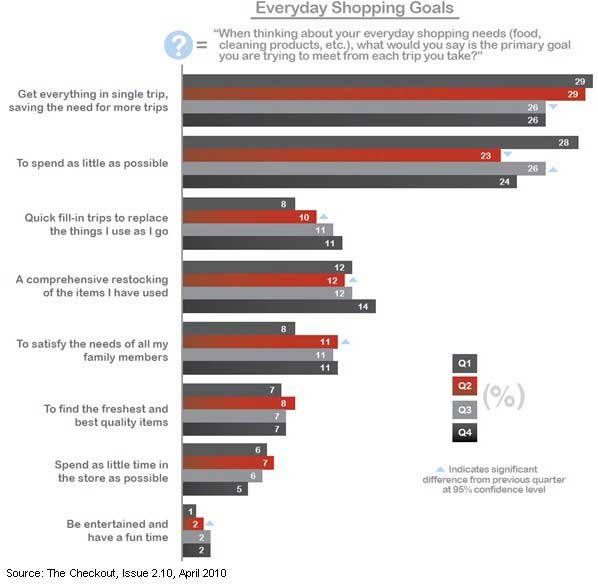

Everyday Shopping Goals

Shoppers have adopted a more utilitarian view of shopping—looking to get everything in a single trip (26%), without overspending (24%), and with little regard for being entertained (2%).

Shoppers have also realized they might have to change their shopping behaviors to adjust for continuing recessionary conditions. For example, 11% of shoppers have taken to quick fill-in trips to avoid larger grocery receipts and impact on the family budget.

However, although both price and convenience have dominated shoppers' priorities this year, both factors seem to be trending downward heading into 2010, possibly indicating that the period of retrenchment for many shoppers could be easing, and a refocus on quality and experience might soon return.

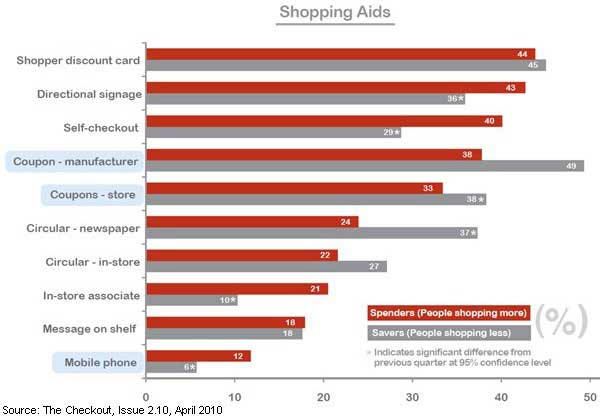

Shopping Aids

Differences in recessionary coping strategies appear between the shopping-aid preferences of Spenders (those who report shopping more) and Savers (those who shop less): Savers show higher price sensitivity than Spenders, as demonstrated by a higher use of circulars (37% vs. 24%) and coupons (38% vs. 33%).

Meanwhile, Spenders use more convenience-based shopping aids such as directional signage (43% vs. 36%), in-store associates (21% vs. 10%), self-checkout (40% vs. 29%), and mobile phones (12% vs. 6%).

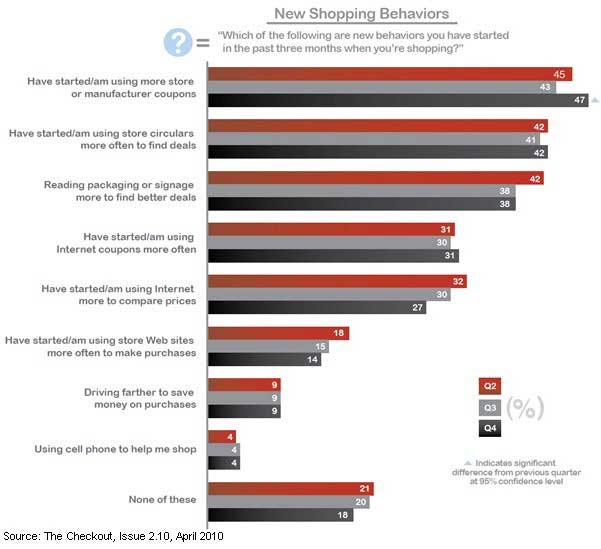

New Shopping Behaviors

Coupons and circulars are playing a much larger role in shoppers' money-saving arsenal. Over one-half of shoppers (47%) used coupons in the fourth quarter, compared with 43% who did so in the previous quarter.

Although Savers have reduced the amount of time and money they spend on the Internet, Spenders are spending more money and at greater frequency, according to the study.

Spenders are increasingly using the Internet to compare prices and make purchases: 34% say online shopping is the best use of technology, compared with just 29% of Savers.

Looking for real, hard data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, a 240-page original research report from MarketingProfs, gives you the inside scoop on how 5,140 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

Reasons for Walking Away

Spenders are walking away from stores empty-handed because they can't find what they want: 37% cited not being able to find exactly what they wanted as the primary reason they did not make a purchase, as did 32% of Savers.

However, 48% of Savers cited price as the primary factor for not making a purchase, compared with 36% of Spenders.

Just 8% of Spenders and 9% of Savers cited the lack of a specific brand as the reason they walked away from the aisle without making a purchase.

Other findings:

- When selecting stores, consumers prefer to shop at retailers that allow them to get all of their shopping done in one place. In addition to selection, everyday low pricing and the price/quality mix rounded out the top 3 criteria for shoppers.

- Spenders are concerned with retailers' breadth and quality of products and feel that the store environment is a direct reflection of who they are as people. Meanwhile, Savers choose their retailer primarily by price considerations, buying less and seeking the lowest prices.

- Wal-Mart remains the most popular value brand, with 14% of shoppers listing the retailer as their top-valued brand, followed by Target (10%).

- Other brands, such as Sony (8%), Apple (6%), and Kellogg's (5%)—generally not offering the lowest-priced products—are communicating value through the quality and familiarity of their brands.

About the data: Findings are from The Checkout, issue 2.10, based on a nationally representative survey of 1,200 US adults conducted monthly by M/A/R/C Research in the fourth quarter of 2009.