The better you plan your B2B customer satisfaction survey, the more you'll get out of it. Done properly, the survey should be a significant source of additional revenue rather than a chore.

1. Acting on the Feedback

If you have to conduct a survey because your quality standards say that you have to, or any other outside influence is telling you to and you feel that, maybe, your company, your organization, is lacking the commitment to make any changes, then consider running an in-house paper-based survey. This way, your customers won't expect any commitment from you, and they won't feel let down when nothing happens.

If, however, your company wants to hear from those important clients and it has the drive to make changes based on the feedback and wants to grow, then please read on and use this checklist. Remember, the better you prepare for your customer satisfaction survey, the more you'll get out of it.

2. Choosing Who You Want to Hear From

You are in B2B, right? You have an ongoing relationship with your customers who buy from you over and over again. You might have one or some large customers with lots of contact points—not just someone in Purchasing, but also Design Engineers, Production Engineers, Operations Directors, Logistics Managers, Supply Chain Directors—decision-makers as well as key influencers.

You have salespeople who need to be involved in the selection of who you want to hear from. If they are not involved, they could feel left out at a critical stage—and, after all, the feedback is designed to help them sell more. But don't let them choose just their friends (those they play golf with), because that's not the point.

Don't choose non-customers. A sales director recently talked about customers that his firm had never sold to. They are suspects or prospects, but not customers. Their perception of your internal systems, disciplines, and procedures is not right for this sort of customer satisfaction survey. Include only your customers.

3. Attributable Feedback

You're going to target your most important customers. Now make sure that you'll find out who said what.

In B2B, people buy from people. Different people (firms) have different needs—it's not a one-size-fits-all—and finding out from an anonymous survey that just one person wants something to be changed is quite different from finding out that your most profitable customer has a personality clash with the key account manager that has been assigned to look after them.

Most survey firms belong to the Market Research Society or ESOMAR (the European equivalent). Those societies have a code of conduct that prohibits the unauthorized attribution of feedback. Work with a firm that can provide attribution.

4. Questions

Some argue that you need to ask only one question: the Net Promoter Score. However, a single NPS score can often be very frustrating for an operations person who is looking for levers to pull. It's like saying "the train is running late," without any other feedback. Did it set off late? Is there a problem with the track or the engine? Was the driver given the wrong set of instructions? Is it because of the weather? Has the train taken the wrong route? Or is your expectation of when the train should arrive misguided?

You need '"useful" rather than "interesting" feedback, so you need to drill down, ask as many questions as possible (PDF).

5. The Right Questions for the Right People

You don't want to build people up by telling them that they are important, and then ask them questions that they wouldn't know the answer to (and someone in your organization will know who those people are). I encourage you to think about segmenting your customer contacts. For example tier 1 and tier 2 automotive suppliers will often split their contacts among Supply Chain, Purchasing, and Design Engineering. You would pose different questions to those three segments, and you would chart the results in that way as well.

6. Using the Customer's Language

It's good to fine-tune your questions. Use your technical language. If your industry talks about "on-hire" and "off-hire," then use those phrases.

7. Knowing Your Customers

When validating customers, we find errors (Mr. should be Ms., or the company name has changed, or the spelling is not quite right, or the ZIP code is wrong) in 40% of contact details. Your most important customers are your most valuable asset—they need to be accounted for, and that all-important relationship needs auditing regularly.

8. Response Rates

You've got only a small number of customers. You are in B2B—you're not a bank, you don't sell telephones or electricity or coffee—and you've chosen who you want to include. Now you need to make sure that you hear from as many of them as possible while posing up to 60 questions and statements.

Postal, Web, and email surveys will provide you with responses from, on average, 5% to 15% of your target. The drop-off rate for telephone surveys with lots of questions is increasing year on year, an you might get a response of 30%. You don't want to make a strategic decision based on a straw poll, so you need to make sure that response rates are as high as possible.

9. Planning for the Feedback

At an early stage, make sure your senior team members know that they will be spending at least a day reviewing feedback from their most valuable asset. The raison d'etre for the survey should always be "to increase profitable sales," and the workshop teams should be looking at the feedback in that light. A balanced approach is recommended. Look at the top-level results for strategy and look at the granular, individual feedback for personal needs and conflicts. The negative feedback may require changes to people and procedures. From positive feedback you can gain references, referrals, more work (a bigger share of the wallet), better terms, and increased prices.

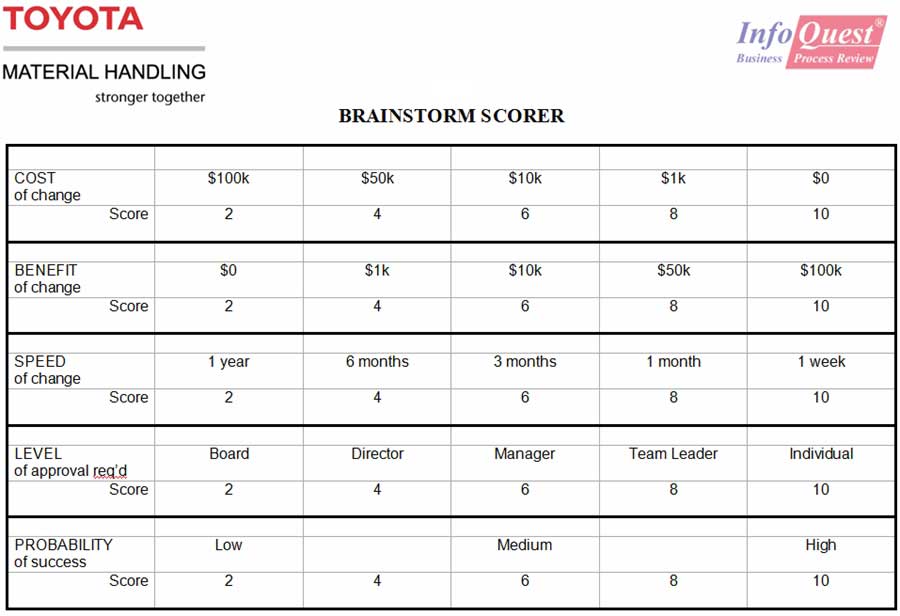

The record number of action ideas from one of my workshops is 165. However many you come up with, it is best to prioritize them through a scoring mechanism, such as the following, and then manage how many actions are being worked on at any one time (I recommend a maximum of six):

10. Getting the Senior Team Involved

The people in your senior team need to be involved as much as possible, to get them on-side in order to make the change-process (based on the survey results) as easy as possible. Get the senior salespeople to check the customer list for omissions. Invite the VPs and directors to choose which questions should be posed—or at least ask them to check the chosen selection before going ahead. (At InfoQuest we go one step further in that if we know who will be attending the post-survey workshop we will send them a survey boxhttps://www.infoquestcrm.co.uk/wp-content/uploads/2012/08/big-box.jpg and ask them to predict how the customers will respond.)

All that helps to break down the barriers and any potential defensiveness; after all, asking the customers about their relationship with you and your team can be seen by some as a threat.