Half of all US consumers would struggle if they had to meet an unexpected expense, and many lack the resources to meet an unexpected financial crisis, like sudden car or home repairs, or minor health-related expenses, according to a TNS Global survey.

Capacity for Risk

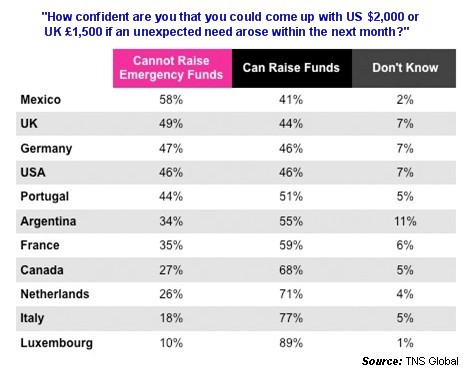

To measure capacity for risk-bearing, the survey queried consumers' ability to generate sufficient funds for a major car repair in one month.

Approximately 46% of American consumers reported they would not be able to generate $2,000 in 30 days from savings, borrowing, friends, or family. Similarly, 49% of UK residents and 27% of Canadian residents said they would not be able to generate sufficient funds.

Turning for Help

Many would turn to their savings as a primary source of emergency funds, including:

- 49% of US consumers

- 50 % of UK consumers

- 52 % of Canadian consumers

Approximately 30% of consumers in the US and UK say they would ask family for help. But women, in particular, are more likely to turn to family: 32% of US women would borrow or ask for help from family, compared with 24% of US men.

Staying Away From Credit Cards

Only 20% of consumers in the US and UK say they would turn to credit cards as a source of emergency funds, and 28% of Canadians say they would do so.

About the survey: The TNS Finance Personal Risk Assessment and Risk Literacy Survey is a consumer survey developed by TNS in association with Harvard Business School and Dartmouth College.