Marconi plays the mamba

listen to the radio

don't you remember...

We built this city we built this city on rock an' roll!

—Jefferson Starship

Last year, I wrote an article that began with, "Something truly extraordinary has been happening in the online world over the past two years, but unless you are between the ages of 16 and 25, you probably don't even know about it. But that won't last much longer."

Those words have proven to be prophetic indeed. The growth of MySpace has been front and center in the media over the past 12 months, in part because of the continued incredible growth of the venture but also because of social outrage generated by those who view it as an inappropriate and unsafe environment for teenagers.

I've spent the last year heavily immersed in the social media industry. So it seems fitting to revisit the topic and take a look at what has happened, what has changed, and what we have learned about the online social networking business model over the past 12 months.

The fundamental economic premise underlying social media ventures is that much of the cost of operating a social media Web site is largely insensitive to scale. The social network provides a mechanism for generating content while the users do all the actual content generation.

The objective then becomes creating a large enough user base such that the revenue generated per user is greater than the costs of operations, spread out over the entire user base. If this can be achieved, then the operating margins are potentially quite exceptional indeed.

No one has successfully done it yet. While the basic software design for a social network can often scale easily, the costs of providing customer support to an ever-increasing user base are not entirely insensitive to scale. Nor are the costs of providing servers and bandwidth. As pages served increase to very large numbers, it becomes more and more difficult to find sufficient ad inventory to serve out in association with those pages. And the one thing that is fairly certain based on results to date is that profits won't be achieved simply from ad revenue served on top of user-generated content.

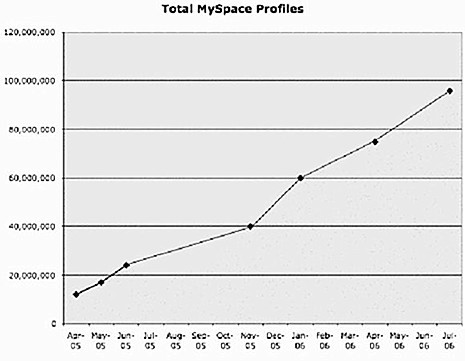

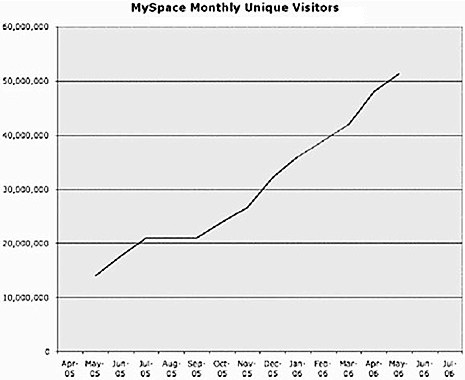

MySpace went online in August 2003, with an official public launch in early 2004. The following two graphs show the total number of MySpace profiles and unique visitors per month over a period extending from April of 2005 to the present.

The site is now reportedly registering more than 50 million unique monthly visitors and should reach 100 million registered profiles by early August. Total reported monthly pageviews were estimated at 27.5 billion in April 2006 (all this data should be interpreted with some degree of caution: Please see the endnote for details on the sources of the data and qualifications on its meaning).

MySpace went through an early period (in large part prior to the timeframe graphed) where growth appeared to follow the initial stages of an exponential growth curve. Growth over the period extending from mid-2005 to mid-2006 has been fairly linear. I think it is not unlikely that by late 2006 we will see some degree of audience saturation, along with a reduction in rate of growth.

MySpace users span all economic classes, geographic locations, and age groups, but tend to show a concentration with the age 16-30 crowd, with the majority of members based in the United States. For all types of artists and performers, including bands, models, comedians, and DJs, MySpace has become the de facto venue for being seen and reaching fans.

MySpace is also putting the entire industry of paid Internet dating sites out of business. The logic becomes... why create a profile on a dating site which requires you to pay for sending messages when you can have one on MySpace for free, and everyone else worth knowing is there?

The MySpace audience is one for which TV, magazines, and newspapers seem to hold ever-diminishing appeal and attention. In acquiring MySpace, News Corp made a bold move in attempting to understand and manage an online channel which Generation Y audiences are using to connect with the world around them.

So what do all these millions of people do on MySpace?

Well, for the most part, they talk with friends about the proverbial threesome of sex, drugs, and rock n' roll.

They tell their personal stories, in words, pictures, and video. They make new friends, whom they often subsequently meet and spend time with out in the real world. They learn about events, parties, and other social functions. They promote themselves and the things they think are cool. They publish extensive data about themselves, much but not all of it truthful. They share stories, jokes, and gossip with their friends through mail messages and bulletins.

MySpace is popular because it gives everyone friends to hang out with, a cool soap box to stand on, and a megaphone to shout with, all without leaving their home.

The problem is, with everyone shouting at once, the cacophony of noise generated often leaves very few who are actually listening. Additionally, although MySpace has developed a strong brand, many aspects of the MySpace brand, while highly attractive to a certain element, remain unattractive to a more mainstream audience, which would welcome viable social networking alternatives that have a high coolness factor without all the perceived drawbacks.

The MySpace brand is in the same class as "Girls Gone Wild." In other words, it's a business that makes a lot of money, but at the same time the connotations of the brand place limitations on where it can go, which advertisers will support it, and how it can scale and expand in the long term.

MySpace faces similar issues, and these factors, along with the noise level of everyone promoting themselves on the site, severely restricts their ability to generate real advertising revenues.

A lawsuit filed last month in Texas is seeking $30 million in damages from MySpace after a 19-year-old man allegedly sexually assaulted a 14-year-old girl whom he met on the site, while misrepresenting his age. While the legal analyses I've read concerning this case seem to indicate that the chances of MySpace being held substantively liable in this instance are quite slim, the plaintiff's attorney is undoubtedly hoping that the media attention and negative publicity surrounding the case will induce MySpace to make a large settlement offer.

Regardless of this specific instance, the message being promulgated in the media, by the schools, and by parent groups is that MySpace is not a safe place for young people to be interacting.

Scott Karp, in his Publishing 2.0 blog, which critically examines the MySpace business model, recently put the key question succinctly: "MySpace is probably the most discussed online business alongside Google and Yahoo. But with Google and Yahoo, the talk revolves around BILLIONS of DOLLARS in highly profitable revenue. For MySpace the talk is never—even in News Corp's earnings release—about dollars and cents. How long will it take for News Corp to turn MySpace into a business as wildly profitable as it is widely used?"

MySpace isn't the only fish in the social networking pond, of course. Facebook is another social networking venture that has received a good deal of press, and it is quite popular particularly with the U.S. college crowd.

Facebook has a user base of around 8 million, along with high activity levels. But its lack of strong brand associations limits the value of the venture in terms of ability to drive potential future revenue streams. The media has discussed Facebook having a valuation on the order of $2 billion.

That implies a value of around $250 per user. Such numbers are mired deep in the silly zone. The cost of a social networking venture acquiring new members quickly is far less than a tenth of that number. A competent team starting from scratch could surely build a social networking venture with 8 million members in about a year on a budget of far less than $100M.

Paying such a huge premium for an existing site would happen only if one is clueless or if the site's brand affinity is so strong that (1) it opens the door to a wide variety of deep relationships and revenue-generating possibilities with users; and (2) it offers the possibility of continued future viral growth at extremely low cost levels per new user.

MySpace offered the potential for both of these factors. Facebook simply doesn't appear to do so.

There are dozens of other social networking ventures out there now, and many more being built. Entrepreneurs who create social networking ventures tend to come from more technical backgrounds, and there is a tendency to believe that building a social network with better or more novel features is the key to success in this area. But I suspect that this is a fallacy; technical factors are only rarely motivators of significant changes in this kind of a consumer trend. Cool features are great, but they are ultimately easily created and easily copied by competitors.

The reality is that unless MySpace pulls "a Friendster" and falls asleep at the wheel, large numbers of people will opt in to a new type of social network only if it offers a tangibly different experience along with strong and relevant, and meaningful, brand associations.

So simply building a better mousetrap than the MySpace folks built won't do the job. None of the ventures that I've seen appears to have the attributes necessary to develop the kind of strong brand affinity that will ever rival MySpace, and most of them appear to have business models that rely solely on ad revenue served on top of user-generated content... a model that, by itself, doesn't appear to be economically viable.

To get a sense of the investing activity in this sector, the Web site paidContent.org tracks social media-related investment deals. The following list shows some of the larger investment deals made in the social media space in recent months (I have not listed a multitude of smaller additional deals):

- Jobster gets $18 million funding from Reed Elsevier.

- Social networking site Multiply.com gets $6 million funding.

- Dating site Engage.com receives $5 million.

- Video sharing site Metacafe gets $15 million funding.

- Online avatar social network Gaia gets $8.93 million funding.

- UK-Heavy social network Bebo gets $15 million funding, WeeWorld $15.5 million funding, and HabbaHotel $23.5 million funding.

- Video sharing site PixPo receives $6.5 million.

- P2P Sharing startup Pando Networks gets $7 million funding.

- Video Hosting/Sharing Site Photobucket Get $10.5 million funding.

- Chinese Audio/Video Sharing Site Toodou Gets $8.5 million funding.

- Photo Sharing Site FilmLoop Gets $7 million funding.

- Social Networking Startup Radiate Raises $5 million funding.

- Business Social Network SoFlow Gets $5 million first round funding.

- Chinese Blog Portal 51.com To Get $12 Million From Sequoia.

- Social Networking Site 900 Seconds Gets $6.5 million funding.

- Facebook Gets $25 million funding.

- Business Social Networking Site Visible Path Raises $17 million.

- Kid Social Network Industrious Kid Gets $6 million.

Most of these deals (some are early round, while others, like those of Jobster and Facebook, are later-round deals) appear to be aimed at providing the resources to grab market share quickly. Getting users is easy if you have the money to reach them. Building a strong brand that keeps users actively involved and engages them in behaviors which generate revenues is much more difficult.

Amazon.com has shown that it can be done through the online storefront business model. It didn't happen overnight—it was years before Amazon.com became profitable. In the process, Amazon.com learned how to do an exceptional job of data mining its user base. (See a related article, "Attack of the Amazons: Data Mining at Amazon.com.")

Social media technologies allow one to potentially go levels deeper than Amazon.com does in terms of creating relationships and developing and mining databases to provide users with lifestyle-related opportunities that they will truly welcome. Such networks can potentially deliver to people the things in life that they desire, in a manner that is continually alive and evolving, and unparalleled.

The incentive is that in return for providing data to the network, people get to participate in a community in a way that adds value to their life and brings them valuable opportunities that they would not otherwise have.

It will take a good bit of work and investment to make this happen on the front end, but the end result for those who figure out how to do it right will be the holy grail of online marketing, and the basis on which I expect enduring billion dollar brands are going to be built.

Another big payoff from social media potentially comes with the recognition that people live their lives both online and offline. Ventures that focus strictly on online behavior neglect that people are often using online social media to create relationships and connections that will enhance their lives away from the computer, while interacting out in the "real world."

Furthermore, while people like to connect globally, they tend to live their lives locally. Building deep connections and relationships with advertisers and sponsors at a local level is going to be a critical component for achieving success for many consumer-oriented social media ventures.

Endnote: The number of profiles data is taken from a variety of published sources along with personal observation. It should be noted that the number of profiles does not equate to number of users. It is not at all uncommon for individual users to create many different profiles... I have five MySpace profiles which I use for different purposes, and there are known instances of individuals/organizations creating thousands of profiles.

The unique visitors per month data also comes from a wide variety of reports, but is ultimately based on data provided by comScore Networks. It should be noted that unique visitors is actually an estimate of unique IP addresses from which the site has been accessed. One human visitor might access the site from many different IP addresses, and each access would be logged as a different visitor. It is also possible that multiple people could access the site using the same IP address behind a firewall, in which case they would all be logged as a single visitor.

Pageview data also comes from comScore Networks, and it can be significantly inflated by automated software that crawls the Web. It is often difficult if not impossible to gauge what percentage of page views are human generated.

This is part one of a two-part article. Next week, in part 2, Cliff Kurtzman will examine how he has applied what he has learned from observing the social networking landscape to his MyCityRocks social engagement testbed.