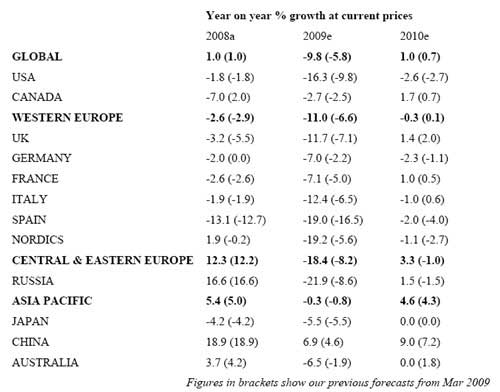

Worldwide advertising expenditure in 2009 is estimated to be down 9.8% compared with 2008, a downward revision of 4 percentage points from projections issued in March, according to media communications agency Carat, part of Aegis Media. This drop is due to significant reduction of forecasts in all regions, with the exception of Asia Pacific, where the 2009 forecast has been revised marginally upwards to -0.3%.

Although global spending for 2009 has been cut back considerably, predictions remain for a slight return to growth in 2010, at 1.0% globally, driven by much more stable conditions in the West and recovery in developing markets, particularly China:

"These significant revisions are not unexpected in the context of the recent volatility of the market, and represent a cautious attitude towards adspend this year, most significantly in the US and Europe. China remains the most resilient of the major economies, and we have revised our estimate upwards since March to 6.9% for 2009. However, even in China, we have noticed advertisers proceeding cautiously, and adjusting spend on a quarterly basis," said Jerry Buhlmann, CEO of Aegis Media. "Despite the reduction to forecasts for 2009, we still believe that 2010 will see growth, albeit very modest. We expect the market to bottom out in North America and Europe, and to improve further in developing markets. Even after that initial recovery, however, the global advertising market will still be below its absolute 2006 level."

Changes in Major Advertising Market Forecasts

Of the world's largest advertising markets, the most notable revisions occurred in the US, Russia, Italy, Germany, and the UK. Lesser downward revisions were seen in Spain, France, and Canada.

In the US, advertising spend in the first half of the year was well below that in 2008. Previously committed activity was scaled back while significant incremental spending has not materialized. The current full-year projection for 2009 is -16.3% (March 2009 forecast of -9.8%), with significant recovery now not expected until the second half of 2010 at the earliest.

All major media categories are tracking below last year. National television and radio have been holding up better, due to their ability to drive strong reach and awareness. Newspapers continue to be hard hit by both the weak economy and consumers spending more time online. The real estate and automotive categories have cut back sharply and classified advertising is weak. Digital losses have been softened by some traditional media spend shifting over and the continued strength of search advertising. Online video has also experienced growth; however, online display has been much more negotiable in terms of price.

In the UK, our latest estimates for the total market are predicting a reduction of -11.7% (March 2009 forecast of -7.1%), with hopes of a Q4 market recovery now unlikely. With the exception of Internet and cinema, all other media are forecast to suffer a double digit decline year over year. TV (-11.9%), Radio (-12.6%), Outdoor (-12.2%) have all been hit by roughly the same decline. Newspapers and magazines have been hit the hardest, -20.3% and -16.3%, respectively, although some of their decline is likely to be structural. Modest growth is forecast for 2010, with the World Cup expected to benefit the market, however a recovery is not forecast to be properly underway until 2011.

In Italy, advertising expenditure is expected to decrease by -12.4% (March 2009 forecast of -6.5%) this year, almost twice the pace of decline of our previous estimate. The forecast for 2010 is for a smaller negative drop of -1.0%, with a possible recovery in 2011 of +1.9%. The print market has been hit badly, with newspapers down 20.4% and magazines down 24%. TV reaffirmed its leadership and although it is also experiencing a decrease in spend for 2009 (-10.2%), its losses will be lower than the market average.

In Russia, market volumes are now expected to decrease by 21.9% (March 2009 forecast of -8.6%). Print and radio adspends are expected to show the most significant declines, followed by OOH. TV and the internet are expected to be more stable.

In Germany, advertising expenditure is forecast to decrease by -7.0% (March 2009 forecast of -2.2%) this year, with declines in the 1H of the year not seen since 2002. Cinema saw the strongest declines, followed by consumer magazines. Newspapers have revised down forecasts however in comparison to other media and bucking the global trend the losses have been limited. Newspapers and radio are seen as important support to sales performance in Germany and both offer the flexibility of shorter planning times.

The gloomy outlook in the US and Western Europe is not repeated in Asia Pacific and Latin America, where revisions since March have been less severe.

In China, our forecast for 2009 has been revised upwards from 4.6% to 6.9%, but even here advertisers are proceeding with caution and adjusting spend on a quarterly basis. The only region forecasting positive growth this year is Latin America (0.5%).

The outlook for the smaller markets of Central and Eastern Europe has deteriorated from a forecast decline of 8.2% to 18.4%; and in the Nordics from -5.6% to -19.2%.

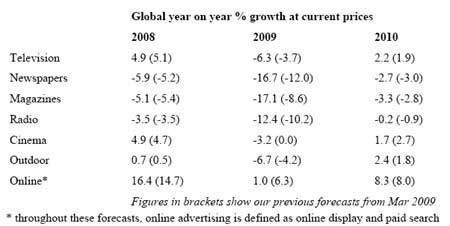

Sector Breakdown

Online advertising remains the only area of the media that will see growth this year, estimated at 1.0% globally. Online growth remains in double digits in the markets of Asia-Pacific and Central and Eastern Europe this year. However, low single-digit growth in Western Europe and a decline in the US have led to a downward revision in forecasts.

Online growth should continue to make significant progress in 2010.

Of the sectors, Television and Cinema continue to hold up best, reflecting the relative popularity of cinema and home entertainment in the downturn:

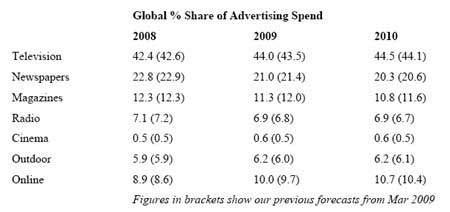

The chart below indicates the projected share of global advertising divided by sector over the next two years, and shows that this year, Online is set to meet the 10% of spend level for the first time. Television is also predicted to grow its share in both 2009 and 2010, with Newspapers and Magazines losing out and other categories remaining broadly flat:

About the data: All data cited here was provided by Carat, a part of Aegis Media, which is the media communications business of Aegis Group plc.