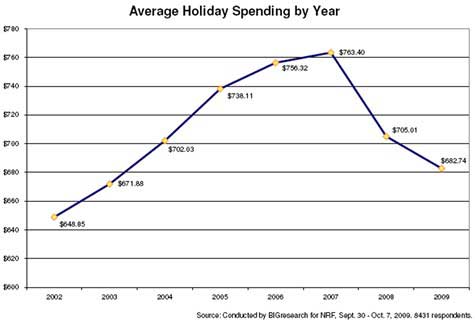

US consumers plan to spend an average of $682.74 during the upcoming holiday season, a 3.2% drop from last year's $705.01, according to NRF's 2009 Holiday Consumer Intentions and Actions Survey, conducted by BIGresearch:

Key findings:

- The NRF expects 2009 holiday sales to decline 1.0% to $437.6 billion.

- Holiday sales in 2008 declined 3.4% to $441.97 billion, the first year NRF had

seen a decline since it began tracking retail industry sales in 1992. On average,

holiday sales have increased 3.39% per year for the last 10 years.

The Economy's Impact

Two-thirds of Americans (65.3%) say the economy will affect their holiday plans this year, with the majority of these consumers saying they will adjust by simply spending less (84.2%). People will also be shopping for sales more often (55.0%), using more coupons (41.7%), and putting up last year's decorations without buying new ones (34.0%).

Many Americans will also make changes in gift-giving, planning to buy more practical gifts (36.0%), buying a joint gift for kids or parents (17.3%), and making more gifts (16.7%).

Additionally, more than one-fourth of Americans (28.6%) say the economy is forcing them to travel less or not at all for the holidays.

Where People Will Shop

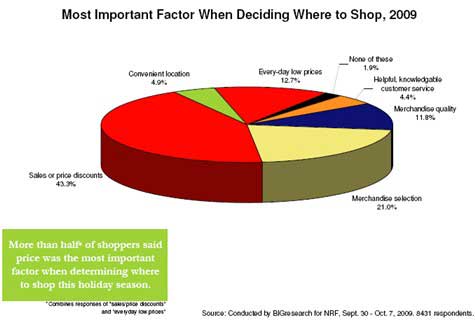

According to the survey, more than half of holiday shoppers say that sales and price discounts (43.3%) or everyday low prices (12.7%) will be the most important factor when deciding where to shop:

Factors like selection (21.0%), quality (11.8%), convenience (4.9%), and customer service (4.4%) declined in importance for consumers from last year.

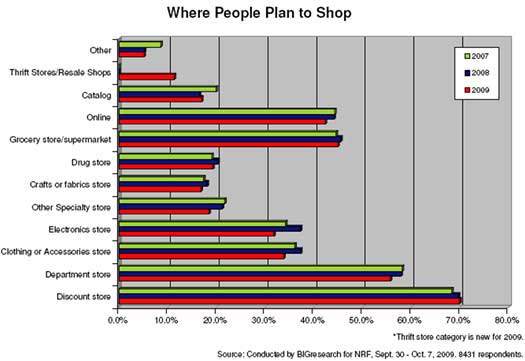

Given the economy's widespread impact, it's not surprising that a strong majority of holiday shoppers (70.1%) will purchase from discounters this year, though more than half (55.8%) will also shop at department stores. Grocery stores (45.0%), the Internet (42.4%), clothing stores (33.8%), and electronics stores (31.8%) will be other popular destinations:

One in 10 holiday shoppers (11.4%) will buy gifts or other holiday-related merchandise at thrift stores or resale shops.

Why They Shop Online

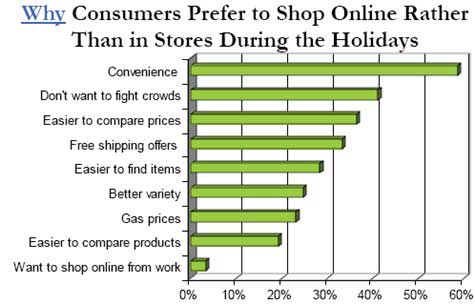

According to the results of the 2008 eHoliday Study, conducted by Shopzilla for Shop.org, 58.6% of consumers in 2008 cited convenience as the reason they shopped online. Other factors they cited:

Retailers are compensating for soft sales this holiday season by cutting back on inventory. According to NRF's Port Tracker report, released in September, traffic to the nation's ports has scaled back to levels not seen since 2003.

"In anticipation of weak demand, many retailers scaled back on inventory levels to prevent unplanned markdowns at the end of the season," said NRF President and CEO Tracy Mullin. "Once the most popular items are gone, retailers won't have anywhere to get them, so if there was ever a holiday season to buy early, this is it."

What Motivated Consumers to Shop in 2008

According to an NRF survey conducted by BIGresearch during the 2008 holiday season, nearly one in five consumers (17.5%) were motivated to shop with a retailer once they saw the company's ad.

Young adults were more inclined to shop with a retailer after viewing their ad (29.6%), while adults 65 and over were the hardest to sway, with only 8.7% saying they were influenced by a retailer's commercial. Women (19.2%) were more likely to be persuaded by holiday ads than men (15.7%).

While television advertisements caught shoppers' attention in 2008, other tried-and-true marketing tactics also influenced shoppers: 44.6% of consumers said coupons were a factor in determining where they did their holiday shopping, up from 35.2% in 2007. Consumers in 2008 said they were also swayed by advertising inserts (30.1%), newspaper ads (24.5%), direct mail (18.5%), and email advertisements (15.8%).

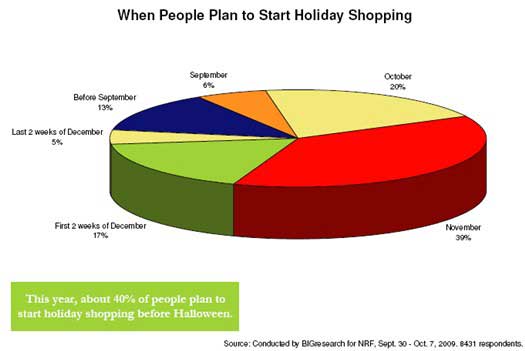

When People Will Shop

Whether they're shopping to get the best selection or trying to stretch out spending over a longer period of time, many holiday shoppers this season are starting early. According to the survey, 39% of Americans will begin their holiday shopping before Halloween, which is comparable to previous years:

.

As in previous years, three-fourths of Americans' holiday budget will be spent on gifts. While spending on family members will decline by a slight 2% ($387.06 in 2009 vs. $395.15 in 2008), gifts for friends ($66.77 vs. $80.13) and co-workers ($19.26 vs. $22.63) will see double-digit drops. Americans also plan to spend about 5% less ($34.81 vs. $36.88) on "other" gifts for people like babysitters, teachers, and clergy.

Candy and food spending may be one bright spot this year, with the average person planning to spend $10 more in that category than last year ($90.26 in 2009 vs. $80.28 in 2008). Spending on other non-gift categories like decorations ($40.75 in 2009 vs. $43.45 in 2008), greeting cards and postage ($26.77 vs. $27.39), and flowers ($17.05 vs. $19.10) is expected to drop.

"While the economic climate has shown some improvement from last holiday season, retailers are not out of the woods yet," said Phil Rist, executive vice president for strategic initiatives at BIGresearch. "With a variety of factors still up in the air, including uncertainty over job security, many Americans just aren't buying into the talk of recovery."

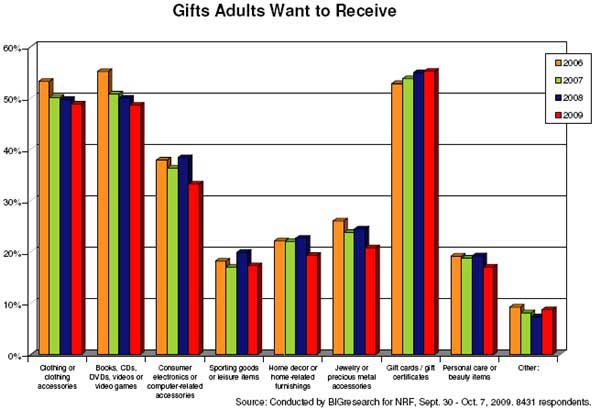

Though Americans were less inclined to purchase gift cards last season, the popular gifts retain their spot at the top of the list among gift recipients, with 55.2% of adults wanting to receive one. Clothing (48.8%), books and DVDs (48.6%), and electronics (33.2%) are other popular choices:

About the data: Data and graphics come from these sources:

- Economy to Impact Two-Thirds of Families this Holiday Season, According to NRF Survey

This article reports results of the National Retail Federation's 2009 Holiday Consumer Intentions and Actions Survey, which was designed to gauge consumer behavior and shopping trends related to the 2009 winter holidays. The survey polled 8,431 consumers and was conducted for NRF by BIGresearch September 30–October 7, 2009.

-

Online Retailers "Resilient, Not Immune" to Challenging Holiday Season

This article reports results from the 2008 eHoliday Study, conducted by BizRate Research, a Shopzilla company, for Shop.org, which surveyed 2,040 online buyers (defined as anyone who has made an online purchase in the previous 12 months) September 29-October 3, 2008 and 60 online retailers October 1-20, 2008. -

Emotional Ads Resonate With Shoppers This Holiday Season, According to RAMA Survey

This article reports results of a survey conducted for RAMA by BIGresearch that polled 8,860 consumers from December 2-9, 2008, asking respondents to write in their favorite holiday television advertisement. - The National Retail Federation's 2009 Holiday Survival Kit