Market analytics experts have written volumes on market mix modeling and other types of analyses designed to address the short-term contribution of advertising and promotion, which typically accounts for 20-40% of total sales. What about the other 60-80%, the base sales? Other than seasonal cycles and macroeconomic factors, what drives base volume sales? Companies often leave many questions about base sales unanswered.

Historically, marketers have invested in brand tracking studies to monitor changes in customer funnel metrics. However, in general, they have not been able to link brand tracking to sales.

Today, marketers have become much more interested in focusing on brand equity. They question whether they are tracking the correct metrics, how brand tracking metrics affect sales, and what they can do to make course corrections.

Those questions are especially relevant in the current challenging economic climate. In addition to working with smaller marketing budgets, marketers must spread their dollars among more activities as online and mobile marketing become mainstream tactics in the marketing mix.

The benefits of such an analysis are multifold. Marketers come to understand the impact of changes in marketing investments and key messages/campaigns on brand equity measures, and alignment comes about between Marketing and Finance on the monetary value of movements in brand equity measures. Furthermore, the analysis quantifies the long-term return on investment (ROI) of advertising and enhances the insights and value gained from brand tracking and marketing mix programs.

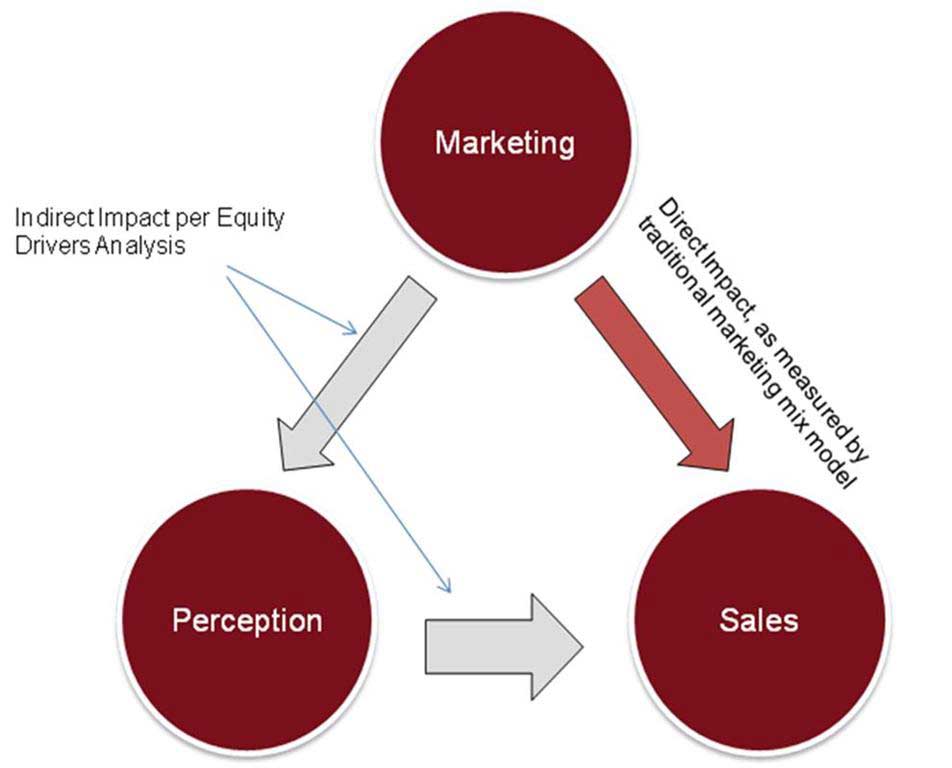

An important component of understanding the effect that marketing has on base sales is the evaluation of a brand's current brand equity and marketing's affect on brand equity:

Equity drivers will provide incremental insights into the impact of changes in consumer attitudes on sales.

To analyze the factors driving base sales and the impact of brand on sales, work with a tested, proven framework to ensure the final analysis is comprehensive and accurate.

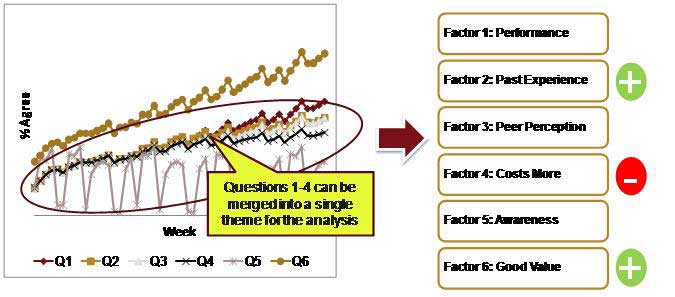

In brand tracking, manufacturers typically ask target consumers a large battery of customer-funnel and brand-imagery questions. Understanding the interplay among those questions sheds light on how consumers link key brand attributes to their willingness to consider, try, and stay loyal to a brand. For instance, a consumer's willingness to consider an automotive brand may go hand in hand with his perceptions of innovation, performance, and prestige. A factor analysis identifies the questions that trend together to combine those variables into a single concept for evaluation.

Once the key concepts are identified, marketers should run a model to determine whether any of them have a significant impact on base sales, and what percentage of base sales that impact represents.

Having isolated the key brand factors that influence base sales, marketers can next evaluate how those factors are affected by individual marketing tactics, and they can derive the indirect sales impact of those tactics.

An example from an actual analysis will illustrate the benefits of understanding the factors driving brand equity.

Marketers at a leading automotive firm were eager to understand the relationship between changes in brand tracker measures and sales. They also needed to identify the factors (or groupings of factors) that were most important, as well as understand the relationship between the execution of advertising and changes in brand tracker measures. Finally, marketers wanted to quantify the longer, cumulative impact of advertising.

The company used the factor analysis to identify questions that trended together, and boiled them down to six key factors. Among them, three factors had a significant effect on sales: Levels of positive "past experience" and "good value" perception correlated positively with sales, while levels of "costs more" correlated negatively with sales.

In this example, the factor analysis distilled the brand survey questions into key concepts. When modeled against base sales, three concepts appeared as significant contributors to base, two as positive and one as negative influencers.

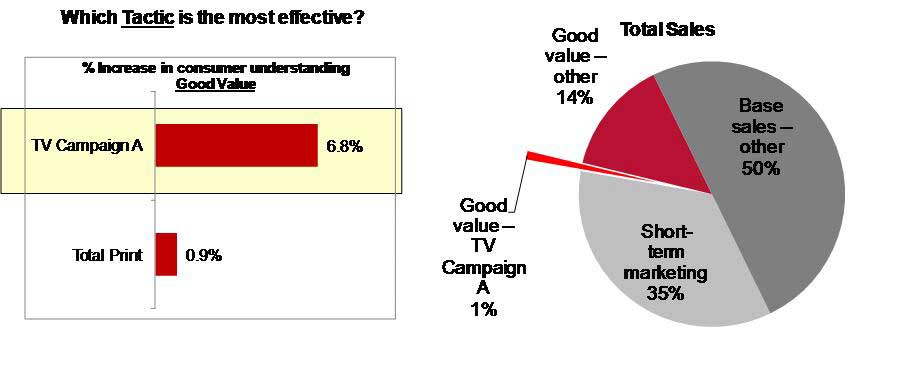

The volume impact from each statistically significant factor was quantified and separated from base sales. Marketers were then able to identify the drivers that influenced each factor.

One TV campaign stood out as more effective at increasing the consumer's perception of "good value." In the following example, "good value" drove 15% of total sales, and TV Campaign A drove a 6.8% increase in consumers' "good value" perception. Therefore, through its impact on brand metrics, TV Campaign A has driven an additional 6.8% x 15%, which equals a 1% increase in total brand sales.

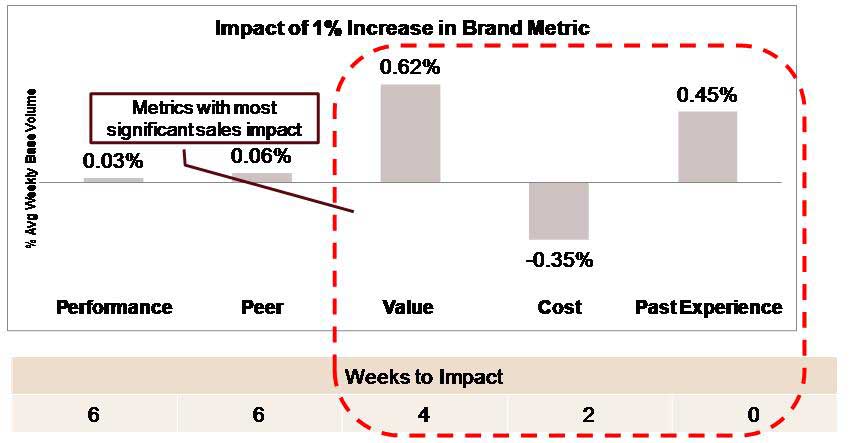

The following graphic summarizes the sales impact of a brand factor that increases 1% and the amount of time it takes for the sales impact to materialize. The company can use this information to prioritize the most important brand metric to influence with its marketing and PR campaigns.

Understanding marketing's impact on base sales made a total ROI calculation possible by aggregating the short-term and long-term impact of marketing.

The previous holiday season demonstrated pent-up consumer demand among specific shopper groups related to specific products, even as large segments of shoppers retained their frugal practices.

As the next holiday season approaches, how can marketers identify the free-spending shopper from the frugal one? How can they create impactful, cost-effective marketing that yields consistently high ROI?

A quantitative understanding of factors driving decisions around base sales will provide a powerful base level of knowledge that allows marketers to get maximum results.