Today's crisis era of coronavirus containment and crashing economic demand present top managers with a truly historic challenge: They face enormous financial and operating difficulties; at the same time, they have a historic opportunity to reshape their companies to produce vast benefits for years to come.

That's because downsizing can either weaken or strengthen your company—both during the crisis and for years after—depending on how you do it. Meanwhile, almost overnight downsizing has become rampant. Layoffs and furloughs are nearly everywhere, and they are major.

Managers are being compelled to develop and implement effective responses in real-time, without any of the planning lead time formerly available. Prior management practices are completely inadequate for dealing successfully with this historic challenge within today's greatly compressed response times.

Faced with rapidly diminishing resources, managers have to get started right away and move quickly. If they get it right, they will own the best customers and leave their competitors in the dust. If they get it wrong, they will face years of struggle trying to catch up.

To succeed in threading that needle, managers need to use different rules to make these decisions—rules that will enable them to be successful in the waves of economic disruption that will continue to flow throughout the economy for at least the next 6-12 months, and for the prolonged readjustment period that follows.

Historic Challenge

Virtually without warning, many businesses today are being forced to deal with unprecedented and externally driven sales declines without nearly enough time to bring expenses into alignment with available revenues. That combination is placing survival-threatening burdens on cash flow and financial reserves.

The greatest danger in responding lies in the inability to focus reduced resources on targets that offer the greatest potential for success. Weakly focused or unfocused broad-brush responses are almost certain to fail or to produce inadequate results.

Creative approaches are essential. What worked in past will not work now. Three key principles provide the foundation for success:

- Focus on your profit core.

- Emphasize people and relationships.

- Concentrate on practicality and rapid implementation.

1. Focus on your profit core

In virtually all companies, 10-20% of the customers, products, employees, and operational activities produce 150+% more of the profits. The most important management imperative today is to focus your resources on doubling down on this area of core strength.

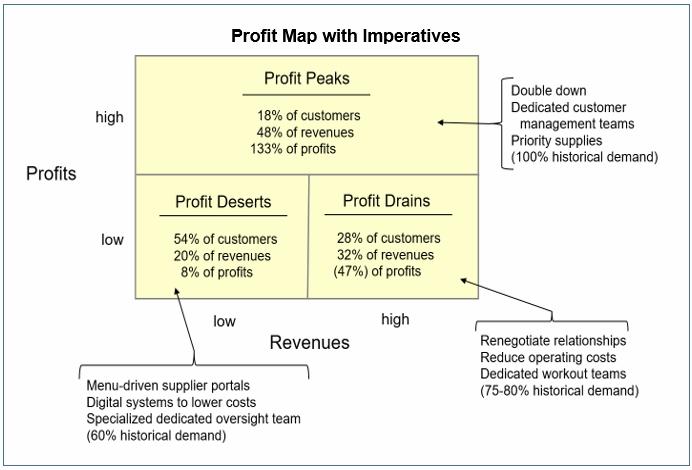

Companies that divide their customers into profit peaks (large, high-profit), profit drains (large, low-profit/loss), and profit deserts (small, low-profit), typically find that about 10-20% of their customers are producing about 150+% more of profits; 10-30% are draining 40-50+% more of profits; and fully 50-80% of their customers are consuming over half of their resources while producing no profits at all.

The following chart, which we call a profit map, illustrates this profitability segmentation for a company's customers:

The same profitability segmentation characterizes your products, employees, and operational activities. The most important thing you can do is to focus your resources on your profit core by locking this business into place, converting profit drains into profit peaks, and matching the cost to serve profit deserts with their profit potential. You can do this even with a reduced workforce and shrinking revenues by managing your profit core using both more powerful metrics and sharply-focused efforts.

More powerful metrics are the essential starting point. To measure real profitability, you must be able to analyze your company at the fundamental business level of each individual sales transaction (i.e., invoice line). Higher-level aggregations typically available today hide vital information about cost drivers and their interrelationships.

Cost-to-serve provides a good example of where most systems do not disaggregate major cost items, and so distort the true cost and profit picture. For example, in our experience analyzing tens of billions of dollars of client revenues, we have consistently found that gross margin, which is one of the most commonly used measures of profitability, seldom predicts net profits because operating costs are so important.

2. Emphasize people and relationships

Crisis times require a renewed emphasis on people and relationships rather than the recent trend toward impersonal systems and related digital transformations. Systems may be more cost-effective in certain high-volume applications, but they cannot deal with the human concerns, questions, and complex intercompany coordination challenges that dominate during crises.

This principle pays out in three key areas: customers, suppliers, and operations and supply chain.

Customers

Effective customer management requires fundamentally different programs for profit peak customers, profit drain customers, and profit desert customers.

Profit-peak customers. Your objective for your profit peak customers is twofold: (1) to systematically build the efficiency of your day-to-day coordination, while (2) taking targeted steps to develop a more integrated operating relationship featuring win-win mechanisms, such as joint forecasting, focused vendor-managed inventory, and coordinated category management.

That requires you deploy a set of highly skilled, dedicated multifunctional customer management teams comprising managers from Sales, Supply Chain, Finance and IT who can link with their profit-peak customer counterparts. The prime requirement is to staff the teams with skilled managers who can work together to manage change in the customer. Supporting systems are a secondary need. Here, reducing costs by downsizing the teams would be enormously counterproductive; in fact, adding selected resources is a great investment.

Your customer management teams have both weekly and monthly tasks. They must meet weekly (by phone, Zoom, etc.) with their customer counterparts to review critical product forecasts in light of changing actual needs, work through substitutions where necessary, take measures to generate immediate cash, and coordinate on other immediate concerns.

On a monthly basis, they need to join with their customer counterparts to manage near-term issues, such as reviewing forecasts, adapting product mix to rapidly changing supply and demand trends, ensuring that replenishment systems are working properly, and installing interim coordinative mechanisms like partial vendor-managed inventory for volatile key products.

Your relationships with your profit-peak customers are where you should invest your people and resources, especially in tight times. You cannot do it everywhere, so identifying and bonding with your profit peak customers is a life-or-death issue.

Profit-drain customers. Your objectives for profit-drain customers also are two-fold: (1) to generate cash by plugging the specific problems that are causing their profit and cash drains, and (2) developing mutual operating cost reductions that increase these customers' profits and convert these large customers into profit peaks. Offering access to secure supplies of scarce products can provide a strong incentive for these customers to renegotiate their relationships with you.

Success requires that you deploy a different set of highly skilled dedicated multifunctional teams to focus on reducing the joint supplier-customer operating costs in order to reduce immediate cash drain outflows while creating a lasting profit-peak level of profitability, and lock this in with long-term contracts. Using a parallel team approach featuring weekly and monthly meetings enables you to leverage all of your relevant skill sets, especially finance and supply chain, to manage both cash and inventory.

Both profit-drain and profit-peak customer management teams need to establish weekly coordination meetings with their customer counterparts to address rapidly changing supply-demand mismatches and other immediate concerns.

The monthly coordination meetings with your profit-drain customers, however, are very different. Though near-term forecasting and related activities are important, the team should place its prime emphasis on changing the underlying problems that are causing the profit and cash drains. Here, the customer's all-in individual P&L, built from its transaction P&Ls, is the critical metric.

That metric will show exactly where the drains occur—surprisingly often in hidden but essential elements such as order pattern. For example, the customer may be ordering daily rather than weekly, which is common practice in crisis situations, when inventory reduction is across-the board. In this case, the customer's visible inventory saving is dwarfed by the supplier's fulfillment cost (and by the customer's own hidden receiving cost). By adjusting the price a little, this destructive behavior can be reversed at relatively small cost, moving the profit drain customer into profit-peak status.

The supporting systems are not particularly complex, although the analytical tools such as all-in transaction-based profit mapping are all-important. The most important companion element is assembling capable teams that can form new relationships with their counterparts in the customers' organizations. Just as in the case of the profit peak customers, downsizing this group would be disastrous.

Profit-desert customers. Your prime objective for profit-desert customers is to reduce your operating costs and lower their priority for allocated product. This is where your downsizing should occur: It is critical to lower your cost to serve to match their profit potential by moving them to more efficient engagement modes.

These customers comprise the segment that is most amenable to systems improvements. Here, you need to understand the cost to serve for these customers to be sure that you are charging correctly for the services you offer. Price discounting should be the exception, not the rule.

Similarly, you need to use digital marketing to communicate with and manage these customers.

It is prohibitively costly to attempt to develop personal relationships with the numerous customers in this segment. Instead, you should create a menu-based set of service offerings, and enforce your "rules of engagement" carefully. This is where your most productive downsizing should occur.

Note, however, that a few profit desert customers are large companies for which you are a minor supplier. You may be able to offer to fully meet their needs in return for a larger share of wallet and long-term contract. They are prime prospects to be developed into profit peaks.

For those customers, a combination of digital systems and skilled managers is essential to success. The first step is to deploy a digital marketing probe process to identify those customers, and the second step is to use a combination of digital marketing and direct sales by profit-peak customer teams to grow your relationships with them. However, the expected value of these efforts is low compared with working with your profit-peak and profit-drain customers, so place a strict time limit on these efforts.

Suppliers

The most effective program for transforming your suppliers is directly parallel to the one that is best for your customers.

Your profit-peak suppliers provide your most profitable products. These suppliers warrant dedicated teams of managers who are highly skilled at developing and growing productive relationships featuring both weekly coordination meetings and monthly forecasting and planning meetings (along with selected early steps to build integrated processes in supply chain management, category management, and product development). The systems required are relatively standard.

Profit-drain suppliers have high enough revenues to warrant dedicated teams of managers who can partner with their supplier counterparts to reduce joint operating costs. It will likely take more work with these suppliers to maintain your supply, but it is crucial to long-term success, especially if your customers prefer these products.

This is a good opportunity to improve your relationships with your profit-drain suppliers, and drive them toward profit peak behavior. Your suppliers will appreciate how well your teams work with them in these difficult times. Your supplier-specific all-in P&L will show you exactly where the profit drains are occurring and which profit-improvement actions will plug the cash and profit drains. In our experience, reducing joint operating costs is a surprisingly effective, although an often hidden, profit lever.

Downsizing either of those sets of teams would be highly counterproductive.

Your profit-desert suppliers are the "long tail" of your supplier revenue distribution. A small team should manage these suppliers, and every effort should be used to get them on supplier portals with standard terms and low human resource requirements. You will not have the resources to directly manage the bulk of your small, low-profit suppliers. This is where you will need systems to lower your costs; and, again, this is where aggressive downsizing will be most productive.

Operations and Supply Chain

Beyond your core supply chain systems (e.g., warehouse management, transportation management, inventory management), highly skilled managers are much more essential than complex systems.

In tight supply situations, it is important that you make decisions about customer product allocations in advance and communicate them broadly. All too often, companies do this in real-time, leading to a scramble for inventory with everyone attempting to support his or her own customer priorities. That leads to the default situation: no priorities at all, and first-come-first-served policies.

During crisis times, traditional supply chain decisions can no longer be made by supply chain managers alone. In product-constrained environments like today's, these decisions are strategic and must be handled at the company level by the multifunctional teams overseeing and managing the company's key segments: profit peaks, profit drains, and profit deserts.

In a crisis period, key managers throughout the company have to be able to judge the nature of both supply and demand. One important component is overall market shrinkage and growth, while a second critical component is the allocation of scarce products inbound from suppliers and outbound to customers.

The second component is particularly difficult, as it requires monitoring both supplier and customer status. Your profit-peak suppliers probably will give you some preference, especially if you have taken measures to reduce your joint operating costs, making you a profit-peak customer to them. Looking downstream, your profit-peak customers warrant full allocations of product, while your profit-drain customers may get only 75-80% of needs, and your profit-desert customers may get a mere 60%.

In manufacturing companies, high-level interfunctional coordination is especially critical. Shortages of particular parts or components may block the production of certain sets of products. The all-important decisions on which products to produce and market requires both supply chain and marketing expertise and knowledge.

That determination requires sound judgement from managers (rather than systems) in all functional areas working together based on their years of experience. Losing this capability to downsizing would be extremely problematic.

3. Concentrate on practicality and rapid implementation

Profit segmentation must form the practical, critical core of your financial planning and analysis process.

- It starts with developing an understanding of your profit peaks, profit drains, and profit deserts.

- It continues with creating an integrated set of programs for each segment—with each reflecting the right balance of people and systems.

- Finally, you need to separately and carefully monitor the performance, and risk, of each profit segment—being thoughtful about where to build your human resource capabilities, and where downsizing will provide a net benefit.

Now is the wrong time to manage by using aggregate metrics and broad across-the-board corrective measures such as general downsizing based on "fairness" (in which each department takes the same percent of force reduction). The companies that will not only survive but also lead in the post-coronavirus markets are those that use the right metrics and surgical decisions about resources to ensure that they have the cash flow and profits to capture the best customers while responding to today's rapidly changing world.

In our experience, forming dedicated teams focused on each key profit segment—profit peaks, profit drains, and profit deserts—at both the upper-management planning and oversight level, and at the operational management and execution level, will ensure that you deploy your resources wisely and maximize both your company's near-term survival and its long-term profitable growth.

At the same time, it is important to balance this effort with selectively continuing your strategic investments in areas such as product development and new technologies that will be critical to your success after the current crisis abates.

* * *

Managers have no choice in terms of timing since today's crisis is externally driven. The timeframe for effective action is very short. Those who act quickly before the situation takes over and the range of options swiftly decreases will create life-preserving cash flow and harvest enormous market share gains from competitors who move too slowly to make a difference.

By focusing your resources on your profit core, and emphasizing your key people and relationships, you can make sure that your initiatives and actions are both practical and timely under today's fast-changing conditions.