Despite a downward spiral in revenues at virtually every traditional media company, most industry executives are optimistic about their financial prospects—and their ability to reinvent themselves in the digital age, according to a study from Booz & Company.

Over two-thirds (70%) of industry executives surveyed characterize their company's fundamental financial situation as sound, strong, or very strong. Even print executives share that optimism: just 34% describe their financial picture as distressed or pressured.

Moreover, 74% of media executives say their organizations will emerge unchanged, or even improved, in the aftermath of the economic downturn.

"While we believe media executives may be overly optimistic, considering the pervasive industry challenges, it is encouraging to see that many media companies are addressing their issues head on, but of course much more will be necessary," said Harry Hawkes, a Booz & Company partner.

"Many industry leaders have already substantially restructured their businesses, they're experimenting with new paid content models, and they're tapping new areas of customers' marketing budgets beyond advertising."

Below, other findings from the study Reset the Media Business Model, based on interviews with 50 senior media executives on their current cost-reduction and growth priorities.

Structural Changes in Media Industry

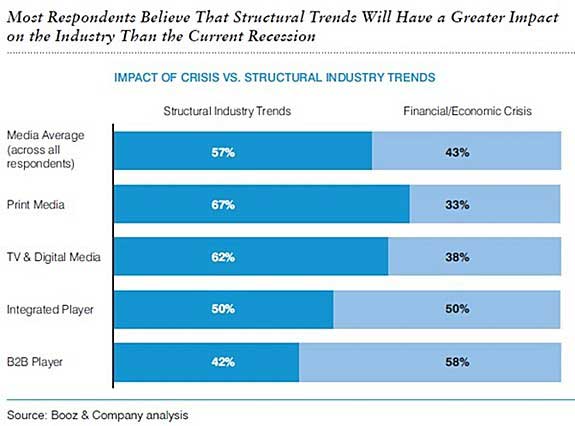

Although a significant proportion of the revenue declines of 2009 can be attributed to the economic downturn, 57% of media execs say structural trends in the industry will ultimately have a greater impact on their businesses than the recession; 67% of print execs say the same.

Media companies had already achieved an average cost savings of close to 7% in 2008, and they expected to cut 9% more in 2009.

Those figures, however, hide the fact that many companies have already achieved radical cost savings, while others have not yet begun to cut costs, Booz & Company said.

Post-Recession Business Outlook

Overall, only 26% of media execs say the recession will leave them worse off than before.

Print media companies are the most concerned about their post-recession situation: 40% of print execs say they are worse off as a result of the recession, compared with 29% of those in TV & digital media.

B2B players (25%) are the most optimistic, perhaps because they have already undergone substantial restructuring and are already benefiting to some degree from subscription-based data services, Booz & Company points out.

Meanwhile, integrated players say their prospects are unchanged or better than pre-recessionary times.

Generating Growth

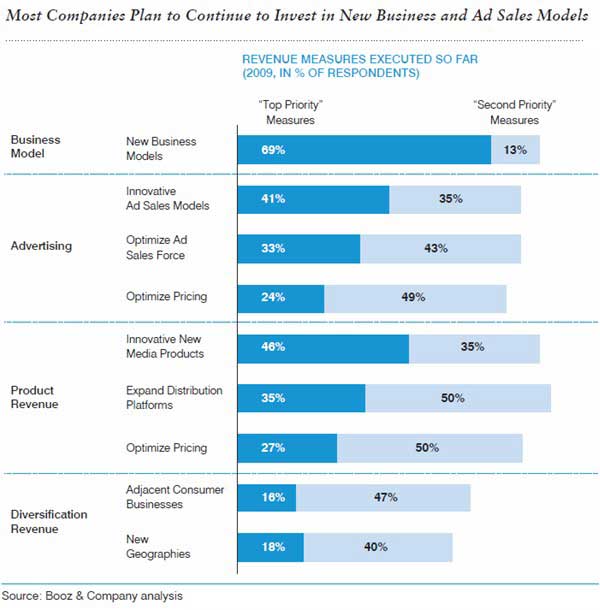

Media execs agree the only way to attain top-line growth is by developing new business models to monetize products and generate new ad sales.

Asked about last year's top strategic priorities, 69% of media execs cited the development of new business models, primarily focused on boosting revenues from digital innovation, including innovative new media products (46%) and expanded distribution platforms (35%).

Digital business models are a top priority across all media types: 52% of execs cite investing in digital business models as their top investment priority, followed by 32% who cite investments in new people and capabilities.

Meanwhile, global expansion (13%) is taking a back seat to the needs of developing digital businesses and new capabilities, at least in the near term.

Share of Digital Revenue to Nearly Double by 2015

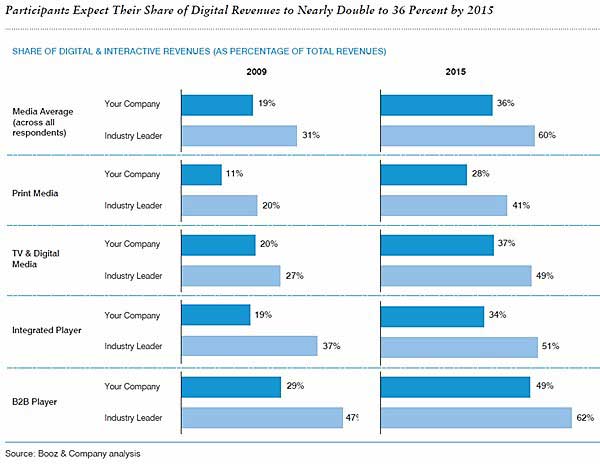

On average, media companies expect the share of their revenues from digital media (as a percentage of total revenue) to increase from 19% in 2009 to 36% in 2015—an increase of 89%. Across media sectors:

- Print companies forecast the biggest growth leap in digital and interactive revenues, up 154%, from 11% today to 28% of total revenues by 2015.

- Integrated players expect digital to account for 34% of revenue in 2015, up 126% from the 19% in 2009.

- TV & digital media companies expect digital to account for 37% of revenue, up 85% from the 20% in 2009.

- B2B players expect digital to account for 49% of revenue, up 69% from the 29% in 2009.

As digital revenues grow, display advertising is expected to decline, from more than one-half of all revenue today to just 29% in 2015.

Challenges to Building New Digital Models

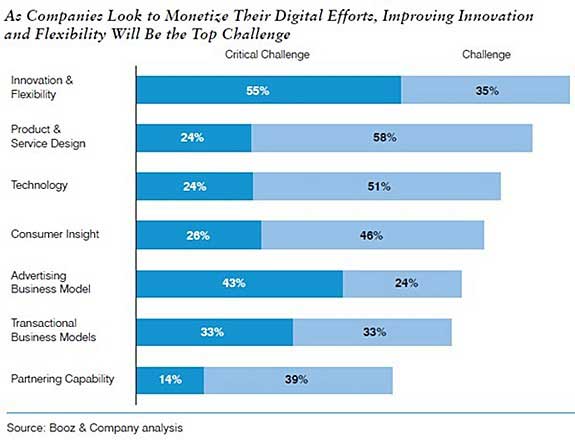

The media industry continues to look for creative new-business practices that allow for improved economics, despite—in some cases—traditional "analog" operating cultures: 90% of media execs say innovation and insufficient flexibility are the most daunting challenges they face in monetizing their digital efforts.

Other challenges include issues of product and service design (82%), technology (75%), and consumer insight (72%).

Media Companies Rethink Their Value Chains

Media executives cite the strength and uniqueness of editorial content (4.1 out of 5) as their top competitive strength, followed by brand positioning and market strength (3.9) and cost management (3.6).

Nevertheless, editorial work is a top cost-cutting target (79%), along with sales forces (84%), distribution (76%), content packaging and programming (73%), technology spending (72%), and consumer marketing (68%).

In addition, media businesses are looking to increase their use of more structural approaches to cost reduction, including portfolio rationalization (80%), outsourcing and off-shoring (54%), process innovation (74%), and improved purchasing (82%).

About the data: Conducted by Booz & Company, the study was based on some 50 interviews with senior executives representing a broad mix of functions in the media business, as well as a quantitative online survey among 67 companies worldwide, from July to September 2009. Of the companies surveyed, 36% were in TV and digital media, 26% were in print, 21% were B2B specialists, and 17% were integrated media companies.