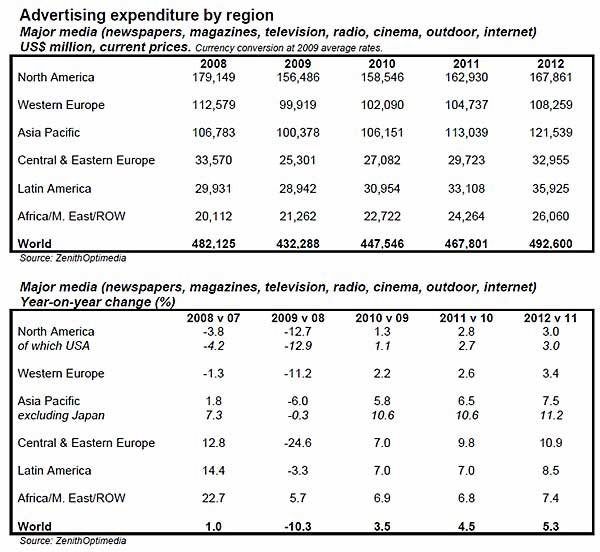

Tentative growth in the US advertising market has begun to propel the global ad recovery, prompting a revised forecast of global ad expenditure, now projected to grow 3.5% in 2010, up from the 2.2% forecast in April, 2010, according to projections by ZenithOptimedia.

Ad spending in North America is now forecast to grow 1.3% in 2010, up 2.8 points from the -1.5% forecast in April.

Global ad spending projections for the next two years have also been upgraded, though less dramatically: 4.5% annual growth is now forecast for 2011, up from the 4.1% forecast in April, and 5.3% growth is forecast for 2012, the same level forecast three months earlier.

Below, additional projections issued by ZenithOptimedia.

Developed Markets to Recover Slowly

Most of the global forecast upgrade can be attributed to North America and Western Europe, where ad spending was stronger than expected in the first half of the year.

Overall, developed markets (North America, Western Europe, and Japan) are forecast to grow 1.3% in 2010, compared with 8.6% growth from developing markets (everywhere else).

The gap will narrow slightly in 2011, but growth in developed markets will remain modest—2.4% in 2011 and 2.9% in 2012—whereas developing markets are expected to grow 9.1% in 2011 and 9.8% in 2012.

Developing markets are expected to drive most of the growth in global ad expenditure over the next few years, contributing 60% of projected incremental growth ($39 billion of the extra $60 billion) to the global ad market between 2009 and 2012.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Internet Advertising Stays Strong

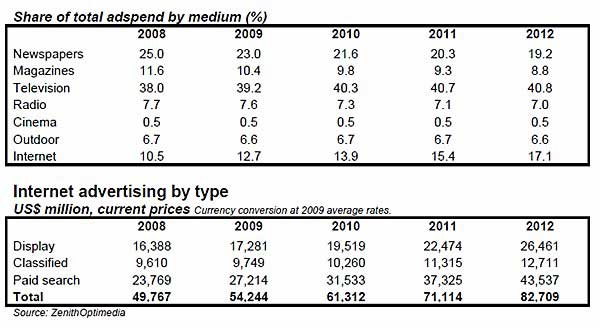

- Rapid growth in Internet mobile and social media is expected to drive the Internet's share of ad expenditure from 12.7% in 2009 to 17.1% in 2012, narrowing the gap between the Internet and newspapers to just 2 percentage points.

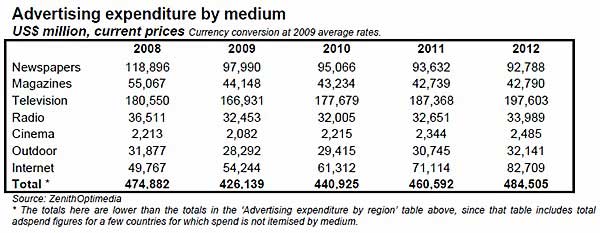

- Paid search, the main engine of Internet growth, accounted for 50.2% of Internet ad spend in 2009; that share is forecast to reach 52.6% in 2012.

- Display accounted for 31.9% of Internet ad spend, down from 32.9% in 2008. New formats, such as Internet video, are likely to help stabilize display in 2010, and drive the category to a projected 32.0% share in 2012.

Among other media, Television has suffered less than other media during the recession, because TV viewing increases during downturns (as a relatively inexpensive form of entertainment) and because its brand-building power is a complement to the Internet's strength in generating response and sales.

TV ad spending is forecast to attract 40.8% of total ad expenditure in 2010, up from the 39.2% in 2009—due in part to the rise of the developing markets, where television is generally a much more dominant medium than in developed markets.

Newspapers and magazines have suffered the most during the economic downturn, and declines have been exacerbated by falling consumer interest in print and substitution of new media. By 2012 newspapers will account for 19.2% of global ad spend share, down from 25.0% in 2008, and magazines will account for 8.8%, down from 11.6%.

About the data: Ad-expenditure projections are issued on a quarterly basis by ZenithOptimedia. The above projections were issued in July 2010.