Today's teens, though digital natives, by a wide margin prefer to shop in stores than online, and even their use of what they consider their favorite social networks is decreasing in importance for them, according to the 23rd semi-annual Taking Stock With Teens survey from Piper Jaffray.

The study also indicates improving discretionary spending across various categories: "Our Spring 2012 survey results provide confirmation that we are in the early stages of a clearly defined discretionary spending cycle," said Jeff Klinefelter, director of research and senior research analyst at Piper Jaffray.

"Double-digit increases in spending on a sequential and year-over-year basis for both upper- and average-income teens, and similar strength in spending intentions, signal improved confidence in the overall environment and a willingness to spend more broadly on key categories of interest."

Below, selected findings from the most recent Taking Stock With Teens survey from Piper Jaffray.

Social Networks and Websites

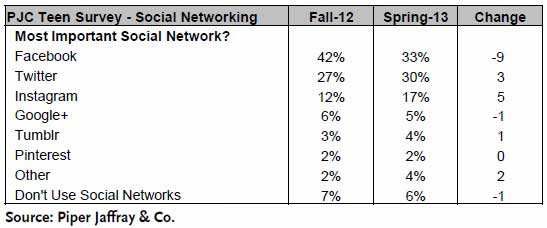

Facebook is still cited by a plurality (33%) of teens as the most important social network, but that's down 9 percentage points from the fall 2012 level of 42%.

Instead, teens give more importance to Twitter and Instagram now than they did six months ago:

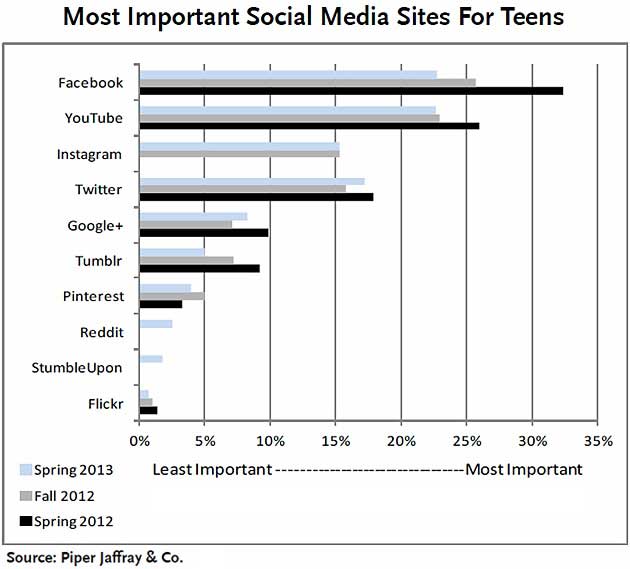

When considering social media websites (as opposed to networks), teens ascribe equal importance to YouTube (not cited as a network) and Facebook, followed by Twitter and Instagram.

Still, relative to six months and 12 months earlier, the importance to teens of both Facebook and YouTube has declined, whereas that of Twitter and Instagram seems to be improving.

Asked whether social media has an impact on their purchasing behavior, more than have said it does: 53% of female teens and 52% of male teens.

Shopping

By a large majority, teens prefer to shop in stores rather than online: 78% vs. 17% in the case of female teens, and 75% vs. 19% in the case of males.

Nevertheless, teens do shop online—in similarly large proportions:

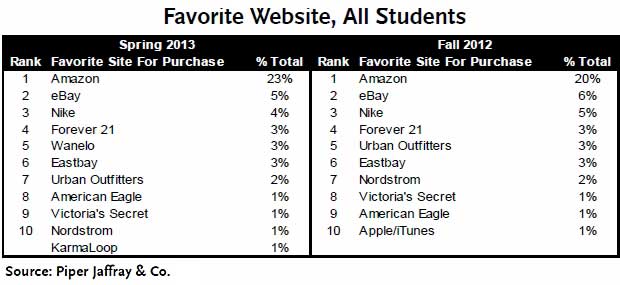

Teens' top 4 favorite shopping websites, led by a wide margin by Amazon, remained unchanged from six months earlier:

The following are additional study findings from the portable devices, fashion, beauty and personal care, restaurant, and videogame categories.

Mobile Devices

Teen spending on portable devices continues to accelerate: 86% of teens report that they are likely to purchase a smartphone for their next device, up from 83% last fall and 81% one year ago.

- Apple's iOS gained market share as the most desired operating system, with 51% of teens reporting they are likely to buy an iOS device (compared with 22% for Android).

- Approximately 34% of teen respondents owned an iPhone, up from 17% last spring, driven by the availability of a $49 iPhone 3GS at the launch of the iPhone 4S.

- Also, 40% of teens expect to purchase an iPhone in the next six months, up from 37% last year.

In tablet market, 34% of teens owned a tablet computer, up from 22% last spring. Of those teen tablet owners, 70% owned an iPad, 19% owned an Android-based tablet, and 11% owned a Kindle Fire.

Furthermore, 19% of teens expected to purchase a tablet in the next six months, with 80% of those teens intending to purchase an iPad.

Fashion

Teens cited improvements in both current fashion spending and intention to spend, across income levels and genders:

- The fashion category accounted for 39% of teen budgets, up from 38% in the fall of 2011 and 37% a year ago.

- Upper-income teens indicated that spending on fashion increased 17% on a sequential basis and 21% year-over-year.

- Average-income teens indicated their spending on fashion increased 18% on a sequential basis, and 15% year-over-year.

Those double-digit increases in fashion spending are the first recorded since the 2003/2004 surveys, when teens across income levels indicated a similar meaningful propensity to spend on the fashion category, Piper Jaffray said.

Strength in spending was broad-based across categories, but spending by male teens in fashion was the highest—historically indicative of a multi-year, dual-gender fashion spending recovery, according to the firm

Food and Restaurants

Teen spending on food and restaurants is at or near the highest level since early 2000:

- Upper-income and average-income survey respondents increased their weekly restaurant spending approximately 10% and 3%, respectively, compared with the fall of last year.

- Taste remained the strongest influence on food and restaurant dining decisions.

- Value also continued to be an important influence on dining decisions and has gained in importance over time, ranking number two in the current survey compared with number five in the spring of 2007.

Videogames

- Teens constitute 33% of videogame players, with videogames accounting for 7% of teen spending.

- Teens are increasingly receptive to downloading games, accessing social networks, and playing games on smartphones and tablets.

- Social networks, tablets, and smartphones are taking increasing eyeball share away from console-based video games.

Beauty and Personal Care

- Beauty spending by upper-income teens increased 8% sequentially and 6% year-over-year. For average-income teens, beauty spending increased 21% sequentially and 18% year-over-year.

- Skin care and cosmetics accounted for a larger share of overall beauty spending, and the beauty spending gap between upper- and average-income teens continues to narrow.

- MAC remained the No. 1 cosmetics brand for upper-income teens, while Cover Girl was once again the No. 1 brand for average-income teens.

- Victoria's Secret remains the preferred fragrance for teens across both income segments, consistent with the past eight surveys.

About the data: The Taking Stock With Teens survey from Piper Jaffray gathered input from approximately 5,600 teens, whose average age was 16.3 years during the latest survey. Teen spending patterns, fashion trends, and brand and media preferences were assessed via visits to geographically diverse high schools in 11 states, and via an online survey of a wider group of teens from 34 states. The survey is conducted in partnership with DECA (an international association of high school students).