Evaluating performance accurately is vital for making strategic recommendations, allocating budget, and getting C-suite approval—which, as a marketer, is your everyday life.

That makes customer lifetime value (LTV) one of the most important metrics to measure at any growing company, whether in startup mode or a more mature stage.

By measuring LTV in relation to customer acquisition cost (CAC), you can measure the investment required to earn a new customer—including the cost of sales and marketing.

This article will help you understand what the LTV:CAC ratio is, how to calculate it, and how to present it so you can sell to, acquire, and retain highly valuable customers.

What Is an LTV:CAC Ratio?

The LTV to CAC ratio is a critical metric that gauges the relationship between the long-term value (AKA revenue) a customer brings to your business and the investment required to acquire that customer.

An indicator of profitability, LTV:CAC is calculated by dividing LTV by CAC.

Why Use the LTV:CAC Ratio?

The LTV:CAC ratio is important for many reasons, including the following

- Profitability measurement: It's crucial for assessing the profitability of your customer acquisition.

- Capital allocation: It helps you make informed decisions about how to allocate budgets.

- Efficiency and optimization: It allows you to allocate resources to the most cost-effective channels and optimize them.

- Sustainability: A high LTV:CAC ratio indicates that you are creating loyal, high-value customers who aren't churning.

- Strategic decision-making: It helps you focus on the most profitable customer segments.

- Investor and stakeholder confidence: A healthy LTV:CAC ratio can instill confidence in the company's financial health and growth prospects.

The Ideal LTV:CAC Ratio

A good LTV:CAC ratio for SaaS companies is 3:1 or better.

If it is lower than that, you need to look at your budget allocation and make shifts to more efficient or better-performing channels.

A ratio of 5:1, on the other hand, indicates the opportunity to invest more dollars into marketing for that specific channel or tactic.

How to Calculate LTV:CAC Step by Step

Before you start, you're going to need your company's historical performance data on hand and an Excel spreadsheet to aggregate the data and run your calculations.

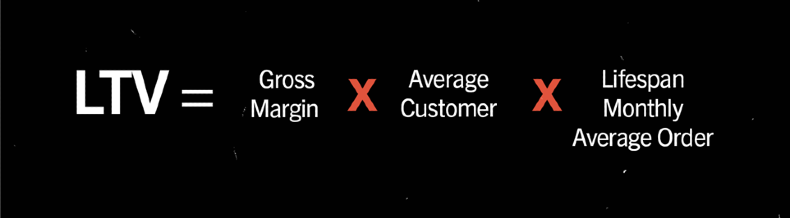

To calculate LTV, you'll need numbers that your finance or rev ops team members would have on hand:

- Gross margin percentage (Net Sales - Cost of Goods Sold x 100 / Net Sales)

- Average customer lifespan in months (Sum of Customer Lifespans / Number of Customers, OR 1 / Churn Rate)

- Monthly average order value in dollars (Revenue / Number of Orders)

You'll also need metrics you can grab from platforms such as your CRM:

- Channel spend (Google, LinkedIn, Facebook, etc.)

- Funnel stages by channel with amounts (leads, MQLs, demos, trials, etc.)

- Number of customers by channel

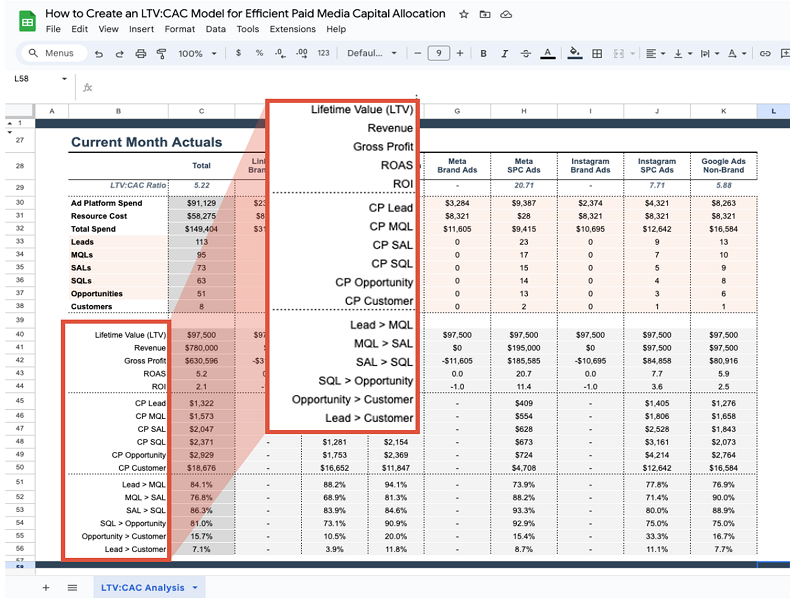

Then the nitty gritty begins. Create a spreadsheet, and enter all of your metrics (yes, all of them). It's tedious to set up, but it'll be worth it when you need to repeat the process because you can just make a copy and change out a few numbers.

Step 1: Calculate LTV for a single customer

In your Excel spreadsheet, create a section where you can calculate LTV:

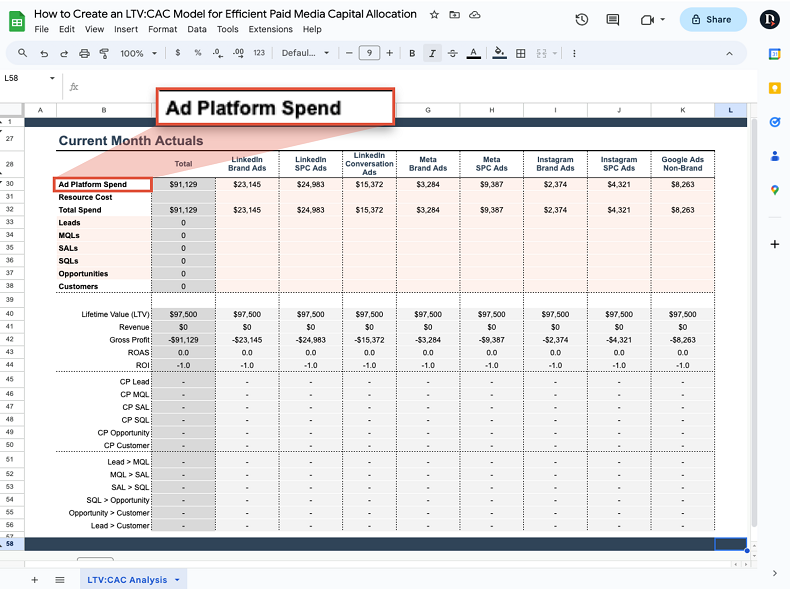

Step 2: Add platform spend

The next metric to add in your magical spreadsheet is your ad platform spend by channel by ad type.

Splitting the LTV:CAC analysis by tactic is important because it allows you to pinpoint what the performance is for each and how they stack up against each other.

Split brand awareness into its own columns from the other types of spend because it typically has no tangible return. It's difficult to attribute a lot of direct funnel stage metrics to brand awareness, so knowing how much you are spending there in comparison with other offers helps you see how it affects the funnel overall when you fluctuate its spend.

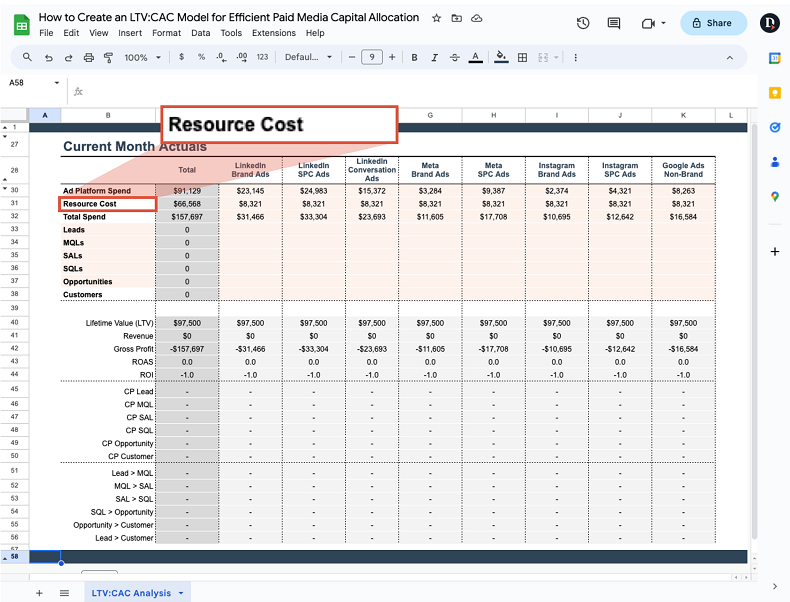

Step 3: Add Sales and Marketing resource costs

When we say your Sales and Marketing resource costs, we mean all of your Sales and Marketing resource costs: payroll, commissions for AEs, contractors, office supplies, software and licenses, conference and event fees, etc. Anything that goes toward Sales or Marketing should be included so you can get a real picture of your profitability.

Attribute the resource costs evenly across each channel because it's hard to say whether one channel eats up more resources than another. (But if you have a good way to attribute the cost per channel, do it!)

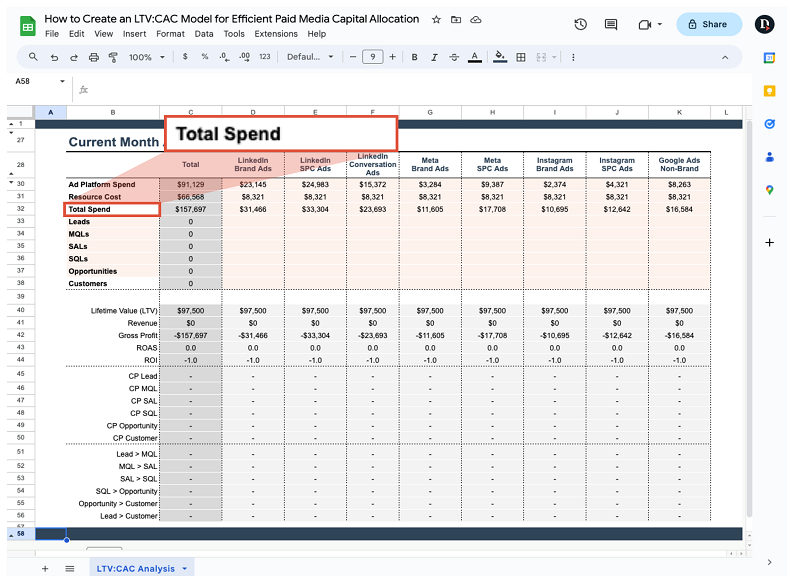

Step 4: Calculate CAC

Below the resource cost, sum up the ad platform spend and resource cost to get your CAC.

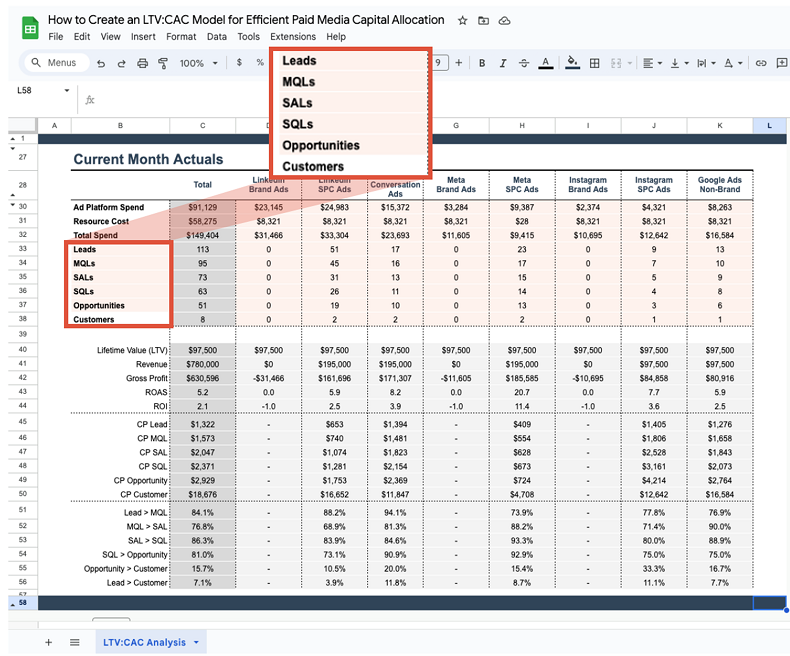

Step 5: Add in your performance metrics by channel

Breakdown your leads, MQLs, etc. by channel and tactic.

Step 6: Enter all your important calculations as formulas so you can easily recreate the same view each month

- LTV: Use the calculation from Step 1

- Revenue: Customers x LTV

- Gross profit: Revenue - Total Spend

- ROAS: Revenue / Total Spend OR LTV:CAC: Revenue / Total Spend

- ROI: (Revenue x Gross Margin - Total Spend) / Total Spend

- Cost pers: Total Spend / Funnel Metric

- Funnel conversion rate: Metric Further Down Funnel / Prior Funnel Metric

The most important part is to review your data. Make your decisions based on where you get the best results and where you seem to be bleeding money.

* * *

The spreadsheet is only a guide and not the end-all-be-all for your decisions. You should always be looking at the total ratio to see metrics for a specific time period.

For example, even though the brand in this model isn't "generating" any customers, we do know it plays an important role in our customers' journey. Cutting it off completely would be a mistake. We need to look at the total ratio to determine impact—not only on paid channels but also on organic ones.

The best way to go is to slowly shift your budget allocations so you can test a shift and find the point of diminishing return before cutting off a channel completely.

* * *

The LTV:CAC ratio is a critical metric for businesses and marketers because it provides a clear picture of the relationship between customer value and acquisition costs.

So, what are you waiting for?

Start harnessing the power of LTV:CAC to enhance your marketing efforts and drive success, and hire PPC consulting services to help you figure out how to allocate budget better.