After hitting rock bottom during the height of corporate bailouts and the economic crisis, the public's perception of corporate America is bouncing back: The percentage of Americans who say the state of reputation of corporate America is "good" increased to 18% in 2009, up 6 percentage points from the 12% recorded a year earlier, and the first positive improvement in four years, according to the 2009 Harris Interactive RQ Study.

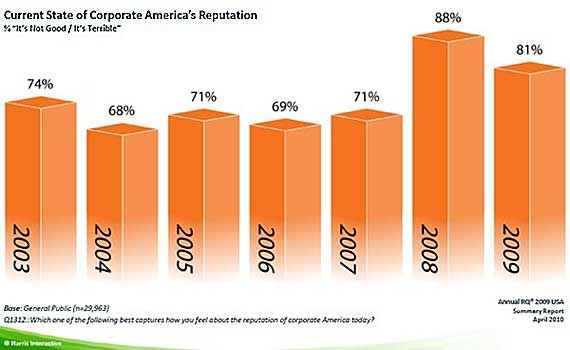

In addition, the percentage of Americans who say the state of corporate reputation is "not good" or "terrible" decreased to 81%, from 88% in 2008.

Below, other findings from the 11th Annual Harris Interactive US Reputation Quotient (RQ) Survey, which measures the reputation of corporate America and ranks the 60 "Most Visible Companies in the US."

Berkshire Hathaway No. 1 on Corporate Reputation

Among the six companies that received an RQ score over 80—considered an "excellent" reputation—Berkshire Hathaway took the top spot from frequent top-scorer Johnson & Johnson by less than 0.5 points. Rounding out the top 6 were Google, 3M Company, SC Johnson, and Intel Corporation.

SC Johnson (No.5) appeared on the list of the 60 most visible companies for the first time this year, and it is the first company since Google in 2005 to make its top 60 debut as a top 5 company.

Nine Lowest-Ranking Were Recipients of Bailouts

At the other end of the spectrum, AIG moved up one spot to No. 59, ceding the lowest rating to Freddie Mac (now No. 60), another first-time company on the list of the 60 most visible. Those two companies, along with Fannie Mae (No. 58), received RQ scores below 50, which over the past eight years of this study has been a strong indicator of a lack of future viability for a company.

Freddie Mac's score of 38.94 is the lowest recorded score since Enron's 30.05 in 2005.

Among the 10 lowest-scoring companies, nine have recently received government bailout money or remain government supported, including newcomer Goldman Sachs (No. 56 with an RQ score of 51.36).

"In addition to the slightly more positive reputation environment, we see a very different overall view of how companies are being evaluated and perceived this year," said Robert Fronk, SVP, Global Practice Lead and Reputation Management at Harris Interactive.

"In last year's study we saw companies that provided value and a sense of comfort getting strong overall reputation ratings. This year, we see overall corporate governance, performance, and leadership driving positive reputation perceptions. Finding two holding companies, Berkshire Hathaway and SC Johnson, in the top five, is a visible reflection of this difference in focus."

Ford as Bright Spot

Ford, ranked No. 37, had an RQ score of 69.77 this year, up 11.28 points from 2008, the largest single-year improvement in the past nine years, placing it in the category of companies with a "good" reputation—quite an accomplishment, considering its starting point and the state of the automotive industry.

"Ford's almost record-breaking leap in reputation, the second-largest in our study's 11-year history, was enabled by perceptions of their products and services finally catching up with the other positive indicators we have seen in the market over the past few years," said Fronk.

"This, combined with perceptions of a clear vision and strong leadership, really distinguishes Ford from one of the lowest-ranking industries and provides them with a competitive business advantage."

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Reputation by Sector

At an industry level, technology remains the highest-rated industry, registering a five-point increase from last year to a current 72% positive rating. The two largest improvements in reputation were in retail and automotive: Both registered nine-point increases.

The only industry to show a decline in reputation was pharmaceutical, which registered a two-point decrease following a five-point rise in 2008. Financial services and tobacco continued to hold the lowest industry rankings; however, even financial services registered a five-point increase from last year.

Companies were also ranked across six additional reputation-related categories. The top 5 corporations within each of those categories are the following:

- Social Responsibility: Johnson & Johnson, Microsoft, SC Johnson, Lowe's, and Whole Foods Market.

- Emotional Appeal: Johnson & Johnson, amazon.com, SC Johnson, Berkshire Hathaway, and General Mills.

- Financial Performance: Berkshire Hathaway, Google, Microsoft, Disney, and Coca-Cola.

- Products & Services: 3M Company, Intel Corporation, Google, Johnson & Johnson, and SC Johnson.

- Vision & Leadership: Berkshire Hathaway, Google, Microsoft, Apple, and Coca-Cola.

- Workplace Environment: Google, Berkshire Hathaway, Microsoft, Johnson & Johnson, and 3M Company.

Overall, the stronger a company's reputation, the more likely consumers invest or recommend investment in the company, according to Harris.

Other company-specific findings:

- Those companies that are financially strong and have had relatively stronger-performing stocks over the past years (e.g., Berkshire Hathaway, Johnson & Johnson, and Apple) are the ones that people are most likely to invest in or recommend as an investment.

- Among the companies most likely to have their company's products and services purchased in 2009 were Amazon.com, Kraft, Coca-Cola, and General Mills.

- The companies least likely to have their products and services recommended were Wells Fargo, JPMorgan Chase, Chrysler, Sprint Nextel, Time Warner, Bank of America, Citigroup, Goldman Sachs, and AIG.

- Companies with the lowest levels of perceptions of trust also have the lowest levels of perceptions of customer service and ethical standards. This year those companies were AIG, Fannie Mae, Freddie Mac, Goldman Sachs, and Citigroup.

- Johnson & Johnson and Lowe's were among the companies that ranked in the top 10 in positive perceptions of customer service, ethical standards, and trust in the event of a product/services problem.

- Recalls for Toyotas and Johnson & Johnson products during the year did not negatively effect consumers' trust in those companies to do the right thing in the event of a product/service problem. Regarding Toyota, trust improved this year: Those who said they would "definitely" trust Toyota went from 27% pre-recall to 43% post-recall. However, those who said they "probably" would trust Toyota went from 53% pre recall to 37% post-recall.

About the data: The Annual RQ surveys more than 29,000 US consumers, using its proprietary Harris Poll online panel. Respondents are first asked to identify the 60 most visible companies and then are surveyed to rate those companies, based on their reputation, on 20 attributes that comprise the RQ instrument. The 2009 RQ survey was conducted from Dec. 29, 2009 to Feb. 15, 2010.