Although one-half (52%) of small business owners say their business's economic situation is worse than it was 12 months earlier, almost three-quarters (73%) are optimistic about the future of their businesses, according to a February survey from Pitney Bowes.

As entrepreneurs attempt to overcome the financial challenges of a tough economy, they remain positive and resilient: If forced to close their businesses, 34% of surveyed small business owners say they would start a new career, while 28% would start a new business; 32% would retire.

Below, other findings from the Pitney Bowes small business survey, which interviewed 504 small business owners in the US about the financial state of their businesses and outlook for 2010.

Top Small Business Stressor: Declining Sales

Nearly three-quarters of small business owners (74%) say their top financial concern is decreased sales.

Other financial concerns:

- Healthcare costs: 52%

- Late payments from customers: 42%

- Greater restrictions on corporate financing: 42%

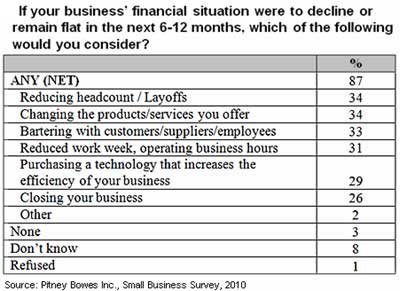

Despite the severity of the recession, many small business owners feel they have financial levers to pull before they would be forced to close. If their financial situations does not improve, 34% say they would change their mix of products or services, while 34% would resort to layoffs.

To minimize the use of cash, one-third (33%) would barter with customers, suppliers, and employees while 31% would reduce operating hours. Some 29% would invest in technologies to increase the efficiency of their businesses.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Operating Cash Flow Concerns

Nearly eight-in-ten small business owners (79%) say they worry about cash flow, including 32% who worry about cash "all the time."

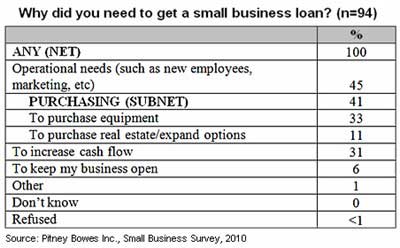

Nearly one-in-five small business owners (18%) say they have taken out a small business loan in the past year. Among those, 45% used the money to cover operational needs, such as new employees or marketing expenses, while 31% used the money to meet cash flow demands.

Fewer small business owners used their borrowed money to increase capacity: 33% say they purchased new equipment, and just 11% purchased real estate or expanded.

Spending in 2010

Over four-in-ten small business owners (42%) say they would most likely spend available cash on technology to boost productivity in 2010. Nearly one-third (30%) would increase payroll spending and 26% would use the money to make capital investments.

Some 18% would not spend any free cash, while 10% would use it to move to a smaller office space.

About the data: Commissioned by Pitney Bowes, the survey was conducted via telephone by International Communications Research, which polled 504 small businesses (fewer than 100 employees) across the US from February 10 to 24, 2010.