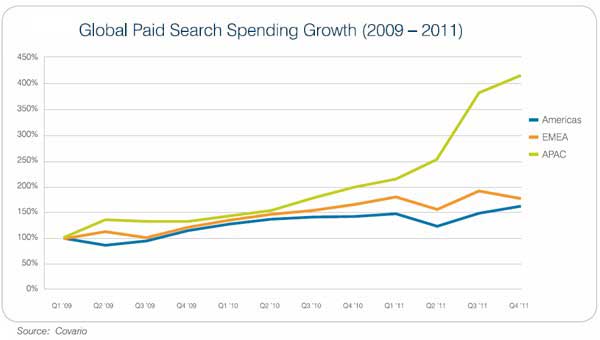

Overall, total annual spending grew 21% in 2011 over 2010 levels, exceeding the 15% to 20% projections issued by Covario in the first quarter.

- North America, powered by the US and Canada, recorded strong spending growth in the quarter: up 11% quarter-on-quarter (QOQ), and up 18% year-on-year (YOY); annualized growth was 10%.

- In the EMEA (Europe, the Middle East, and Africa), growth was down 8% QOQ, but up 9% YOY; annualized growth was 22%.

- APAC (Asia-Pacific) countries continued to dominate growth opportunities in the high-tech industry. QOQ growth was up 8%, while YOY growth was up over 100%; annualized growth was 97%.

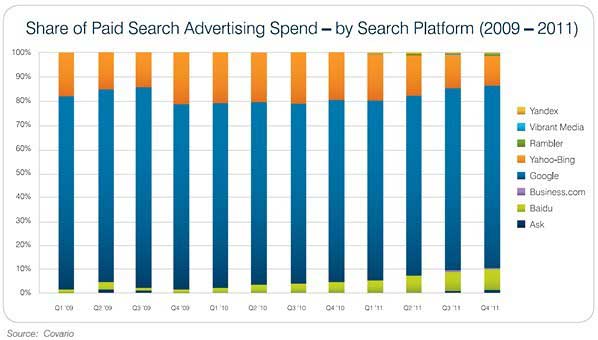

Search Market Share

Baidu, which commands the most market share in APAC countries, given its dominance in China, grew 19% QOQ, and 185% YOY.

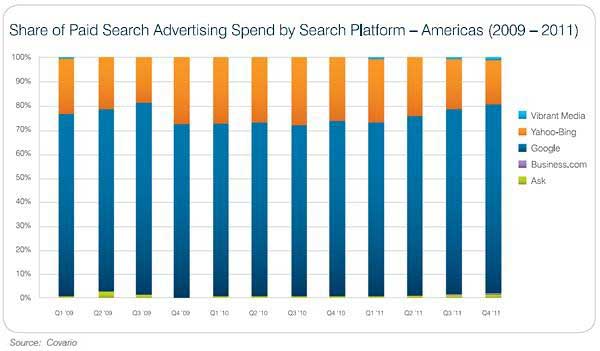

In North America, fourth-quarter paid-search spending was up 11% QOQ, and up 18% from YOY.

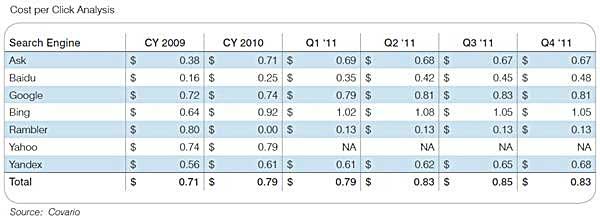

CPCs (cost per clicks) remained relative flat in 4Q11 over 3Q11 levels.

Below, the three-year trends in CPCs for the major platforms worldwide:

Among paid-search advertisers, 4Q11 was the first quarter since mid-2010 where the trend toward higher CPCs was broken. Impressions recorded only a moderate increase in volume, compared with the more dramatic increases observed for clicks and CTRs.

- Changing consumer behavior: Consumers in the early phases of the purchasing funnel are increasingly making use of social networks, as well as other alternatives to search, for product recommendations. Consumers are further along the conversion path, and more likely to click on a paid-search ad, by the time they perform a Web search.

- Ad strategies becoming more efficient: Higher quality and more relevant search ads are driving consumer engagement, and search engines are rewarding those efforts with higher positioning on the results page. An increased use of bidding platforms is also keeping CPCs down.

- Search engines improving: The increased effectiveness of matching paid-search ads to queries, and steady enhancements to such existing features such as ad-site links, location extensions, and product images, are all driving better recognition of user intent.

About the data: The Covario Global Paid Search Spend Analysis is based on paid-search spending from among global high-tech and consumer-electronics advertisers, for the period 1Q09 to 4Q11.