Though M&A activity was subdued in 2009, a substantial pickup in deal-making in the latter half of the year––much of it involving marketing & interactive services and online media marketing & technology companies––is restoring confidence in M&A in 2010, according to The Jordan, Edmiston Group.

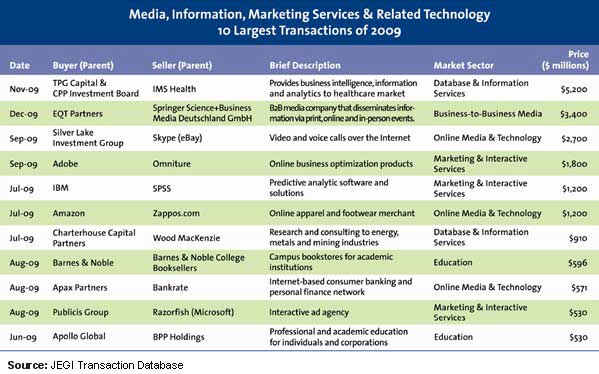

Fueled by continued strength in the online media and the interactive marketing services and technology sectors, the 10 largest deals were driven by a mix of cash-rich strategic corporate buyers such as Adobe, IBM, and Publicis Groupe, as well as private equity firms such as TPG Capital, EQT Partners, and Apax Partners.

The top 10 transactions of 2009 were spread across the following markets: Marketing & Interactive Services (3 deals); Database & Information Services (2); Education (2); Online Media & Technology (2); and Business-to-Business Media (1).

Below, highlights from media, information, and marketing services & related technology M&As in 2009.

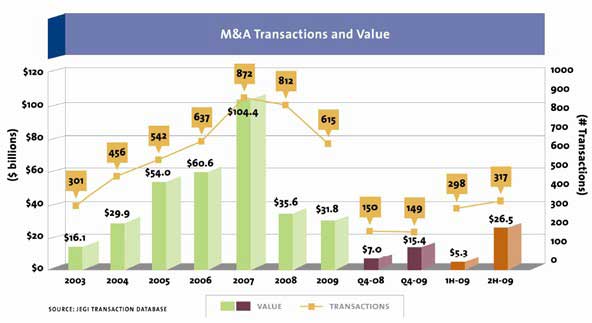

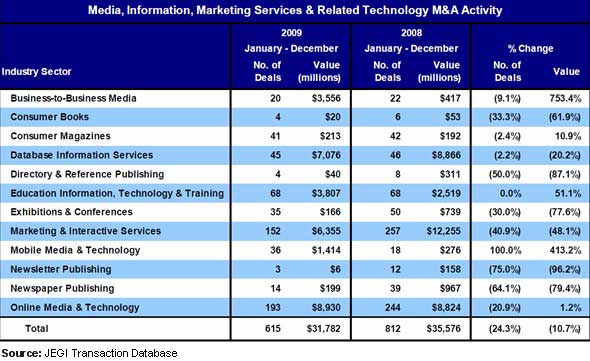

In 2009, a total of 615 transactions occurred in the media, information, and marketing services and related technology category, at a total value of nearly $32 billion.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook—a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Although the number of deals was down 24% compared with 2008 levels, transaction value declined only 11%, due to a strong rebound in M&A transaction value in the second half of 2009, during which $27 billion in transactions were announced, or 83% of the year's total value.

- With 193 transactions at a combined value of $8.9 billion in 2009, online media and technology remained the most active sector. However, the number of deals for the sector declined 21% year over year, while deal value remained on par with 2008 levels.

- M&A transaction value for the database information services sector was driven by the announced $5.4 billion acquisition of IMS Health by TPG Capital and the CPP Investment Board in November. In total, deal value for the sector was down 20% in 2009, but the number of deals was on par with 2008 levels.

- Marketing and interactive services was the second most active sector for M&A in 2009, with 152 transactions valued at $6.4 billion. However, the sector suffered steep declines of 41% and 48% in number of deals and value, respectively, in 2009 versus 2008.

- The education information, technology and training sector had 68 announced transactions, valued at $3.8 billion. In 2009, deal value rose 51% over 2008 levels, making this sector one of the best performing sectors on a year-over-year basis.

- The number of deals in the business-to-business media sector decreased 9%, but a few larger deals in Q4 (the most notable being the $3.4 billion acquisition of Springer Science+Business Media by EQT Partners in December 2009) drove an increase in deal value of over 750%.

- Mobile media & technology was the highest-performing industry sector, generating impressive year-over-year growth in 2009, including a doubling of the number of transactions as well as 413% increase in total transaction value. For the year, the sector generated 36 deals with an announced valued at $1.4 billion, led by Google's announced $750 million acquisition of mobile ad platform AdMob in November.

- The consumer magazine sector remained active in 2009, as 41 transactions were announced, versus 42 in 2008. However, deal activity was driven by small transactions of primarily depressed assets, as average deal size was approximately $5 million for the year.

- Exhibitions and conferences sector deal activity slowed considerably in 2009, with only 35 transactions, valued at $166 million, representing respective year-over-year declines of 30% and 78%.

- The consumer books sector declined 33% in number of deals and fell 62% in deal value, with four deals completed for $20 million in 2009.

About the data: The M&A activity data was compile by The Jordan, Edmiston Group, Inc. (JEGI) of New York, a provider of independent investment banking services for media, information, and marketing services and related technologies. https://www.jegi.com.