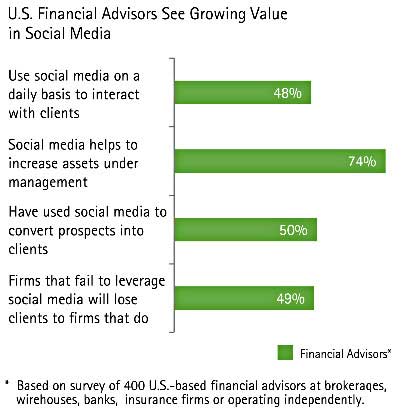

Social media has become an important way for financial advisers to engage with clients and grow their business, according to survey from Accenture: 48% of financial advisers say they interact daily with clients via social media and 74% say social media helps them increase the financial assets under their management.

In addition, 50% of surveyed financial advisers say they have successfully used social media to convert prospects into clients.

Not surprisingly, nearly one-half (49%) of the financial advisers surveyed said firms that fail to use social media will lose clients to firms that do so.

For the report, Accenture polled 400 US financial advisers, most (60%) of whom manage assets of more than $20 million, as well as 1,000 high-income, digitally savvy US investors.

"The use of social media to interact with clients is a differentiator for advisers today, but it will be mere table stakes in the not too distant future," said Alex Pigliucci, global managing director of Accenture Wealth and Asset Management Services.

"Wealth management firms that fail to adopt social media will miss an opportunity to build relationships with clients on their terms. This is becoming increasingly critical as investors are demanding online resources to help them better understand investment strategy and advice."

Below, additional findings from Accenture's report titled "Closing the Gap: How Tech-Savvy Advisors Can Regain Investor Trust."

Social networks have become of source of new business: Some 40% of financial advisers say they have found new clients via Facebook, 25% have done so via LinkedIn, and 21% have found new clients via Twitter.

Financial advisers acknowledge various benefits to using social media channels and cite the following as their top 3:

- Getting answers to clients quickly and easily: 59%

- Increasing their touchpoints with referral sources: 58%

- Keeping up to date on industry news: 58%

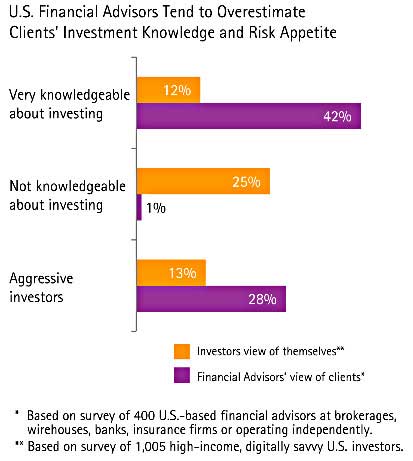

Interestingly, financial advisers appear to overestimate both their clients' investment knowledge and their appetite for risk.

The study compares the investment perspectives of financial advisers with those of high-income, digitally savvy investors:

- Advisers are three times more likely to view their clients as "very knowledgeable" than investors are to view themselves as such (42% vs. 12%).

- Only 1% of advisers describe their clients as "knowledgeable" about investing, compared with 25% of investors who self-identified that way.

- Advisers are more than two times more likely to view their clients as "aggressive" investors than investors are to view themselves that way (28% vs. 13%).

- 67% of advisers claim to have a "personal relationship" with their clients, whereas only 38% of clients view that relationship as "personal."

About the study: Findings are based on a survey of 400 US-based financial advisers, working for 2+ years at brokerages/wirehouses/banks (250 respondents), or as independents or representatives of regional banks or insurance firms (150). Some 70% of respondents were men. A separate survey of consisted of 1,005 high-income, digitally savvy US investors, composed equally of men and women, who are current investors or intend to invest within three years and use social media at least every week.