How many marketing dollars did you waste last year contacting customers who didn't buy from you? It's easy to look back to see where your investment was ineffective.

On the tangible side, there are the catalogs and direct-mail pieces that were sent to people who didn't buy. Less quantifiable are the effects of increased spam reports and lost goodwill because you persistently contacted people who have completed their life span.

Also, there's an ongoing branding debate about the value of impressions to build awareness and goodwill. What's the cost of bad impressions from over-marketing? It has to be exponentially higher than the value of good impressions.

How many marketing dollars will your company waste this year?

That question is harder to answer. How do you know which customers have completed their shopping life cycle with your company? If they are grouped in a high-performance segment, they may receive promotions for up to two years after they stop buying.

The problem is that in most marketing models all new customers are treated equally. The first purchase is the entry fee into the promotional funnel. Individuals are bagged, tagged, and sorted by identifiers such as recency, order size, and demographics.

Not all customers, new or old, are equal

Some customers enter the marketing funnel excited about your products or services and stay a lifetime. Your marketing dollars purchased the privilege of a long-term relationship.

Other customers enter out of short-term need or curiosity and leave after the first or second purchase. Your investment rented a brief promotional opportunity with hit-and-run shoppers.

Traditional marketing analytics won't distinguish between the two. You have to dig deep into buying behavior to find the early-warning signals. If you don't, you'll continue sending promotions until you receive cease-and-desist notifications or the money runs out.

Acquisition and retention costs are equal

It costs the same to acquire and market to customers who buy for a full life cycle, those who hit-and-run, and the ones in between. The first is an asset, the second an expense, and the third can go either way. Your goal is to identify the expensive customers as quickly as possible and minimize your marketing investment.

Before you start digging in your customer database for behavioral identifiers, determine the extent of the problem by measuring customer retention and attrition by year. If you find that your active database is growing but attrition rate exceeds the acquisition rate, you may be replacing high-lifetime-value customers with hit-and-runners.

Depreciating customer value is an insidious company killer.

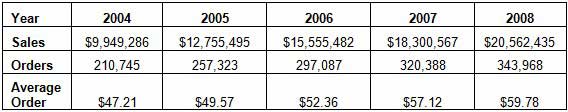

You have to aggressively look for it because it hides deep in your database. Sales reports are misleading because revenue can increase while customer value decreases. A customer-retention checkup of a $20 million company provided the following sales history:

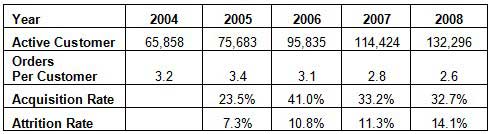

The company appeared to be on a strong growth track with effective marketing. Sales, orders, and average orders were all increasing. Additional analytics tell a different story, however:

While the active customer count was increasing, orders per customer were declining. More customers were ordering less often. That translates into increased marketing costs and reduced average lifetime value.

Even though the acquisition rate was strong, its decline—coupled with the attrition rate increase—pointed to a company in serious trouble. If the company had waited for the symptoms to appear on the sales report, it would have been too late to save the business.

Poor-quality products were sabotaging marketing

Following the customer-retention checkup, the second stage of the review was to identify any trends that contributed to the core customer shift. The marketing plan had been consistent over the five years, and there was still room for the company to grow in its niche.

Further analysis revealed a high percentage of onetime buyers. Digging deeper into the data linked product quality with the hit-and-runners and growing attrition rate: In an effort to increase customer acquisition and sales, low-end products were marketed at promotional prices. The poor quality left a lasting impression on first-time buyers. They didn't order again.

Fortunately, the story has a happy footnote. The quality issues were resolved, and new customers have responded well. The increase in price created a slight reduction in the acquisition rate, but the conversions from first-time buyer to active customer have significantly increased.

The same analytics that tell you what you're doing wrong also show what's right

It is impossible to drill deep into customer analytics without revealing challenges and opportunities. Your marketing dollars will always buy some lifetime customers and rent some hit-and-runners. When you know the difference and implement a marketing strategy that matches customers' buying patterns, your return on investment increases.

Are you ready to start data-digging?

If so, begin with a customer-retention checkup. Look at your customer acquisition and retention dynamics for the last five years. Drill deep into the data, comparing hit-and-run customers with converted buyers. Why are they different? How are they the same? What do you need to change to improve customer retention?