Even as more marketers adopt loyalty and rewards programs to improve sales, they are failing to fully engage their customers: Most consumers surveyed (54%) say the barrage of irrelevant messages, low-value rewards, and impersonal engagement don't particularly engender loyalty, according to a survey from the CMO council.

Overall, program members want better financial rewards and more individualized communications:

- 70% say they want to see more discounts and savings from loyalty programs.

- 58% want better personal benefits and services.

- 52% want more compelling personal offers as a reward for steering their business to loyalty-program operators.

At the same time, 65% of marketers view loyalty program investments as an essential or quite valuable part of the marketing mix, and 61% say loyalty program participants are among the most profitable customers.

However, only 13% of marketers say they have been highly effective in leveraging loyalty and brand preference among club members. Another 25% admit they have not mobilized brand loyalists to become active advocacy agents.

Customers and marketers agree: Deeper engagement and personalized contact, not mass blast communications and gimmicks, drives loyalty, according to the CMO Council survey.

Below, other findings from the CMO Council's Feeling the Love from the Loyalty Clubs study.

Marketers' View: Discounts Engender Loyalty

Marketers are inducing loyalty mostly with discounts or free products and premiums rather than quicker, better service or improved customer handling:

- 39% of marketers view discounts and savings as the key member benefits.

- 34% view free products and premiums as essential incentives.

- 33% are committed to offering points for merchandise redemption as a further motivator.

Asked to outline typical customer complaints about loyalty programs:

- 30% of marketers report that customers see little or no added value to becoming loyalty members.

- 24% say rewards lack substance for many customers; a similar percentage of customers complain they don’t get enough personalized attention.

- 21% cite customers' problems with receiving too much spam email and junk mail.

- 23% cite issues with redeeming points and 18% cite issues with redeeming miles.

Marketers Still Committed to Loyalty Programs

Despite the challenges, marketers plan to continue investments in loyalty programs:

- Nearly 80% of marketers say they are committed to maintaining or further funding loyalty programs, both at a financial and operational level.

- Over 34% report they are significantly increasing their commitments.

- 46% are maintaining their current commitments.

- Just 4% expect to discontinue their programs.

Online channels will likely dominate investments: Nearly 60% of marketers plan to make better use of the Web and social networking tools to grow and develop loyalty programs.

Other actions planned for achieving greater ROI from program membership include the following:

- Personalizing interactions and target messages: 51%

- Increasing frequency and relevance of communications: 39%

- Gathering more insights and intelligence for better customer handling: 38%

- Adding new benefits, incentives and inducements: 36%

- Studying industry best practices and making adjustments accordingly: 19%

Untapped Customer Information

Marketers are failing to exploit the full value of loyal customer information. For example, regarding in-depth profiling of customers, the vast majority of marketers still aggregate and analyze only limited customer data sets: 73% collect basic demographics and 68% track the location of members. Critical insights––such as advocacy rates (14%), brand loyalty and attachment (27%), personal preferences (31%), satisfaction levels (33%), and product preferences (38%)––are not being leveraged.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Key Program Challenges

Acquiring and retaining motivated and engaged participants is the top problem facing 46% of marketers. Other issues marketers confront:

- Measuring marketing value and effectiveness: 42%

- Collecting, integrating and maintaining customer data: 41%

- Deriving valuable insight and intelligence: 38%

- Delivering more personalized offers and inducements: 34%

- Creating more customized communications: 33%

Digital Channels Critical in Program Promotion

Nearly 60% of marketers rely on websites to promote their loyalty and rewards programs. Another 60% rely on email, 47% on word-of-mouth marketing, 46% on point-of-sale information, 42% on direct mail, and 39% on sales or service representatives.

Most member communication is monthly (30%), but 20% of marketers interact with members on a daily, weekly or bi-weekly basis. The most preferred methods of communication:

- Email: 84%

- Printed mailings and statements: 51%

- Corporate web sites: 45%

- Dedicated club sites: 32%

- SMS text messaging: 24%

- Social networks: 16%

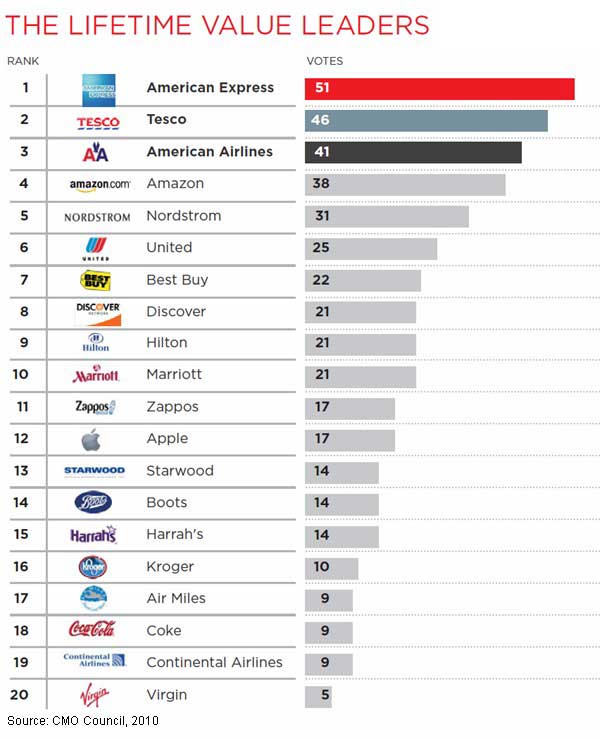

Marketers Rank the Lifetime Value Leaders

Asked to identify the industry leaders that leverage loyalty to build customer lifetime value, marketers voted American Express on top, thanks to the company's clear value to its members and personalized service. Tesco was ranked No. 2, followed by American Airlines.

Consumers' View: Lack of Relevant Communications

More than 64% of consumers want to receive information and notifications via email. However, they are tired of irrelevant and excessive communications. Among a list of negatives associated with loyalty and rewards program membership, these are the top three:

- Too much spam and junk email: 44%

- Too many conditions and restrictions: 38%

- Rewards that lack real value: 37%

Most customers (60%) say they learn about programs through retail or point-of-sale engagements.

However, marketers say they promote their programs most heavily via the Web and email: Over 30% say they use blogs, online communities, or social networks. But according to consumers, these are three of the least-used resources for learning about loyalty programs: Only 5% say they learn about membership through social media, 3% say blogs, and 11% say online advertising.

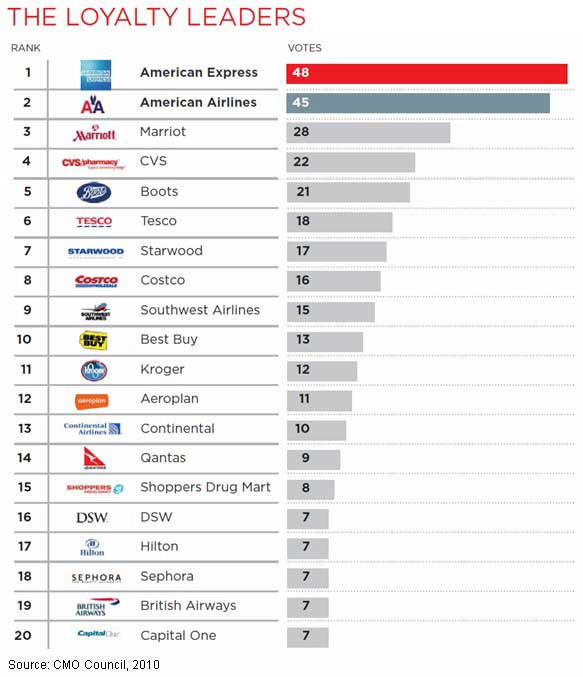

Customers Rank Loyalty Leaders

Asked to rank the top loyalty programs, consumers had a hard time selecting a single best-in-class winner: The most common answer was "Don't know."

However, a few programs emerged as leaders in providing customers with exemplary experiences, including top-ranked American Express. American Airlines was No. 2, followed by Marriot Corporation.

About the data: Conducted by CMO Council on behalf of InfoPrint Solutions Company, the online survey includes the insights of over 600 marketers and more than 700 consumers collected in the third and fourth quarters of 2009. Over 50% of consumers surveyed had household incomes of over $100,000 and were fairly evenly split across gender and age groups. Nearly 75% reported enrollment in supermarket loyalty programs, 69% in airline frequent flier clubs, and 58% in credit card incentive programs. Hotels and motels, drug stores, warehouse price clubs, specialty retailers, rental cars, and restaurants are other leading beneficiaries of loyalty and rewards enrollment.