M&A activity for media, information, and marketing services rebounded strongly in the first half of 2010, led by digital and technology-driven companies, according to The Jordan, Edmiston Group Inc. (JEGI).

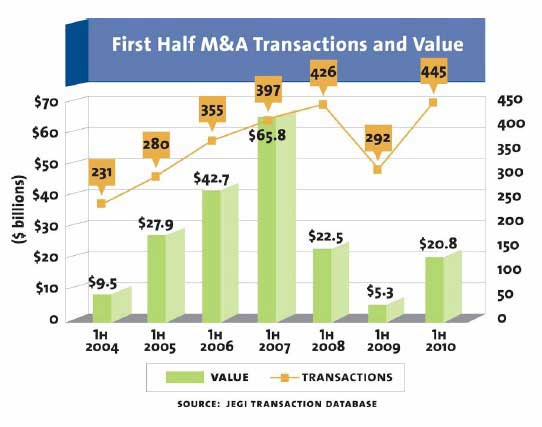

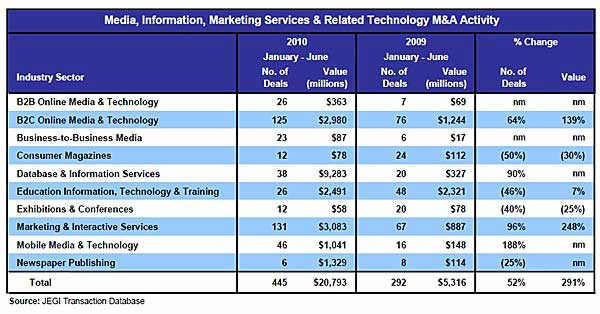

Some 445 deals totaling $20.8 billion were transacted during the period, up 52% in deal volume and up 291% in deal value over 1H09 levels.

The sharp rise in deal value was driven by several multibillion-dollar transactions announced in the second quarter of 2010, including Madison Dearborn Partners' acquisition of credit and information management company TransUnion for an estimated $2.5 billion and the acquisition by Silver Lake Partners and Warburg Pincus of financial information provider Interactive Data Corporation for $3.2 billion.

Deal Growth by Sector

Overall, six market sectors recorded strong growth in deal activity in the first half of 2010 over 1H09 levels:

- B2B Media (deal volume up 283%)

- B2B Online Media (up 271%)

- Mobile Media & Technology (up 188%)

- Marketing & Interactive Services (up 96%)

- Database & Information Services (up 90%)

- B2C Online Media (up 64%)

Below, highlights from media, information, and marketing services & related technology M&As in 1H10.

The largest deals among marketing services and technology companies in the second quarter were the following:

- IBM's acquisition of Coremetrics, the Web analytics and digital marketing optimization company, for an estimated $150 million.

- Salesforce.com's acquisition of Jigsaw Data Corp., an online business contact database, for $142 million.

- Alliance Data System's acquisition of Equifax's Direct Marketing Services division for $117 million.

- Yahoo's acquisition of online content publisher Associated Content for a reported $90 million.

However, overall deal sizes for the interactive markets remained relatively small, averaging $23 million in the second quarter, compared with $47 million for the overall media marketplace.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Other M&A Highlights, Ranked by Deal Value

The number of M&A transactions and deal value increased significantly in 1H10 for the database and information services sector: 38 deals were announced for a total value of $9.3 billion, compared with 20 deals for a total value of $327 million in 1H09. The two largest announced transactions of Q2 took place in this sector, both led by private-equity firms: Madison Dearborn Partner's acquisition of TransUnion for an estimated $2.5 billion; and the acquisition of Interactive Data Corporation by Silver Lake Partners and Warburg Pincus for $3.2 billion.

Marketing and interactive services was the most active sector for M&A in 1H10, with 131 transactions for a total value of $3.1 billion. The sector also registered strong gains in deal value during the period, up 250% from 1H09. The largest second-quarter transaction was Hearst Corporation's acquisition of iCrossing. Notable acquistions announced in the second quarter included the following:

- Acxiom acquisition of GoDigital (data quality and precision marketing)

- Adknowledge acquisition of Hydra Group (online multi-channel advertising platform)

- Attensity Group acquisition of Biz360 (market intelligence solutions)

- AudienceScience acquisition of Consorte Media (digital marketing agency)

- Avande acquisition of Ascentium's Microsoft Dynamics CRM assets

- Google acquisition of Global IP Solutions (IP voice and video processing software for realtime communications) for $68 million

- GSI Commerce acquisitions of VendorNet (supply chain management software) and Fetchback (remarketing solutions)

- HIG Venture investment in Triad Digital Media (digital media and online advertising services)

- IBM acquisition of Coremetrics for an estimated $150 million

- Interpublic Group acquisition of Cubocc (digital marketing agency)

- Lithium Technologies acquisition of ScoutLabs (Web-based applications for social media tracking and monitoring)

- Oracle acquisition of Market2Lead (demand-generation and marketing automation)

- ReachLocal acquisition of SMB Live (social marketing platform software)

- WPP acquisition of Midia Digital and I-Cherry (digital marketing agency)

The B2C online media and technology sector continued to be very active: 125 transactions at a total value of $3 billion were conducted in 1H10. Though smaller transactions drove the bulk of deal volume in this sector, larger deals included Providence Equity Partners' acquisition of 25% of AutoTrader.com from Cox Enterprises for an estimated $550 million; AXA Private Equity's acquisition of Go Voyages from Groupe Arnault for $493 million; Rakuten's acquisition of e-commerce company Buy.com for $250 million; Digital Sky Technologies' acquisition of ICQ from AOL for $188 million; Yahoo's acquisition of Associated Content for a reported $90 million; and Cyberplex Media's acquisition of Tsavo Media for $75 million.

The education information, technology, and training sector fell 46% in deal volume in 1H10 compared with 1H09 levels, but year-over-year transaction value was flat at approximately $2.4 billion. Online learning and technology have been driving M&A activity in this market, and notable second-quarter transactions included Thoma Bravo's acquisition of online learning solutions provider PLATO Learning for $143 million, and Archipelago Learning's acquisition of Education City, a provider of e-learning resources for schools and families, for $87 million.

The newspaper publishing sector continued to be quiet: Only six transactions were announced in 1H10, compared with eight in 1H09. However, deal value jumped in the period, led by two distressed sales to creditor groups: the $1.1 billion sale of CanWest, a Canadian based newspaper publisher; and the $135 million buyout of Philadelphia Newspapers.

The mobile media and technology sector recorded a large uptick in M&A activity in 1H10: 46 deals were conducted at total value of $1 billion, compared with the 16 deals at a total value of $148 million in 1H09. Interactive marketing and technology leaders, such as Akamai, Apple, Google, Groupon, Research in Motion, Twitter, and Yahoo were active acquirers of mobile media and technology assets in the second quarter. A larger percentage of the deals were in the application technology sector, such as Apple's acquisition of Siri, an iPhone app that acts as a personal assistant; Google's acquisition of Pink, an Android app that will identify any work of art photographed by users; and Twitter's acquisition of Atebits, Tweetie apps for using Twitter on Mac computers and iPhones.

With 26 transactions, the B2B online media and technology sector's deal activity increased nearly 300% in 1H10 compared with 1H09 levels. Small transactions dominated the sector, such as TechTarget's acquisition of BeyeNETWORKS, an online network of sites that provide free resources for business intelligence professionals; LoopNet's acquisition of Reaction Web, a provider of online solutions for the commercial real estate industry; and Canon Communication's acquisition of Pharmalot, a blog for the pharmaceutical industry.

In the business-to-business media sector, the number of deals increased to 23 in 1H10, driven by Reed Elsevier's multiple divestitures of its Reed Business Information-US print and related online media assets. Overall, however, this sector recorded a number of smaller deals in 1H010, valued at $87 million. In the second quarter, active acquirers in this sector included Babcox Publications, DealFlow Media, ST Media, and Thomson Reuters.

The M&A market for consumer magazines recorded minimal M&A activity: Only 12 transactions were announced in 1H10 at a total deal value of $78 million, primarily for distressed assets. A few notable transactions for the second quarter included Active Interest Media's acquisition of Skram Media, a publisher of outdoor sports magazines, and CurtCo Media's divestitures of Sarasota and Gulfshore Life, San Diego Magazine, and Art & Antiques Worldwide Media in three separate deals.

In the exhibitions and conferences sector, transaction volume and value declined In 1H10, down 40% and 25%, respectively, compared with 1H09 levels. In the second quarter, JEGI completed the sector's largest transaction—the sale of dmg world media's Alberta Gift Show and Montreal Gift Show to the Canadian Gift & Tableware Association. Other notable Q2 deals included Access Intelligence's acquisition of RETECH, a show operator for the renewable and alternative energy technology sectors, and United Business Media's acquisition of Navalshore, a Brazil-based provider of tradeshows and conferences for the maritime industry.

About the data: The M&A activity data was compiled by The Jordan, Edmiston Group Inc. (JEGI) of New York, a provider of independent investment banking services for media, information, and marketing services and related technologies.